Concept explainers

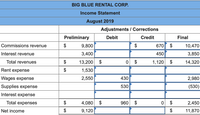

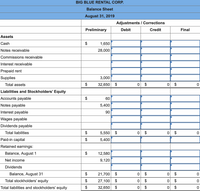

Big Blue Rental Corp. provides rental agent services to apartment building owners. Big Blue Rental Corp.’s preliminary income statement for August 2019 and its August 31, 2019, preliminary

- Rental commissions of $670 had been earned in August but had not yet been received from or billed to building owners.

- When supplies are purchased, their cost is recorded as an asset. As supplies are used, a record of those used is kept. The record sheet shows that $530 of supplies were used in August.

- Interest on the note payable is to be paid on May 31 and November 30. Interest for August has not been accrued—that is, it has not yet been recorded. (The Interest Payable of $90 on the balance sheet is the amount of the accrued liability at July 31.) The interest rate on this note is 10%.

- Wages of $430 for the last week of August have not been recorded.

- The Rent Expense of $1,530 represents rent for August, September, and October, which was paid early in August.

- Interest of $450 has been earned on notes receivable but has not yet been received.

- Late in August, the board of directors met and declared a cash dividend of $4,500, payable September 10. Once declared, the dividend is a liability of the corporation until it is paid.

Required:

a. Using the columns provided on the income statement and balance sheet for Big Blue Rental Corp., make the appropriate adjustments/corrections to the statements, and enter the correct amount in the Final column. (Hint: Use the five questions of transaction analysis.

(Enter amounts in the Adjustments/Corrections columns as positive numbers. Net income Adjustments/Corrections: Please use the numbers from the Income Statement and enter amounts in both the Debit and Credit columns.)

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Identify the letter for the principle or assumption from A through F in the blank space next to situation that it best explains or justifies: _________In December of this year, Chavez Landscaping received a customer’s order and cash prepayment to install sod at a house that would not be ready for installation until March of next year. Chavez should record the revenue from the customer order in March of next year, not in December of this year.arrow_forwardSheffield Corp. received a check for $19080 on July 1, which represents a 6-month advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited for the full $19080. Financial statements will be prepared on July 31. Sheffield's should make the following adjusting entry on July 31: debit Unearned Rent Revenue, $19080; credit Rent Revenue, $19080. debit Cash, $19080; credit Rent Revenue, $19080. debit Rent Revenue, $3180; credit Unearned Rent Revenue, $3180. debit Unearned Rent Revenue, $3180; credit Rent Revenue, $3180.arrow_forwardOn April 25, Foreman Electric installs wiring in a new home for $3,500 on account. However, on April 27, Foreman’s electrical work does not pass inspection, and Foreman grants the customer an allowance of $600 because of the problem. The customer makes full payment of the balance owed, excluding the allowance, on April 30. Required: 1. 2. & 3. Record the journal entries for the above information. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Charles Whyte commenced business on May 1 2019, making up his accounts to September 30 annually. The statement of the Profit or Loss Account for the first 17 months ended September 30,2020 is as follows: Gross Profit Less: Repairs and maintenance. Local transport and travelling Salaries and wages Provision for bad debts Preliminary expenses Depreciation Bank interest and charges Legal and professional charges General expenses (Allowable) Clearing expense on motor vehicle Bad debt Amounts written off Loan to absconded employee (ii) (iii) (iv) (1) You are also given the following additional information. Bad debt £ (v) £'000 30/10/2018 1/1/2019 1/5/2019 1,500 2,450 6,500 1,350 960 1,630 1,520 1,380 1,870 685 2,800 Building Motor Vehicle Furniture and fittings Legal and professional charges were: Salaries and wages: The following qualifying capital expenditures were acquired on: Fines for contravention of the law Legal expenses for tax appeal Audit and accountancy charges £'000 19,300…arrow_forwardMarsteller Properties Inc. owns apartments that it rents to university students. At December 31,2019, the following unadjusted account balances were available: The following information is available for adjusting entries:a. An analysis of apartment rental contracts indicates that $3,800 of apartment rent is unbilledand unrecorded at year end.b. A physical count of supplies reveals that $1,400 of supplies are on hand at December 31, 2019.c. Annual depreciation on the buildings is $204,250.d. An examination of insurance policies indicates that $12,000 of the prepaid insurance applies to coverage for 2019.e. Six months’ interest at 9% is unrecorded and unpaid on the notes payable. f. Wages in the amount of $6,100 are unpaid and unrecorded at December 31.g. Utilities costs of $300 are unrecorded and unpaid at December 31.h. Income taxes of $5,738 are unrecorded…arrow_forwardAdonis, Inc. paid $3,000 for three months of rent on November 1, 2020. At December 31, 2020, the company's bookkeeper made a mistake and forgot to prepare the required adjustment to record rent expense. Because of this error both total expenses and net income are understated. O expenses are overstated and net income is understated. both total assets and expenses are overstated. O total assets are correct and expenses are understated. both net income and total assets are overstated.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education