FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

do fast please as soon ass possible in one hour

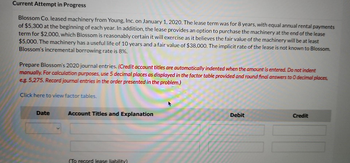

Transcribed Image Text:Current Attempt in Progress

Blossom Co. leased machinery from Young, Inc. on January 1, 2020. The lease term was for 8 years, with equal annual rental payments

of $5,300 at the beginning of each year. In addition, the lease provides an option to purchase the machinery at the end of the lease

term for $2,000, which Blossom is reasonably certain it will exercise as it believes the fair value of the machinery will be at least

$5,000. The machinery has a useful life of 10 years and a fair value of $38,000. The implicit rate of the lease is not known to Blossom.

Blossom's incremental borrowing rate is 8%.

Prepare Blossom's 2020 journal entries. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 0 decimal places,

e.g. 5,275. Record journal entries in the order presented in the problem.)

Click here to view factor tables.

Date

Account Titles and Explanation

(To record lease liability)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Great Calls has a special plan offer this month. There is a $6.00 per month charge each month and calls anywhere in the United States are $0.04 per minute. What would the monthly cost be if you typically talk for 550 minutes per month? Question 47 options: $16.00 $22.00 $6.00 $28.00arrow_forwardPlease try to solve complete within one hour pleasearrow_forwardFast pls solve this question correctly in 5 min pls I will give u like for sure Surbharrow_forward

- Fast pls solve this question correctly in 5 min pls I will give u like for sure Surbh A $53,000 loan is taken out on a boat with the terms 9% APR for 36 months. How much are the monthly payments on this loan? < OA. $2,022.46 OB. $1,685.39 OC. $2,191.00 OD. $1,853.92arrow_forwardFast pls solve this question correctly in 5 min pls I will give u like for sure Mnty An anonymous donor wishes to give an endowment that will initially payout $50,000 per year forever. Assuming they can secure a 4% interest rate, how much would the donor need to contribute to the endowment so that I can pay out forever if a) it continues to pay out $50,000 per year continuously? b) the payouts, have a continuously compounded annual increase of 3%? c) the payouts, increased by $4000 per year continuously?arrow_forward5 You have a credit card with a balance of $11,500 and an APR of 17.3 percent compounded monthly. You have been making monthly payments of $225 per month, but you have received a substantial raise and will increase your monthly payments to $275 per month. How many months quicker will you be able to pay off the account? Multiple Choice 28.75 months 25.88 months 24.64 months 9.29 months 26.83 monthsarrow_forward

- PROBLEM #2 Novex Company keeps careful track of the time to complete customer orders. During the most recent quarter, the following average times were recorded for each unit or order: Days . 17.0 Wait time..... Inspection time........0.4 Process time ..........2.0 Move time ..... Queue time.... .5.0 Goods are shipped as soon as production is completed. ..0.6 Required: 1. Compute the throughput time. 2. Compute the manufacturing cycle efficiency (MCE). 3. What percentage of the production time is spent in non-value-added activities? 4. Compute the delivery cycle time.arrow_forwardplz solve it within 30-40 mins ill give you multiple upvotesarrow_forwardFast pls solve this question correctly in 5 min pls I will give u like for sure Savitik You bought $15.25 worth of merchandise from a convenience store, but the final bill was $16.44. What is the sales tax rate? 7.6% 8.0% 6.5% 6.9% 7.8% The height of a giant redwood tree is 200 feet, and the height of an oak tree is 120 feet. Taking the height of the redwood tree as the base value, the percentage change in height from the redwood tree to the oak tree is: -31.25% -20.00% -40.00% -14.27% 33.33% The university bookstore sold 4,100 textbooks last year and 4,700 textbooks this year. By what percentage did textbook sales increase over last year's sales? 9.76% 11.90% 9.09% 14.63% 17.07% This year, 5,700 of the students are women. Last year, 4,000 of the students at Big State University were women. What is the percentage change in women who attended Big State University this year compared to last year? 38.00% 42.50% 80.80% 29.82% 70.18% If the unemployment rate…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education