FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

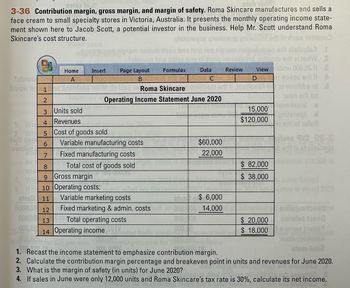

Transcribed Image Text:3-36 Contribution margin, gross margin, and margin of safety. Roma Skincare manufactures and sells a

face cream to small specialty stores in Victoria, Australia. It presents the monthly operating income state-

ment shown here to Jacob Scott, a potential investor in the business. Help Mr. Scott understand Roma

Skincare's cost structure.

Sabnuo

bluow to

tadt geg

awollg

em noitudintnoo brstinu neq nip

Tebquod bns aslea tinu ni tniog

Formulas

moo erit steluals3 .f

trom ert zi terW S

Page Layout

las Data Joxe Review

atinu 000,00

Bruno Bow CWOODW0193802 91 A

View

E

2

1 of moitibbs nl

wen erit ed

sand 6

pritsiaqo .d

erit of nate

Home

Insert

SZ ĀRU STCOD 0

1

be ting viace 101 01.03 bisq asRoma Skincare andam

2

Operating Income Statement June 2020

3

Units sold

Revenues

Cost of goods sold

4

5

6 Variable manufacturing costs

7

Fixed manufacturing costs

be

8

Total cost of goods sold

Spe

9

Gross margin

4. Wh

5. If 10 Operating costs:

21800 11

6000,00 12

000,00 13

000.08 14 Operating income

000.8

Variable marketing costs

$ 6,000

Fixed marketing & admin. costs m 10000114,000

000,008

Total operating costs

$60,000

22,000

2120

15,000

$120,000

$ 82,000

$ 38,000

advertisin

$ 20,000

$ 18,000

9V3 28-8

assilsizega

soilique terique

2016152109110

Boivisa traits

Testuss

nousteinimba

1. Recast the income statement to emphasize contribution margin.

2. Calculate the contribution margin percentage and breakeven point in units and revenues for June 2020.

3. What is the margin of safety (in units) for June 2020?

SIGU518J

adun.mp3 S

4. If sales in June were only 12,000 units and Roma Skincare's tax rate is 30%, calculate its net income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Income statement information for Einsworth Corporation follows: Sales $433,000 Cost of goods sold 160,210 Gross profit 272,790 Prepare a vertical analysis of the income statement for Einsworth Corporation. If required, round percentage answers to the nearest whole number. blankEinsworth CorporationVertical Analysis of the Income Statement Amount Percentage Sales $433,000 fill in the blank 1% Cost of goods sold 160,210 fill in the blank 2 Gross profit $272,790 fill in the blank 3%arrow_forwardMultiple Choice$80,830$72,167$38,970$46,090arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education