FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

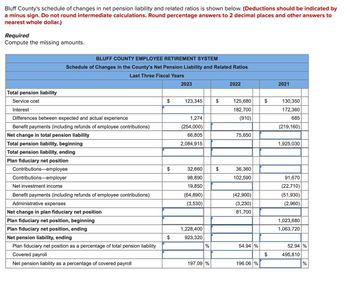

Transcribed Image Text:Bluff County's schedule of changes in net pension liability and related ratios is shown below. (Deductions should be indicated by

a minus sign. Do not round intermediate calculations. Round percentage answers to 2 decimal places and other answers to

nearest whole dollar.)

Required

Compute the missing amounts.

Total pension liability

Service cost

Interest

BLUFF COUNTY EMPLOYEE RETIREMENT SYSTEM

Schedule of Changes in the County's Net Pension Liability and Related Ratios

Last Three Fiscal Years

2023

Differences between expected and actual experience

Benefit payments (including refunds of employee contributions)

Net change in total pension liability

Total pension liability, beginning

Total pension liability, ending

Plan fiduciary net position

Contributions employee

Contributions-employer

Net investment income

Benefit payments (including refunds of employee contributions)

Administrative expenses

Net change in plan fiduciary net position

2022

2021

$

123,345

$

125,680

$

130,350

182,700

172,360

1,274

(254,000)

(910)

685

(219,160)

66,805

75,650

2,084,915

1,925,030

$

32,660

$

36,360

98,890

102,590

91,670

19,850

(22,710)

(64,890)

(42,900)

(51,930)

(3,530)

(3,230)

(2,960)

81,700

1,023,680

1,063,720

Plan fiduciary net position, beginning

Plan fiduciary net position, ending

1,228,400

Net pension liability, ending

$

923,320

Plan fiduciary net position as a percentage of total pension liability

Covered payroll

%

54.94 %

52.94 %

$

495,810

Net pension liability as a percentage of covered payroll

197.09 %

196.06 %

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Campbell County uses the consumption method to record all inventories and prepayments. The County has a 3/31 fiscal year-end. On April 1, 2015, the county purchased a two-year insurance policy at a total cost of $400,000, paying for the policy out of the general fund. In the fund financial statements, the amount of insurance expenditures for the fiscal year ended 3/31/2016 would be A.) $400,000. B.) $300,000. C.) $200,000. D.) $100,000.arrow_forwardThe City of Castleton’s General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year: Debits Credits Cash $ 476,000 Taxes Receivable—Delinquent 601,000 Allowance for Uncollectible Delinquent Taxes $ 189,120 Interest and Penalties Receivable 28,080 Allowance for Uncollectible Interest and Penalties 12,960 Inventory of Supplies 17,900 Vouchers Payable 166,500 Due to Federal Government 77,490 Deferred Inflows of Resources—Unavailable Revenues 427,000 Fund Balance—Nonspendable—Inventory of Supplies 17,900 Fund Balance—Unassigned 232,010 $ 1,122,980 $ 1,122,980 Prepare a General Fund balance sheet as of June 30, 2020.arrow_forwardDawson City has a December 31 fiscal year end. The City levies property taxes of $5,000,000 on February 1, 2022 and expects 2% to be uncollectible. The City has two due dates for collection, 1/2 on October 31, 2022 and 1/2 on April 30, 2023. Record the requested journal entries: 1. Record the levy on February 1, 2022, assuming the City records the entire levy as unavailable revenue. 2. Record the collection of property taxes of $2,410,000 on October 31, 2022. 3. Record any necessary adjusting journal entry at December 31, 2022. 4. Record any necessary journal entry to recognize revenue associated with the 2/1/2022 levy in 2023. Repeat this process and record all four journal entries if the entire levy had been treated as revenue at the time of the levy.arrow_forward

- For the month of June 2023, patient charges at Southfield Hospital (a not-for-profit hospital) were $2,940,000. Third-party payers were billed $1,900,000. The hospital estimated that contractual adjustments would reduce the amount collected from their-party payers to $1,790,000. Prepare the neccessary journal entry to record the contractual adjustments.arrow_forwardThe factors affecting pension expense are not always obvious.As the accountant for Sunlight City, you determine the following with respect to the city's pensions in a particular year.Service cost $356,000Interest on total pension liability 400,000Actual earnings on pension plan investments 500,000Projected earnings on pension plan investments 450,000Employer contribution to the plan 180,000Benefits paid to retirees 211,000 Based on the information provided, what should the city report as its pension expense for the year? Suppose that the benefits paid to retirees were actually $251,000 rather than $211,000. How would that affect the pension expense? Explain. Suppose also that the city failed to contribute anything to the pension plan. How would that affect the pension expense to be reported on the government‐wide statements? Explain. How would it affect the pension expenditure to be reported on the statements of the general fund?arrow_forwardOn January 1 of the current reporting year, Coda Company's projected benefit obligation was $29.3 million. During the year, pension benefits paid by the trustee were $3.3 million. Service cost was $9.3 million. Pension plan assets earned $4.3 million as expected. At the end of the year, there was no net gain or loss and no prior service cost. The actuary's discount rate was 10%. Required:Determine the amount of the projected benefit obligation at December 31. (Enter your answers in millions rounded to 2 decimal places. Amounts to be deducted should be indicated with a minus sign.)arrow_forward

- Godoarrow_forwardPROBLEM. Journalize the following transactions using the Excel worksheet provided in the link., Convert your completed worksheet to a PDF and attach below. WORKSHEET LINK March 31, 20--: Paid total wages of $9,350.00. These are the wages for the last semimonthly pay of March. All of this amount is taxable under FICA (OASDI and HI). In addition, withhold $1,175 for federal income taxes and $102.03 for state income taxes. These are the only deductions made from the employees wages. March 31, 20-- Record the employer's payroll taxes for the last pay in March. All of the earnings are taxable under FICA (OASDI and HI), FUTA (0.6%), and SUTA (2.8%). April 15, 20--: Made a deposit to remove the liability for the FICA taxes and the employees federal income taxes withheld on the two March payrolls.arrow_forwardYou have the following information related to Chalmers Corporation's pension plan: Use the PV of 1, PVAD of 1, and PVOA of 1 tables where appropriate. (Use the appropriate factor(s) from the tables provided.) a. Defined benefit, noncontributory pension plan. b. Plan initiation, January 1, 20X3 (no credit given for prior service). c. Retirement benefits paid at year-end with the first payment one year after retirement. d. Assumed discount rate of 7%. e. Assumed expected rate of return on plan assets of 9%. f. Annual retirement benefit equals years of credited service × 0.02 x highest salary. g. Chalmers made $1,200 contributions to the pension fund at the end of each year. h. The actual returns were $0 and $48 in 20X3 and 20X4, respectively. i. Information for Frank Bullitt, the firm's only employee, follows: January 1, 20X0 December 31, 20Y7 (15 years from plan inception) Start date Expected retirement date Expected number of payments during retirement 20 Selected actual and expected…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education