FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

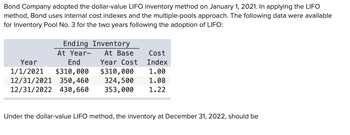

Transcribed Image Text:Bond Company adopted the dollar-value LIFO inventory method on January 1, 2021. In applying the LIFO

method, Bond uses internal cost indexes and the multiple-pools approach. The following data were available

for Inventory Pool No. 3 for the two years following the adoption of LIFO:

Inventory

At Base

Year Cost

Ending

At Year-

End

Year

1/1/2021 $310,000

$310,000

12/31/2021 350,460

324,500

12/31/2022 430,660 353,000

Cost

Index

1.00

1.08

1.22

Under the dollar-value LIFO method, the inventory at December 31, 2022, should be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for J101 are as follows: Oct. 1 Inventory 480 units at $14 13 Sale 280 units 22 Purchase 600 units at $16 29 Sale 450 units a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of the merchandise sold on October 29. Round your "average unit cost" to two decimal places. c. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31. Round your "average unit cost" to two decimal places.arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forwardThe 2021 inventory data for Island Corporation is presented below. Assume that Island uses periodic inventory tracking. 2021 Beginning Inventory (purchased in 2020) 100 units @ $28 per unit Purchases: Purchase 1 on 1/20/21 300 units @ $30 per unit Purchase 2 on 6/15/21 1,100 units @ $34 per unit Sales: Sale 1 on 4/8/21 520 units @ $60 per unit Sale 2 on 9/25/21 860 units @ $60 per unit When Island examines the actual units in ending inventory, they see that 30 of the units are from 2021 beginning inventory, 40 units are from the 1/20/21 purchase, and 50 units are from the 6/15/21 purchase. What is Inventory on the 12/31/21 Balance Sheet if Island uses FIFO? $3,400 $4,080 $45,120 $45,800 What is Cost of Goods Sold on the 2021 Income Statement if Island uses LIFO? $3,400 $4,080 $45,120 $45,800 What is Inventory on the 12/31/21 Balance Sheet if Island…arrow_forward

- Question: Langley Inc. inventory records for a particular development program show the following at October 31, 2020: At October 31, ten of these programs are on hand. Langley uses the perpetual inventory system. 1. Journalize for Langley: a. Total October purchases in one summary entry. All purchases were on credit. b. Total October sales and cost of goods sold in two summary entries. The selling price was $500 per unit, and all sales were on credit. Langley uses the FIFO inventory method. (Please show the calculations/where the number is from) Ex: I didn't understand the part of the answer for the entry Cost of Goods Sold & Inventory 1,710. 2. Under FIFO, how much gross profit would Langley earn on these transactions? What is the FIFO cost of Langley’s ending inventory?arrow_forwardSheridan Company's record of transactions for the month of April was as follows. Compute cost of goods sold assuming periodic inventory procedures and inventory priced at FIFO. Cost of goods sold $ eTextbook and Media Save for Later Attempts: 0 of 5 used (d) In an inflationary period, which inventory method - FIFO, LIFO, average - cost - will show the highest net income? inventory method will show the highest net income. 4132129Purchases1,650 @ 5.801,320 @770 @ 550 @5,8306.206.30a 6.502327Sales1,540 @ 10.001,320 @ 11.00990 @5,06012.00arrow_forwardThe following inventory transactions took place for Sunland Ltd. for the year ended December 31, 2023: Date Jan 1 Jan 5 Feb 15 Mar 10 May 20 Aug 22 Sep 12 Nov 24 Dec 5 beginning inventory sale purchase purchase sale Event purchase sale purchase sale Ending inventory Unit cost of the last item sold $ CA $ Quantity 24,300 LA 6,200 32,200 9,200 40,900 14,800 20,350 9,800 17,300 Cost/ Selling Price $47.00 77.00 38.25 45.00 Calculate the ending inventory balance for Sunland Ltd., assuming the company uses a perpetual inventory system and the first-in, first-out cost formula. Also calculate the per-unit cost of the last item sold. (Round unit costs to 2 decimal places, e.g. 52.75 and ending inventory to O decimal places, e.g. 5,276.) 77.00 42.50 77.00 57.00 77.00arrow_forward

- On August 31, 2010, Harvey Co. decided to change from the FIFO periodic inventory system to the weightedaverage periodic inventory system. Harvey is on a calendar year basis. The cumulative effect of the change is determineda. As of January 1, 2010.b. As of August 31, 2010. c. During the eight months ending August 31, 2010, by a weighted-average of the purchases.d. During 2010 by a weighted-average of the purchases.arrow_forwardThe Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1982. In 2021, the company decided to change to the average cost method. Data for 2021 are as follows: Beginning inventory, FIFO (6,500 units @ $45.00) Purchases: 6,500 units @ $51.00 6,500 units @ $55.00 Cost of goods available for sale Sales for 2021 (11,000 units @ $85.00) Additional information: 1. The company's effective income tax rate is 25% for all years. 2. If the company had used the average cost method prior to 2021, ending inventory for 2020 would have been $266,500. 3. 8,500 units remained in inventory at the end of 2021. Answer is not complete. Complete this question by entering your answers in the tabs below. $331,500 357,500 Required: 1. Prepare the journal entry at the beginning of 2021 to record the change in principle. 2. In the 2021-2019 comparative financial statements, what will be the amounts of cost of goods sold and inventory reported…arrow_forward7. Taylor Corporation reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. The company’s records under this system reveal the following inventory layers at the beginning of 2021 (listed in chronological order of acquisition): 17,500 units @ $15 $ 262,500 22,500 units @ $20 450,000 Beginning inventory $ 712,500 During 2021, 45,000 units were purchased for $25 per unit. Due to unexpected demand for the company's product, 2021 sales totaled 55,000 units at various prices, leaving 30,000 units in ending inventory. Required:1. Calculate the amount to report for cost of goods sold for 2021.2. Determine the amount of LIFO liquidation profit that the company must report in a disclosure note to its 2021 financial statements. Assume an income tax rate of 25%.3. If the company decided to purchase an additional 10,000 units at $25 per unit at the end of the year, how much income tax currently payable would be saved?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education