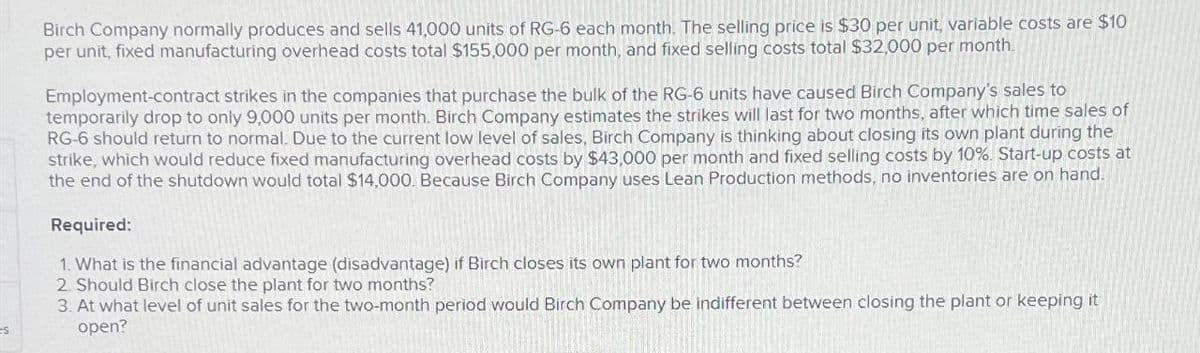

Birch Company normally produces and sells 41,000 units of RG-6 each month. The selling price is $30 per unit, variable costs are $10 per unit, fixed manufacturing overhead costs total $155,000 per month, and fixed selling costs total $32,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Company's sales to temporarily drop to only 9,000 units per month. Birch Company estimates the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Birch Company is thinking about closing its own plant during the strike, which would reduce fixed manufacturing overhead costs by $43,000 per month and fixed selling costs by 10%. Start-up costs at the end of the shutdown would total $14,000. Because Birch Company uses Lean Production methods, no inventories are on hand. Required: 1. What is the financial advantage (disadvantage) if Birch closes its own plant for two months? 2. Should Birch close the plant for two months? 3. At what level of unit sales for the two-month period would Birch Company be indifferent between closing the plant or keeping it open?

Birch Company normally produces and sells 41,000 units of RG-6 each month. The selling price is $30 per unit, variable costs are $10 per unit, fixed manufacturing overhead costs total $155,000 per month, and fixed selling costs total $32,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Company's sales to temporarily drop to only 9,000 units per month. Birch Company estimates the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Birch Company is thinking about closing its own plant during the strike, which would reduce fixed manufacturing overhead costs by $43,000 per month and fixed selling costs by 10%. Start-up costs at the end of the shutdown would total $14,000. Because Birch Company uses Lean Production methods, no inventories are on hand. Required: 1. What is the financial advantage (disadvantage) if Birch closes its own plant for two months? 2. Should Birch close the plant for two months? 3. At what level of unit sales for the two-month period would Birch Company be indifferent between closing the plant or keeping it open?

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 5EA: Maple Enterprises sells a single product with a selling price of $75 and variable costs per unit of...

Related questions

Question

None

Transcribed Image Text:S

Birch Company normally produces and sells 41,000 units of RG-6 each month. The selling price is $30 per unit, variable costs are $10

per unit, fixed manufacturing overhead costs total $155,000 per month, and fixed selling costs total $32,000 per month.

Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Company's sales to

temporarily drop to only 9,000 units per month. Birch Company estimates the strikes will last for two months, after which time sales of

RG-6 should return to normal. Due to the current low level of sales, Birch Company is thinking about closing its own plant during the

strike, which would reduce fixed manufacturing overhead costs by $43,000 per month and fixed selling costs by 10%. Start-up costs at

the end of the shutdown would total $14,000. Because Birch Company uses Lean Production methods, no inventories are on hand.

Required:

1. What is the financial advantage (disadvantage) if Birch closes its own plant for two months?

2. Should Birch close the plant for two months?

3. At what level of unit sales for the two-month period would Birch Company be indifferent between closing the plant or keeping it

open?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning