Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

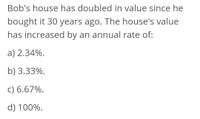

Transcribed Image Text:Bob's house has doubled in value since he

bought it 30 years ago. The house's value

has increased by an annual rate of:

a) 2.34%.

b) 3.33%.

c) 6.67%.

d) 100%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Each year for your anniversary, beginning with the first one, you put 300.00 away earning 7%.How much would you have if you started the day you were married and you were married for 11 years?arrow_forwardBob has money in an investment with 5% that compounds 11 times a year. His initial investment was $1423.00, and now has been accruing interest for 6 years. What is the total value of his investment now?arrow_forwardJudy was givin $3000 to invest that would last 8 years. $1050 earned exponentially at a rate of 3.2% anually, $1950 earned 2.8% annual interest compounded biannually (twice a year). What is her balance after 8 years?arrow_forward

- Victor and Maria regularly buy and sell a number of items on eBay, Craig's List, and through the free community newspaper, from which they earn about $4,000 each year. What is the accumulated future value of those annual amounts over 22 years if the annual earnings were invested regularly and provided a 3 percent return each year?arrow_forwardFour years ago, Leroy invested $12,600.00. Today, he has $20,700.00. If Leroy earns the same annual rate implied from the past and current values of his invsetment, then in how many years from today does he expect to have exactly $50,600.00 O 7.20 years (plus or minus 0.05 years) 7.57 years (plus or minus 0.05 years) O 6.25 years (plus or minus 0.05 years) 11.20 years (plus or minus 0.05 years) None of the above is within .05 percentage points of the correct answerarrow_forwardA homeowner purchased a house 30 years ago by $85,000, today the house value is $140,000. What compounded annual interest rate was recover by the owner of the house?arrow_forward

- Ten years ago Alexander bought an investment property for $100,000.00. Over the 10-year period inflation has held consistently at 2% annually. If Alexander expects a 15%/yr real rate of return, what would he sell the property for today?arrow_forwardTwelve years ago you financed your $93,000 house with monthly payments on a twenty-yearmortgage loan with interest charged at 6.25% compounded monthly. Your realtor says the currentnet market value of the home is $102,000. What is your equity in the house?arrow_forwardMickey & Minnie have $47 million in cash. Before they retire, they want the $47 million to grow to $112 million. How many years before Mickey & Minnie can retire if they earn 11.0% per annum on their stash of cash? Assume annual compounding. (Enter your answer in years to 2 decimal places, e.g., 12.34)arrow_forward

- This year 10 years after you first took out the loan, you check your loan balance. Only part of your payments have been going to pay down the loan, the rest has been going towards interest. You see that you still have 120,730 left to pay on your loan. Your house is now valued at $180,000. how much of your original loan have you paid off?arrow_forwardYou took out a mortgage on a new house 13 years ago. You bought the house for $300,000; the mortgage loan was $164,000. The original mortgage loan was 30 years. Payments are monthly in the amount of $782.96. What is your remaining balance?arrow_forwardYour uncle has $260,000 invested at 7.5%, and he now wants to retire. He wants to withdraw $35,000 at the end of each year, starting at the end of this year. He also wants to have $25,000 left to give you when he ceases to withdraw funds from the account. For how many years can he make the $35,000 withdrawals and still have $25,000 left in the end? O a. 6.71 years O b. 11.98 years Oc. 9.39 years Od. 11.26 years Oe. 10.50 yearsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education