FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

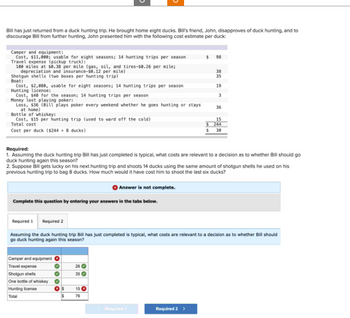

Transcribed Image Text:Bill has just returned from a duck hunting trip. He brought home eight ducks. Bill's friend, John, disapproves of duck hunting, and to

discourage Bill from further hunting, John presented him with the following cost estimate per duck:

Camper and equipment:

Cost, $11,000; usable for eight seasons; 14 hunting trips per season

Travel expense (pickup truck):

100 miles at $0.38 per mile (gas, oil, and tires-$8.26 per mile;

depreciation and insurance-50.12 per mile)

Shotgun shells (two boxes per hunting trip)

Boat:

Cost, $2,080, usable for eight seasons; 14 hunting trips per season

Hunting License:

Cost, $40 for the season; 14 hunting trips per season

Money lost playing poker:

Loss, $36 (Bill plays poker every weekend whether he goes hunting or stays

at home)

Bottle of whiskey:

Cost, $15 per hunting trip (used to ward off the cold)

Total cost

Cost per duck ($244 + 8 ducks)

Complete this question by entering your answers in the tabs below.

Camper and equipment

Travel expense

Shotgun shells

One bottle of whiskey

Hunting license

Total

*100*

Required:

1. Assuming the duck hunting trip Bill has just completed is typical, what costs are relevant to a decision as to whether Bill should go

duck hunting again this season?

2. Suppose Bill gets lucky on his next hunting trip and shoots 14 ducks using the same amount of shotgun shells he used on his

previous hunting trip to bag 8 ducks. How much would it have cost him to shoot the last six ducks?

Answer is not complete.

35

$ 15

$

76

$ 98

Required 1

Required 2

Assuming the duck hunting trip Bill has just completed is typical, what costs are relevant to a decision as to whether Bill should

go duck hunting again this season?

< Required 1

$

$

Required 2 >

38

35

19

3

36

15

244

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rich Uncle is getting on in years and no longer can safely navigate the stairs in his beautiful three-story (plus basement) mansion. So, following his doctor’s advice, he pays $250,000 to have a four-story elevator installed. Immediately prior to installation of the elevator the mansion’s FMV was $7.5M. With the new elevator the mansion’s FMV is $7.75M. Ignoring the %-of-AGI floor, what is the amount of Rich Uncle’s medical expense deduction, if any, on account of the installation? Why is that the correct amount?arrow_forwardErnie Bilko has a business idea. He wants to rent an abandoned gas station for just the months of November and December. He will convert the gas station into a drive-through Christmas wrapping station. Customers will drive in, drop off their gifts, return the next day, and pick up their wrapped gifts. He needs $333,900 to rent the gas station, purchase wrapping paper, hire workers, and advertise. If he borrows this amount at 6 1/2% interest for those two months, what size lump sum payment will he have to make to pay off the loan? (Round your answer to the nearest cent.)arrow_forwardGerry likes driving small cars and buys nearly identical ones whenever the old one needs replacing. Typically, he trades in his old car for a new one costing about $15,000. A new car warranty covers all repair costs above standard maintenance (standard maintenance costs are constant over the life of the car) for the first two years. After that, his records show an average repair expense (over standard maintenance) of $2500 in the third year (at the end of the year), increasing by 50 percent per year thereafter. If a 30 percent declining-balance depreciation rate is used to estimate salvage values and interest is 9 percent, how often should Gerry get a new car? Click the icon to view the table of compound interest factors for discrete compounding periods when i = 9%. Gerry should get a new car every years, which has the (Round to the nearest whole number as needed.) EAC of $arrow_forward

- Do not give image formatarrow_forwardA 91.arrow_forwardBill just returned from a duck hunting trip with eight ducks. Bill's friend, John, disapproves of duck hunting, and to discourage Bill from further hunting, John presented him with the following cost estimate per duck: Camper and equipment: Cost, $10,000; usable for eight seasons; 14 hunting trips per season Travel expense (pickup truck): $ 89 100 miles at $0.38 per mile (gas, oil, and tires-$0.20 per mile; depreciation and insurance-$0.18 per mile) 38 Shotgun shells (two boxes per hunting trip) 35 Boat: Cost, $2,160, usable for eight seasons; 14 hunting trips per season 19 Hunting license: 5 24 15 $ 225 $ 28 Cost, $70 for the season; 14 hunting trips per season Money lost playing poker: Loss, $24 (Bill plays poker every weekend whether he goes hunting or stays at home) Bottle of whiskey: Cost, $15 per hunting trip (used to ward off the cold) Total cost Cost per duck ($225 +8 ducks) Required: 1. Assuming the duck hunting trip Bill just completed is typical, what costs are relevant to a…arrow_forward

- Jarvie loves to bike. In fact, he has always turned down better-paying jobs to work in bicycle shops where he gets an employee discount. At Jarvie’s current shop, Bad Dog Cycles, each employee is allowed to purchase four bicycles a year at a discount. Bad Dog has an average gross profit percentage on bicycles of 25 percent. During the current year, Jarvie bought the following bikes: Description Retail Price Cost Employee Price Specialized road bike $ 7,400 $ 5,100 $ 5,920 Rocky Mountain mountain bike 4,200 3,500 3,360 Trek road bike 4,700 4,200 3,290 Yeti mountain bike 4,200 3,120 3,360 What amount is Jarvie required to include in taxable income from these purchases?arrow_forwardAmanda must decide to buy or lease a car that she has selected. She has negoiated a purchase price of $35,000 and can borrow money from her credit union by putting $3,000 down and paying $751.68 per month for 48 months at 6% APR. Alternatively, she could lease the car for 48 months at $495 per month by paying $3,000 capitalized cost reduction and a $350 dispostition fee on the car whic is project to have a residual value of $12,100 at the end of the lease. 1. What is the buying dollar cost? 2. What is the leasing dollar cost?arrow_forwardary is considering opening a hobby and craft store. Mary plans to operate the business for six years. Mary requires a minimum 6% return on this investment. Ignore income taxes in this problem.) The data pertaining to her investment opportunity are: Cost of equipment $ 175,000 Working capital needed $ 185,000 Annual cash inflow from sales $ 190,000 Annual cash outflow for operating costs $ 145,000 Salvage value of equipment $ 20,000 Mary plans to operate the business for six years. Mary requires a minimum 6% return on this investment. What is the present value factor you will use for the net annual cash flows?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education