FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

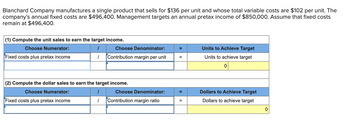

Transcribed Image Text:Blanchard Company manufactures a single product that sells for $136 per unit and whose total variable costs are $102 per unit. The

company's annual fixed costs are $496,400. Management targets an annual pretax income of $850,000. Assume that fixed costs

remain at $496,400.

(1) Compute the unit sales to earn the target income.

Choose Numerator:

Fixed costs plus pretax income

Choose Denominator:

=

Units to Achieve Target

Contribution margin per unit

=

Units to achieve target

0

(2) Compute the dollar sales to earn the target income.

Choose Numerator:

Fixed costs plus pretax income

Choose Denominator:

Dollars to Achieve Target

1

Contribution margin ratio

=

Dollars to achieve target

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Prearcan CVBA's income statement shows the following: Sales Revenue: $9,121,000 Variable Costs: 4,797,000 Fixed Costs: 3,946,000 If unit sales were 5,000, the contribution margin per unit to the nearest cent is : $arrow_forwardA company's product sells at $12.26 per unit and has a $5.39 per unit variable cost. The company's total fixed costs are $96,700. The contribution margin per unit is:arrow_forwardManjiarrow_forward

- Compare the following two companies: Company A is a retail merchandise firm with current sales of $4,000,000 and a 45% contribution margin. Company A's fixed costs are $600,000. Company B is a service firm with current service revenue of $2,800,000 and a 15% contribution margin. Company B’s fixed costs are $375,000. The following names are to be considered when completing this problem: Operating Income Variable Costs Sales Fixed Costs per Unit Selling Price per Unit Variable Cost per Unit Contribution Margin Fixed Costs Operating Loss 1. Based on the information given, prepare a complete contribution margin income statement for Company A: Company AContribution Margin Income StatementProjected 2. Based on the information given, prepare a complete contribution margin income statement for Company B: Company BContribution Margin Income StatementProjected 3.Compute the degree of operating leverage for…arrow_forwardFranklin Company incurs annual fixed costs of $133,500. Variable costs for Franklin's product are $29.70 per unit, and the sales price is $45.00 per unit. Franklin desires to earn an annual profit of $45,000. Required Use the contribution margin ratio approach to determine the sales volume in dollars and units required to earn the desired profit. Note: Do not round intermediate calculations. Round your final answers to the nearest whole number. Sales in dollars Sales volume in unitsarrow_forwardSunn Company manufactures a single product that sells for $215 per unit and whose variable costs are $172 per unit. The company's annual fixed costs are $597,700. (a) Compute the company's contribution margin per unit. Contribution margin (b) Compute the company's contribution margin ratio. Numerator: (c) Compute the company's break-even point in units. 1 1 Numerator: 1 1 Numerator: Denominator: Denominator: (d) Compute the company's break-even point in dollars of sales. 1 1 Denominator: = = II II = Contribution Margin Ratio Contribution margin ratio Break-Even Units Break-even units Break-Even Dollars Break-even dollarsarrow_forward

- Information concerning a product produced by Ender Company appears here: Sales price per unit $ 174 Variable cost per unit $ 76 Total annual fixed manufacturing and operating costs $ 656,600 Required Determine the following: Contribution margin per unit. Number of units that Ender must sell to break even. Sales level in units that Ender must reach to earn a profit of $245,000. Determine the margin of safety in units, sales dollars, and as a percentage.arrow_forwardBonita Industries has a weighted-average unit contribution margin of $30 for its two products, Standard and Supreme. Expected sales for Bonita are 70000 Standard and 20000 Supreme. Fixed expenses are $2400000. At the expected sales level, Bonita’s net income will be $1800000. $300000. $(1050000). $2700000.arrow_forwardRitchie Manufacturing Company makes a product that it sells for $150 per unit. The company incurs variable manufacturing costs of $60 per unit. Variable selling expenses are $18 per unit, annual fixed manufacturing costs are $ 480,000, and fixed selling and administrative costs are $240, 000 per year. Required: Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Confirm your results by preparing a contribution margin income statement in excel for the break - even sales volume.arrow_forward

- A firm manufactures a product that sells for $25 per unit. Variable cost per unit is $2 and fixed cost per period is $1840. Capacity per period is 2000 units. (a) Develop an algebraic statement for the revenue function and the cost function. (b) Determine the number of units required to be sold to break even. (c) Compute the break-even point as a percent of capacity. (d) Compute the break-even point in sales dollars.arrow_forwardLi Company has a unit selling price of $150, unit variable costs of $45, and total fixed costs of $47,200. How much sales revenue must Li Company generate to achieve net income of $27,700. Sales revenue needed to achieve target net income $arrow_forwardBlanchard Company manufactures a single product that sells for $180 per unit and whose total variable costs are $126 per unit. The company's annual fixed costs are $842,400. Management targets an annual pretax income of $1,350,000. Assume that fixed costs remain at $842,400. (1) Compute the unit sales to earn the target income. Choose Numerator: Choose Denominator: Units to Achieve Target Units to achieve target %3D (2) Compute the dollar sales to earn the target income. Choose Numerator: Choose Denominator: Dollars to Achieve Target Dollars to achieve target %3Darrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education