FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

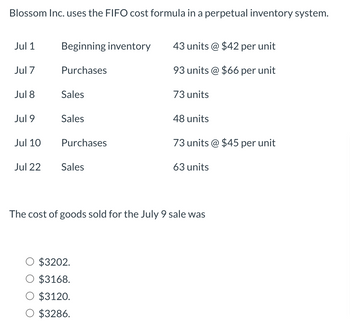

Transcribed Image Text:Blossom Inc. uses the FIFO cost formula in a perpetual inventory system.

Jul 1

Jul 7

Jul 8

Jul 9

Jul 10

Jul 22

Beginning inventory

Purchases

Sales

Sales

Purchases

Sales

43 units @ $42 per unit

93 units @ $66 per unit

$3202.

$3168.

$3120.

$3286.

73 units

48 units

73 units @ $45 per unit

63 units

The cost of goods sold for the July 9 sale was

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following are the transactions for the month of July. Units Unit Cost Unit Selling Price July 1 Beginning Inventory 55 $ 10 July 13 Purchase 275 11 July 25 Sold (100 ) $ 14 July 31 Ending Inventory 230 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. How would i creat a FIFO periodic table?arrow_forwardWan Tan Corp. made the following four inventory purchases in June: June 1 150 units $5.20 June 10 200 units $5.85 June 15 200 units $6.30 June 28 150 units $6.60 On June 22, 450 units were sold. The company uses the perpetual inventory system and the weighted average to value the inventory. Calculate the cost of goods sold for the sale. Round to the nearest whole dollar. Select one: a. $2,580 b. $2,628 c. $2,700 d. $1,572arrow_forwardGive me correct answer with explanation.viarrow_forward

- godo subject-Accounting-arrow_forwardurrent ALLE empt mFIogress Flint Corporation uses a perpetual inventory system reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 120 $6 $720 12 Purchases 360 2,520 23 Purchases 240 1,920 30 Inventory 250 I Calculate the average cost per unit, using a perpetual inventory system. Assume a sale of 420 units occurred on June 15 for a selling price of $9 and a sale of 50 units on June 27 for $10. (Round answers to 3 decimal places, e.g. 5.125.) June 1 %24 June 12 $ June 15 $ 7:59 acer 7.arrow_forwardConcord has the following inventory information. July 1 Beginning Inventory 30 units at $15 90 units at $23 7 Purchases 22 Purchases 10 units at $20 O $2060. O $2090. O $2270. O $2173. $450 2070 200 $2720 A physical count of merchandise inventory on July 31 reveals that there are 30 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for July isarrow_forward

- The units of Manganese Plus available for sale during the year were as follows: Mar. 1 Inventory 24 units @ $32 $768 June 16 Purchase 30 units @ $35 1,050 Nov. 28 Purchase 38 units @ $39 1,482 92 units $3,300 There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. a. Determine the inventory cost by the FIFO method. b. Determine the inventory cost by the LIFO method. c. Determine the inventory cost by the average cost methods. Round answer to two decimal places. %24 %24 %24arrow_forwardJesters company uses a periodic inventory system and reports the following for the month of June DATE EXPLAINATION UNITS UNIT COST TOTAL COST June 1 Inventory 120 $5 $600 12 Purchase 370 $6 $2220 23 Purchase 200 $7 $1400 30. Inventory. 230 How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO? Explain why the average cost is not $6arrow_forwardPlease help mearrow_forward

- Sunland Company's inventory records show the following data for the month of September: Units Unit Cost Inventory, September 1 200 $5.00 Purchases: September 8 900 6.00 September 18 900 7.00 A physical inventory on September 30 shows 520 units on hand. Calculate the value of ending inventory and cost of goods sold if the company uses LIFO inventory costing and a periodic inventory system. Ending inventory $ Cost of goods sold $ +Aarrow_forwardSuppose that Pharoah has the following inventory data: July 1 Beginning inventory 25 units at $5.00 5 Purchases 101 units at $5.50 14 Sale 67 units 21 Purchases 50 units at $6.00 30 Sale 47 units Assuming that a perpetual inventory system is used, what is the cost of goods sold on a LIFO basis for July? O $650.50 ○ $980.50 O $330.00 O $485.00arrow_forwardSuppose that Sunland has the following inventory data: Nov. 1 Inventory 10 units @ $7 each Purchase 100 units @ $7.45 each 60 units @ $7.30 each 80 units @ $7.60 each 8 17 25 Purchase Purchase The company uses a periodic inventory system. A physical count of merchandise inventory on November 30 reveals that there are 90 units on hand. Cost of goods sold under FIFO is O $666. O $681. O $1180. O $1419.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education