Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

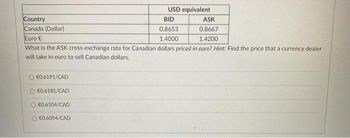

Transcribed Image Text:Country

Canada (Dollar)

Euro €

BID

ASK

0.8653

0.8667

1.4000

1.4200

What is the ASK cross-exchange rate for Canadian dollars priced in euro? Hint: Find the price that a currency dealer

will take in euro to sell Canadian dollars.

€0.6191/CAD

€0.6181/CAD

USD equivalent

€0.6104/CAD

O €0.6094/CAD

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the information below to answer the questions that follow. U.S. $ EQUIVALENT CURRENCY PER U.S. $ .6394 .9793 U.K. Pound (£) Canada dollar a. Which would you rather have, $100 or £100? b. Which would you rather have, $100 Canadian or £100? c-1. What is the cross-rate for Canadian dollars in terms of British pounds? (Do not include the Canadian dollar sign, C$. Round your answer to 4 decimal places, e.g., 32.1616.) c-2. What is the cross-rate for British pounds in terms of Canadian dollars? (Do not include the pound sign, £. Round your answer to 4 decimal places, e.g., 32.1616.) c-1. Cross-rate c-2. Cross-rate 1.5640 1.0211 с 1€ /Can$arrow_forwardPls answer and explain in detail Question:Dealer A quotes 3.6800-3.6833 for the SAR/USD exchangerate to Dealer B. (a) The price at which A is willing to buy the US dollar? (b) The price at which A iswilling to buy the Saudi Arabian riyal? (c) The price at which B can buy the US dollar? (d) The price at which B can buy the Saudi Arabian riyal? (e) The price at which A is willing to sell the US dollar? (f)The price at which A is willing to sell the Saudi Arabian riyal? (g) The price at which B can sell the USdollar? (h) The price at which B can sell the Saudi Arabian riyal?arrow_forwardplease help me to solve this questionarrow_forward

- Use the following information on the U.S. dollar value of the euro to answer the question. Forward Rate for Spot Rate April 30, 2024 Delivery $1.130 $1,140 October 20, 2023 November 1, 2023 December 31, 2023 April 30, 2024 Select one: 1.148 1.100 1.170 On October 30, 2023, a US company receives a purchase order from a customer in Spain. Under the sale terms, the customer will pay the company €100.000 on April 30; 2024 On October 30, the US company also enters a forward contract to sell €100,000 on April 30, 2024. The company delivers the merchandise to the customer on November 1, On April 30, the company receives €100,000 from the customer and sells it using the forward contract. The company's accounting year ends December 31. What net gain or loss is recognized in 2023, in addition to sales revenue? esc a $500 net loss b. 1800 net gain, c. $800 net loss d. $500 net gain 3.145 1165 1.170 * 8: MacBook Air & FL 40 # 6-41 16 W 19 F M marrow_forwardVALUE OF EURO (U.S. dollars per euro) 1.9 1.8 1.7 1.6 1.5 1.4 1.3 1.2 1.1 0 50 100 150 200 250 300 350 400 450 500 550 600 QUANTITY OF EUROS (Billions) At an exchange rate of 1.5 per euro, the quantity of euros demanded is of euros demanded is + (?) billion euros, while at an exchange rate of 1.1 per euro, the quantity sloping. billion euros. This confirms that the demand curve for euros isarrow_forwardD Question 13 Please use the data below, to answer the following question. BigMac price in the US BigMac price in UK Current Exchange Rate O $3.25 At the going exchange rate, the dollar price of BigMac in UK is: $3.40 $3.00 USD 3.25 $3.10 GBP 1.50 1 USD - GBP 0.5arrow_forward

- Canadian Denmark Euro S per Foreign Currency $.7800 $.2000 $.9900 Foreign Currency per $ 1.2821 5.0000 1.0101 a. How many Canadian dollars would you receive for $500? b. A Mercedes costs Euros 130,000. How many $ would you need? c. What is the cross rate of Canadian $ and Denmark?arrow_forwardQuestion 12 Given the following cross currency rates, identify an arbitrage trade and show the profit if you start with $1,000. (USD = U.S. dollar, SGD = Singapore dollar, CHF = Swiss franc) SGD:USD CHF:USD SGD:CHF 1,045.46 3.00 1.50 2.20arrow_forwardSav whether the stated currency has appreciated or depreciated. Ex rate at t=1 Ex rate at t=2 $1.09 Currency Swiss Franc $1.12 USD/Swiss USD/Swiss Franc Franc 125 yen/euro 130 yen/euro Euro 18 peso/CAD 21 peso/CAD Peso 7 RMB/USD 6.5 RMB/USD RMBarrow_forward

- Currencies clipartToday, the exchange rate between the US dollar and Bananaland's currency is $1.000=BBB4.693, and between the US dollar and Cherryland's currency is $1.000=CCC6.519. Calculate the implied cross-rate between Bananaland's and Cherryland's currencies, expressed as the amount of BBB per one unit of CCC. Do NOT use units in your answer, and only put the numeric answer. Round your answer to FOUR decimal places, for example, 1.2345arrow_forwardUse the information below to answer the questions that follow. Japanese yen Japanese yen 6 month Australian dollar Australian dollar 3 month U.S. $ EQUIVALENT .00916 .00899 .7748 .7751 a. Yen b. Australian dollar c. Dollar relative to yen d. Dollar relative to A$ CURRENCY PER U.S. $ 109.20 111.21 1.2907 1.2902 a. Is the yen selling at a premium or a discount? b. Is the Australian dollar selling at a premium or a discount? c. Do you expect the value of the dollar to increase or decrease relative to the value of the yen? d. Do you expect the value of the dollar to increase or decrease relative to the value of the Australian dollar?arrow_forwardAssume the exchange rate is 1.05 Swiss francs per U.S. dollar. How many U.S. dollars are needed to purchase 1,250 Swiss francs? Multiple Choice $1,315.79 $1,190.48 $1,128.80 $1,140.00 $1,318.46arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education