Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

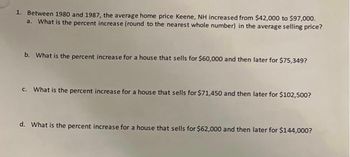

Transcribed Image Text:1. Between 1980 and 1987, the average home price Keene, NH increased from $42,000 to $97,000.

a. What is the percent increase (round to the nearest whole number) in the average selling price?

b. What is the percent increase for a house that sells for $60,000 and then later for $75,349?

c. What is the percent increase for a house that sells for $71,450 and then later for $102,500?

d. What is the percent increase for a house that sells for $62,000 and then later for $144,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An investor is looking for a loan for an investment property that he has found. He can afford a monthly payment of $1,475. The interest rated quoted to him was 7.25%. He built the following table from that information. A $74,049 $125,638 $161,580 t 5 10 15 a) A(5) = b) If the investment property cost $161,580, how many years must the investor make monthly payments? t 20 25 30 A $186,620 $204,066 $216,220arrow_forwardThe amount of money (in billions of dollars) lent to customers with credit scores below 620 for subprime mortgages can be approximated by the function g(x) = 299.2e-0.15x, where x = 1 corresponds to the year 2001. (a) Find the value of subprime mortgage lending in 2011 for the described customer base. (b) If the trend continues, what is the first full year in which subprime lending falls below $4 billion? (a) Which of the following describes how to find the value of subprime mortgage lending in 2011 using the given information? Select the correct choice below and fill in the answer box to complete your choice. (Type an integer or a decimal.) A. To find the value of subprime mortgage lending in 2011, substitute g(x). for x and evaluate to find B. To find the value of subprime mortgage lending in 2011, find the intersection point of the graphs y=299.2e-0.15x and y=. The vahre of subprime mortgage lending in 2011 is represented by the y-coordinate. In 2011, the assets are about $ billion.…arrow_forwardThis morning, you borrowed $14,700 at an APR of 8.9 percent. If you repay the loan in one lump sum three years from today, how much will you have to repay? $15,514.47 $18,984.58 O $19,022.33 $15,324.60 O None of these answers are correctarrow_forward

- The purchase price of an acre of land in the Louisiana purchase in 1803 was about 4 cents. Suppose the value of this property grew at an annual rate of 4.9% compounded annually. What would an acre of land be worth in 2020?arrow_forwardIn December 2020, a pound of lemons cost $1.52, while a pound of bananas cost $1.16. Two years earlier, the price of lemons was $1.31 a pound and that of bananas was $1.02. What was the annual compound rate of growth in the price of lemons? What was the annual compound rate of growth in the price of bananas? If the same rates of growth persist in the future, what will be the price of lemons in 2030? What about the price of bananas? An engineer in 1950 was earning $6,400 a year. In 2020, she earned $84,000 a year. However, on average, prices in 2020 were higher than in 1950. What was her real income in 2020 in terms of constant 1950 dollars?arrow_forwardSolve it correctly please. I will rate accordingly.arrow_forward

- A homeowner purchased a house 30 years ago by $85,000, today the house value is $140,000. What compounded annual interest rate was recover by the owner of the house?arrow_forwardIf an average home in your town currently costs $300,000, and house prices are expected to grow at an average rate of 5 percent per year, what will an average house cost in 10 years?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education