FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

spreadsheet 10.1

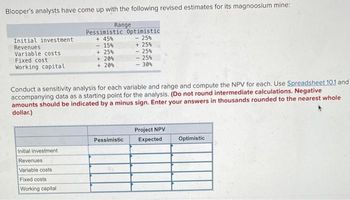

Transcribed Image Text:Blooper's analysts have come up with the following revised estimates for its magnoosium mine:

Range

Initial investment

Revenues

Variable costs

Fixed cost

Working capital

Initial investment

Pessimistic Optimistic

+45%

Revenues

Variable costs

Fixed costs

Working capital

- 15%

+ 25%

+ 20%

+ 20%

Conduct a sensitivity analysis for each variable and range and compute the NPV for each. Use Spreadsheet 10.1 and

accompanying data as a starting point for the analysis. (Do not round intermediate calculations. Negative

amounts should be indicated by a minus sign. Enter your answers in thousands rounded to the nearest whole

dollar.)

25%

+ 25%

- 25%

- 25%

30%

Pessimistic

Project NPV

Expected

Optimistic

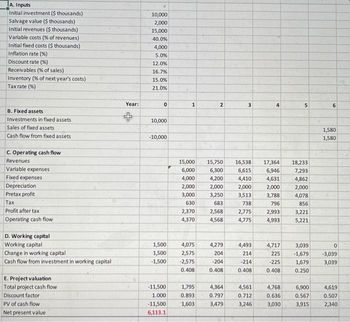

Transcribed Image Text:A. Inputs

Initial investment ($ thousands)

Salvage value ($ thousands)

Initial revenues ($ thousands)

Variable costs (% of revenues)

Initial fixed costs ($ thousands)

Inflation rate (%)

Discount rate (%)

Receivables (% of sales)

Inventory (% of next year's costs)

Tax rate (%)

B. Fixed assets

Investments in fixed assets

Sales of fixed assets

Cash flow from fixed assets

C. Operating cash flow

Revenues

Variable expenses

Fixed expenses

Depreciation

Pretax profit

Tax

Profit after tax

Operating cash flow

D. Working capital

Working capital

Change in working capital

Cash flow from investment in working capital

E. Project valuation

Total project cash flow

Discount factor

PV of cash flow

Net present value

Year:

10,000

2,000

15,000

40.0%

4,000

5.0%

12.0%

16.7%

15.0%

21.0%

0

10,000

-10,000

1,500

1,500

-1,500

1

15,000

6,000

4,000

2,000

3,000

630

2,370

4,370

4,075

2,575

-2,575

0.408

1,795

0.893

2

15,750 16,538

6,300

6,615

4,200

4,410

2,000

2,000

3,250

3,513

683

738

2,568

4,568

4,279

204

-204

0.408

-11,500

4,364

1.000

0.797

-11,500 1,603 3,479

6,113.1

3

2,775

4,775

4,493

214

-214

0.408

4,561

0.712

3,246

4

17,364

6,946

4,631

2,000

3,788

796

2,993

4,993

4,717

225

-225

0.408

4,768

0.636

3,030

5

18,233

7,293

4,862

2,000

4,078

856

3,221

5,221

3,039

-1,679

1,679

0.250

6,900

0.567

3,915

6

1,580

1,580

0

-3,039

3,039

4,619

0.507

2,340

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q#2 Submit this question as one CPP files Write a complete C++ program. In this program you have to write 3 functions in addition to the main function. 1. Function #1: Write function throwDice that generates a random number between 1 and 6. The function should return the generated number. int throwDice(); 1. Function #2: Write function userGuess that asks the user to enter a valid number between 1 and 6. The function should ask the user to re-enter as long as the input is not valid. The function should return the valid input of the user. int userGuess(); 1. Function #3: Write function decide that receives as input parameters two integers, the first parameter dice represents the dice value and the second parameter userG represents a user guess. This function should return true if userG and dice are equal; otherwise, it should return false. bool decide(int dice, int userG); Write a complete program to do the following in the main: 1. Call the function dice. 2. Call the function…arrow_forwardHi can you show how to input in excel using the pmt formula thank you so mucharrow_forwardManaged CDOs is designed for what?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education