Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

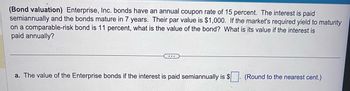

Transcribed Image Text:(Bond valuation) Enterprise, Inc. bonds have an annual coupon rate of 15 percent. The interest is paid

semiannually and the bonds mature in 7 years. Their par value is $1,000. If the market's required yield to maturity

on a comparable-risk bond is 11 percent, what is the value of the bond? What is its value if the interest is

paid annually?

...

a. The value of the Enterprise bonds if the interest is paid semiannually is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Current Yield for Annual Payments Heath Food Corporations bonds have 7 years remaining to maturity. The bonds have a face value of 1,000 and a yield to maturity of 8%. They pay interest annually and have a 9% coupon rate. What is their current yield?arrow_forwardYield to Maturity and Yield to Call Arnot International’s bonds have a current market price of $1,200. The bonds have an 11% annual coupon payment, a $1,000 face value, and 10 years left until maturity. The bonds may be called in 5 years at 109% of face value (call price = $1,090). What is the yield to maturity? What is the yield to call if they are called in 5 years? Which yield might investors expect to earn on these bonds, and why? The bond’s indenture indicates that the call provision gives the firm the right to call them at the end of each year beginning in Year 5. In Year 5, they may be called at 109% of face value, but in each of the next 4 years the call percentage will decline by 1 percentage point. Thus, in Year 6 they may be called at 108% of face value, in Year 7 they may be called at 107% of face value, and so on. If the yield curve is horizontal and interest rates remain at their current level, when is the latest that investors might expect the firm to call the bonds?arrow_forwardBond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have a 10% coupon rate, payable semiannually. The bonds mature in 8 years, have a face value of $1,000, and a yield to maturity of 8.5%. What is the price of the bonds?arrow_forward

- Bond Yields and Rates of Return A 10-year, 12% semiannual coupon bond with a par value of 1,000 may be called in 4 years at a call price of 1,060. The bond sells for 1,100. (Assume that the bond has just been issued.) a. What is the bonds yield to maturity? b. What is the bonds current yield? c. What is the bonds capital gain or loss yield? d. What is the bonds yield to call?arrow_forwardBond Valuation and Changes in Maturity and Required Returns Suppose Hillard Manufacturing sold an issue of bonds with a 10-year maturity, a 1,000 par value, a 10% coupon rate, and semiannual interest payments. a. Two years after the bonds were issued, the going rate of interest on bonds such as these fell to 6%. At what price would the bonds sell? b. Suppose that 2 years after the initial offering, the going interest rate had risen to 12%. At what price would the bonds sell? c. Suppose that 2 years after the issue date (as in Part a) interest rates fell to 6%. Suppose further that the interest rate remained at 6% for the next 8 years. What would happen to the price of the bonds over time?arrow_forward(Bond valuation) Enterprise, Inc. bonds have an annual coupon rate of 9 percent. The interest is paid semiannually and the bonds mature in 12 years. Their par value is $1,000. If the market's required yield to maturity on a comparable-risk bond is 13 percent, what is the value of the bond? What is its value if the interest is paid annually? a. The value of the Enterprise bonds if the interest is paid semiannually is $. (Round to the nearest cent.) b. The value of the Enterprise bonds if the interest is paid annually is $ (Round to the nearest cent.) I 01 C C 46°F Clear Next 2:19 AM 4/2/2023arrow_forward

- (Bond valuation) A bond that matures in 11 years has a $1,000 par value. The annual coupon interest rate is 8 percent and the market's required yield to maturity on a comparable-risk bond is 15 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? a. The value of this bond if it paid interest annually would be $__________. (Round to the nearest cent.)arrow_forward(Bond valuation) A bond that matures in 15years has a $1,000 par value. The annual coupon interest rate is 13 percent and the market's required yield to maturity on a comparable-risk bond is 14 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? a. The value of this bond if it paid interest annually would be $__________.(Round to the nearest cent.)arrow_forwardEnterprise, Inc. bonds have a 9 percent annual coupon rate. The interest is paid semiannually and the bond mature in eight years. Their par value is $1,000. If the market’s required yield to maturity on a comparable-risk bond is 8 percent, what is the value of the bond? What is its value if the interest is paid annually? How to calculate this using mathematical calculation with formulas in finance?arrow_forward

- (Bond valuation) A bond that matures in 15years has a $1,000 par value. The annual coupon interest rate is 13 percent and the market's required yield to maturity on a comparable-risk bond is 14 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? The value of this bond if it paid interest semiannually would be $________(Round to the nearest cent.)arrow_forwardPlease answer fast I give you upvotearrow_forward(Bond valuation) Enterprise, Inc. bonds have an annual coupon rate of 14 percent. The interest is paid semiannually and the bonds mature in 13 years. Their par value is $1,000. If the market's required yield to maturity on a comparable-risk bond is 8 percent, what is the value of the bond? What is its value if the interest is paid annually? Question content area bottom Part 1 a. The value of the Enterprise bonds if the interest is paid semiannually is $enter your response here. (Round to the nearest cent.) Part 2 b. The value of the Enterprise bonds if the interest is paid annually is $enter your response here. (Round to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT