FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

| Birdfeeders Unlimited makes backyard birdfeeders. The company sells the birdfeeders to home improvement stores. | ||||||||||

| $15 | Sales price per birdfeeder | |||||||||

| 1.5 | Board feet of wood required for each birdfeeder | |||||||||

| $4 | Cost per board foot (actual) | |||||||||

| 10% | Desired ending wood inventory stated as a percentage of next month’s production requirements | |||||||||

| 20% | Desired ending finished goods inventory (finished birdfeeders) stated as a percentage of next month’s sales | |||||||||

| $550,000 | Total cost of direct materials purchases in December | |||||||||

| 45% | of direct materials purchases are paid in the month of purchase | |||||||||

| 55% | of direct materials purchases are paid in the month after purchase |

Prepare the direct materials purchases budget for the first three months of the year, as well as a summary budget for the quarter. Assume the company needs 120,000 board feet of wood for production in April.

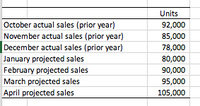

Transcribed Image Text:Units

October actual sales (prior year)

November actual sales (prior year)

December actual sales (prior year)

January projected sales

92,000

85,000

78,000

80,000

February projected sales

90,000

March projected sales

95,000

April projected sales

105,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Break-Even Units: Units for Target Profit Jay-Zee Company makes an in-car navigation system. Next year, Jay-Zee plans to sell 20,000 units at a price of $380 each. Product costs include: Direct materials $80.00 Direct labor $46.00 Variable overhead $11.00 Total fixed factory overhead $705,800 Variable selling expense is a commission of 6 percent of price; fixed selling and administrative expenses total $86,200. Required:arrow_forwardShaw Company produces and sells two packaged products—Z-Bikes and y Bikes. Revenue and cost information relating to the products follow: Product Z Bikes Y Bikes Selling price per unit $ 175.00 $ 200.00 Variable expenses per unit $ 85.00 $ 105.00 Traceable fixed expenses per year $ 200,000 $ 75.00 Common fixed expenses in the company total $110 annually. Last year the company produced and sold 50,000 units of Z Bikes and 30,000 units of Y Bikes. Required: Prepare a contribution format income statement segmented by product lines.arrow_forwardCompany Y produces and sells two packaged products Weedban and Greengrow Revenue and cost information related to the products follows: Weedban Greengrow SALES price per unit $9.00 $ 31.00 Variable expense per unit $2.90 $14.00 Traceable fixed expense per year $131,000 $44,000 Last year the company produced and sold 38,500 units of weed ban and 17,000 of Green grow. It's annual common fixed expenses are $106,000. Prepare a contribution format income statement segmented by-product lines ? Thank you,arrow_forward

- Heather Hudson makes stuffed teddy bears. Recent information for her business follows: Selling price per bear Total fixed costs per month Variable cost per bear $31.50 1,729.00 18.50 Required: If she sells 289 bears next month, determine the margin of safety in units, in sales dollars, and as a percentage of sales. Note: Round your intermediate calculations to the nearest whole number and round your "Percentage of Sales" answer to 2 decimal places. (i.e. 0.1234 should be entered as 12.34%. Round your "Margin of safety (Dollars)" answer to the nearest whole number.) Margin of safety (Units) Margin of safety (Dollars) Margin of safety percentage %arrow_forwardPlease help me with show all calculation thankuarrow_forwarda pharmacy takes up its spring time shipment of sunglasses to provide of cost and a profit of 70% of cost. for overhead expense of 40% at the end of the summer what rate of markdown can the pharmacy apply to the remaining inventory of sungLASSES and still break even on sales at this level ? round to the neares 0.1%arrow_forward

- Hardevarrow_forwardMarwik Pianos. Inc purchases pianos from a large manufacturer for an average cost of $1,482 per unit and then sells them to retail Customers for an average price or S2,100 each. The company's selling and administrative costs for a typical month are presented below Costs Cost Formuala Selling $965 per month Advertising $4,793 per month plus 5% of Sales Sales Salaries and commissions $57 per piano sold Delivery of Pianos to customers $670 per month Utilities $4,903 per month Depreciaiton of Sales Facilities Administrative Executive Salaries $13,506 per month Insurance $701 per month Clerical $2,480 per month,plus $ 37 per piano sold Depreciation of Office Equipment $916 per month During August, Marvik Pianos sold and delivered 63 pianos. Prepare Traditional Income Statement and also prepare contribution format income statement for cost(Show costs and revenues on both a total and a per unit basis down through contribution margin)arrow_forwardMost work is done need help with Per Unit and Percent of Sales Section.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education