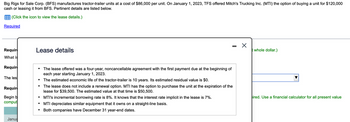

Big Rigs for Sale Corp. (BFS) manufactures tractor-trailer units at a cost of $86,000 per unit. On January 1, 2023, TFS offered Mitch's Trucking Inc. (MTI) the option of buying a unit for $120,000 cash or leasing it from BFS. Pertinent details are listed below. | (Click the icon to view the lease details.) Required • The lease offered was a four-year, noncancellable agreement with the first payment due at the beginning of each year starting January 1, 2023. Requir What is Requir The les Requir Begin b comput Lease details • • The estimated economic life of the tractor-trailer is 10 years. Its estimated residual value is $0. The lease does not include a renewal option. MTI has the option to purchase the unit at the expiration of the lease for $39,500. The estimated value at that time is $50,500. • MTI's incremental borrowing rate is 8%. It knows that the interest rate implicit in the lease is 7%. MTI depreciates similar equipment that it owns on a straight-line basis. • Both companies have December 31 year-end dates. - ☑ whole dollar.) ired. Use a financial calculator for all present value Janua

Big Rigs for Sale Corp. (BFS) manufactures tractor-trailer units at a cost of $86,000 per unit. On January 1, 2023, TFS offered Mitch's Trucking Inc. (MTI) the option of buying a unit for $120,000 cash or leasing it from BFS. Pertinent details are listed below. | (Click the icon to view the lease details.) Required • The lease offered was a four-year, noncancellable agreement with the first payment due at the beginning of each year starting January 1, 2023. Requir What is Requir The les Requir Begin b comput Lease details • • The estimated economic life of the tractor-trailer is 10 years. Its estimated residual value is $0. The lease does not include a renewal option. MTI has the option to purchase the unit at the expiration of the lease for $39,500. The estimated value at that time is $50,500. • MTI's incremental borrowing rate is 8%. It knows that the interest rate implicit in the lease is 7%. MTI depreciates similar equipment that it owns on a straight-line basis. • Both companies have December 31 year-end dates. - ☑ whole dollar.) ired. Use a financial calculator for all present value Janua

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Please provide the requirements. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Big Rigs for Sale Corp. (BFS) manufactures tractor-trailer units at a cost of $86,000 per unit. On January 1, 2023, TFS offered Mitch's Trucking Inc. (MTI) the option of buying a unit for $120,000

cash or leasing it from BFS. Pertinent details are listed below.

| (Click the icon to view the lease details.)

Required

•

The lease offered was a four-year, noncancellable agreement with the first payment due at the beginning of

each year starting January 1, 2023.

Requir

What is

Requir

The les

Requir

Begin b

comput

Lease details

•

•

The estimated economic life of the tractor-trailer is 10 years. Its estimated residual value is $0.

The lease does not include a renewal option. MTI has the option to purchase the unit at the expiration of the

lease for $39,500. The estimated value at that time is $50,500.

•

MTI's incremental borrowing rate is 8%. It knows that the interest rate implicit in the lease is 7%.

MTI depreciates similar equipment that it owns on a straight-line basis.

•

Both companies have December 31 year-end dates.

-

☑

whole dollar.)

ired. Use a financial calculator for all present value

Janua

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education