FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Question

Prepare Statement of Profit or Loss for the month ended 31 March.

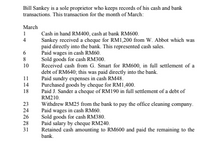

Transcribed Image Text:Bill Sankey is a sole proprietor who keeps records of his cash and bank

transactions. This transaction for the month of March:

March

1

Cash in hand RM400, cash at bank RM600.

Sankey received a cheque for RM1,200 from W. Abbot which was

paid directly into the bank. This represented cash sales.

Paid wages in cash RM60.

Sold goods for cash RM300.

Received cash from G. Smart for RM600, in full settlement of a

debt of RM640; this was paid directly into the bank.

Paid sundry expenses in cash RM48.

Purchased goods by cheque for RM1,400.

Paid J. Sander a cheque of RM190 in full settlement of a debt of

4

6

8

10

11

14

18

RM210.

Withdrew RM25 from the bank to pay the office cleaning company.

Paid wages in cash RM60.

Sold goods for cash RM380.

Paid salary by cheque RM240.

Retained cash amounting to RM600 and paid the remaining to the

bank.

23

24

26

28

31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Journal entries based on perpetual inventory: Returned one damage product to the buyer for the $25.arrow_forwardPurchases of an inventory item during last month vere as follows: Number of items Unit price $5.00 5 10 8 15 $8.00 $6.00 $3.00 What was the weighted average price per item? O a Ob O c Od $5.21 $49.50 $55.50 $5.50arrow_forwardcalculate number of days sales in inventoryarrow_forward

- ! Required information [The following information applies to the questions displayed below.] The following are the transactions for the month of July. July 1 July 13 July 25 July 31 Beginning Inventory Purchase Units 46 Unit Cost $ 10 Unit Selling Price 230 11 Sold Ending Inventory (100) 176 $ 14 Required: a. Calculate cost of goods available for sale and ending inventory under FIFO. Assume a periodic inventory system is used. b. Calculate sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. Complete this question by entering your answers in the tabs below. Required A Required B Calculate cost of goods available for sale and ending inventory under FIFO. Assume a periodic inventory system is used. FIFO (Periodic) Units Cost per Unit Total Beginning Inventory Purchases July 13 S Prev 1 2 3 of 11 Nextarrow_forwardHelp asaparrow_forwardto.mheducation.com/ext/map/index.html?_con=con&external_browser=U&launchUn=htt Assignment 3- COGM Margaret Rosenthal, accountant for Russell Manufacturing Company, prepared the following income statement for the quarter ending December 31, 2019. Sales Purchases of materials (1) Payroll (2) Advertising Administrative travel) Manufacturing utilities Facility rental (3) Depreciation (4) Sales commissions Annual insurance (manufacturing) Office utilities Management salaries (5) Net income Notes: (1) 80% of the materials were direct (2) 70% direct labour; 30% indirect labour (3) 80% related to manufacturing (4) 75% related to manufacturing (5) 30% related to manufacturing Direct materials Work in process Finished goods Furthermore, Rosenthal compiled the following information with respect to inventories for the quarter (note that the company does not maintain inventories of indirect materials). Beginning $ 7,120 $1,395,100 248,390 267,500 37,500 28,100 50,400 95,000 64,500 46,000 45,000…arrow_forward

- petermine the gross profit, cost of merchandise sold, and ending inventory on July 31 using the (a) first-in, first-out, (b) last-in, first-out, and (c) average cost flow methods.arrow_forwardDONT GIVE ANSWER IN IMAGE FORMATarrow_forwardOn December 7, Smart Touch delivers equipment to a small retailer on consignment. The cost of the equipment was $1,460 and the combined retail selling price is $2,200. If the retail shop sells the equipment, Smart Touch will pay 20% commission. Both companies use a perpetual inventory method. Date Accounts Debit Creditarrow_forward

- Don't give answer in imagearrow_forwardThe following are the transactions for the month of July. Units Unit Cost Unit Selling Price July 1 Beginning Inventory 55 $ 10 July 13 Purchase 275 11 July 25 Sold (100 ) $ 14 July 31 Ending Inventory 230 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. How would i creat a FIFO periodic table?arrow_forwardpr.2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education