FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

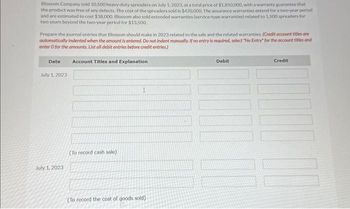

Transcribed Image Text:Blossom Company sold 10,500 heavy-duty spreaders on July 1, 2023, at a total price of $1,850,000, with a warranty guarantee that

the product was free of any defects. The cost of the spreaders sold is $420,000. The assurance warranties extend for a two-year period

and are estimated to cost $38,000. Blossom also sold extended warranties (service-type warranties) related to 1.500 spreaders for

two years beyond the two-year period for $13,500.

Prepare the journal entries that Blossom should make in 2023 related to the sale and the related warranties. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter o for the amounts. List all debit entries before credit entries.)

Date

July 1, 2023

July 1, 2023

Account Titles and Explanation

(To record cash sale)

I

(To record the cost of goods sold).

Debit

Credit

100 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pharoah Company offers a five-year warranty on its products. Pharoah previously estimated warranty costs to be 3% of sales but in 2025 revised this estimate to 1% due to process and quality control improvements. Pharoah reported warranty costs of $80100 on $2670000 of sales in 2023 and $95100 on $3170000 in 2024 . Sales revenue for 2025 was $5170000. What is the adjustment to retained earingings in 2025?arrow_forwardRefer to the photoarrow_forwardProctor provides 1 year warranty on every chair it produces and sells. On 12-31-19, proctor reported warranty payable of $960,000. During 2019, proctor recognized $640,000 of warranty expense. Warranty claims of $510,000. Tax rate $21%. A) DTC: 201,600 B) DTA: 174, 300 C) DTC: 130, 000 D) DTA: 228,900arrow_forward

- Sunnyvale Computer Company sells a line of computers that carry a six-month warranty. Customers are offered the opportunity to buy a two-year extended warranty for an additional charge. During 2024, Sunnyvale received $328,000 from customers for these extended warranties. All sales are on credit, and funds are received evenly throughout the year and the warranties go into effect immediately after purchase. Required: Prepare a summary journal entry to record sales of the extended warranties. Also prepare any other entries associated with the warranties that should be recorded during 2024. 1. Record the $328,000 sale of the extended warranties. 2.Record the recognition of revenue from extended warranties for the year ending December 31, 2024.arrow_forwardExtravagant Company, which uses IFRS, sells home appliances. On January 1, 2024, it sells a fridge to a customer for $5,300 cash and, as part of a promotion, Extravagant gives the customer a free 15- month extended warranty (service-type warranty). The fridge also has a 9-month assurance-type warranty, which is estimated to cost Extravagant 4% of sales revenue. Assume that the 15-month extended warranty begins after the 9-month assurance-type warranty has expired, so the customer effectively receives 24 months of warranty coverage. Additional information follows: (a) The fridge, if sold by itself, would normally sell for $5,100. The cost of the fridge to Extravagant, based on a first-in first-out (FIFO) perpetual inventory system, is $1,900. (b) The extended warranty, if sold by itself, would normally sell for $1,275. Required: (A) Prepare the journal entry/entries that should be recorded on January 1, 2024. (B) How much Operating Income would be reported by Extravagant for the…arrow_forwardCarla Vista Resellers Ltd. (CVRL) sells gently used and refurbished appliances. The company provides a three-month warranty that is included in the cost of the appliance. Claims under the warranties vary from replacing defective parts to providing customers with new appliances if repairs cannot be made. During 2024, the estimated cost related to the three-month warranties was $36,480, of which $24,000 had been incurred before year end ($18,240 on replacement appliances and $5,760 for parts). For an additional charge of $144, CVRL also offers extended warranty coverage for three years on its refurbished appliances. This amount is expected to cover the costs associated with the extended warranties. During 2024, CVRL sold 480 three-year warranty plans. The costs incurred during the year for repairs and replacements under these plans amounted to $14,400. Based on experience, the company estimates that its total warranty costs over the three-year coverage period will be $43,200, which it…arrow_forward

- Adams, Inc. sells widgets that come with an unconditional five-year warranty. According to Adams' best estimates, 7.8% of all units sold will require repair or replacement under that warranty, and the average cost of honoring one warranty claim is $60. During 2023, Adams' first year of operations, 176,000 widgets were sold, 1,278 of which were repaired or replaced under warranty claims. On its December 31, 2023 balance sheet, what amount of warranty liability will Adams report?arrow_forwardWoodmier Lawn Products introduced a new line of commercial sprinklers in 2023 that carry a one-year warranty against manufacturer's defects. Because this was the first product for which the company offered a warranty, trade publications were consulted to determine the experience of others in the industry. Based on that experience, warranty costs were expected to approximate 2% of sales. Sales of the sprinklers in 2023 were $2.8 million. Accordingly, the following entries relating to the contingency for warranty costs were recorded during the first year of selling the product: General Journal Accrued liability and expense Warranty expense (2% × $2,800,000) Warranty liability Actual expenditures (summary entry) Warranty liability Cash Debit 56,000 Required 1 Required 2 25,000 Credit 56,000 In late 2024, the company's claims experience was evaluated and it was determined that claims were far more than expected-3% of sales rather than 2%. View transaction list 25,000 Required: 1. Assuming…arrow_forwardOn December 31, 2023, Sablok Company sells production equipment to Tang Inc. for $50,000. Sablok includes a one-year assurance warranty service with the sale of all its equipment. The customer receives and pays for the equipment on December 31, 2023. Sablok estimates the prices to be $48,800 for the equipment and $1,200 for the cost of warranty. Instructions Are the sale of the equipment and the warranty separate performance obligations within the contract? Explain. Prepare a single compound journal entry to record this transaction on December 31, 2024. Ignore any related cost of goods sold entry. Repeat the requirements for part (b), assuming that, in addition to the assurance warranty, Sablok sold an extended warranty (service-type warranty) for an additional two years (2024–2025) for $800. (Hint: Use unearned revenue).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education