Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

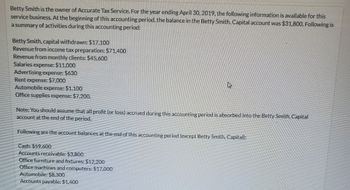

Transcribed Image Text:Betty Smith is the owner of Accurate Tax Service. For the year ending April 30, 2019, the following information is available for this

service business. At the beginning of this accounting period, the balance in the Betty Smith, Capital account was $31,800. Following is

a summary of activities during this accounting period:

Betty Smith, capital withdrawn: $17,100

Revenue from income tax preparation: $71,400

Revenue from monthly clients: $45,600

Salaries expense: $11,000

Advertising expense: $630

Rent expense: $7,000

Automobile expense: $1.100

Office supplies expense: $7,200.

Note: You should assume that all profit (or loss) accrued during this accounting period is absorbed into the Betty Smith, Capital

account at the end of the period.

Following are the account balances at the end of this accounting period (except Betty Smith, Capital):

Cash: $59,600

Accounts receivable: $3,800

Office furniture and fixtures: $12,200

Office machines and computers: $17,000

Automobile: $8,300

Accounts payable: $1,400

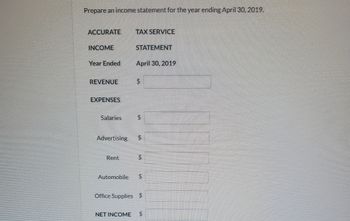

Transcribed Image Text:Prepare an income statement for the year ending April 30, 2019.

ACCURATE

INCOME

Year Ended

REVENUE

EXPENSES

Salaries

TAX SERVICE

Rent

STATEMENT

April 30, 2019

$

5.

Advertising $

$

Automobile $

Office Supplies $

NET INCOME $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- In 2010, the U.S. Congress passed the Affordable Care Act. This law requires most Americans to purchase health insurance for themselves and members of their family. The Juarez family has a health insurance plan that will reimburse them for 70% of their health care expenses after they pay a $5,200 deductible. Last year, the Juarez family had medical expenses that totaled $16,384. What is the amount paid by the Juarez family’s insurance company?Answer: Work/Explain: Please write clearly so i can read itarrow_forwardIs the following problem a percent increase problem or a percent decrease problem? Pat earns $10 per hour. She will be getting a 5% pay raise next year. What will be her new hourly pay?arrow_forwardJan Petri is the stockholder and operator of Galaxy LLC, a motivational consulting business. At the end of its accounting period, December 31, 20Y2, Galaxy has assets of $788,000 and liabilities of $189,000. Using the accounting equation, determine the following amounts: a. Stockholders' equity as of December 31, 20Y2.$fill in the blank 1 b. Stockholders' equity as of December 31, 20Y3, assuming that assets increased by $150,000 and liabilities decreased by $45,000 during 20Y3.$fill in the blank 2arrow_forward

- Explain Reporting the Funded Status of the Pension Plan.arrow_forwardYear Quarter Revenue 2005 Qtr1 5,206 Qtr2 6,310 Qtr3 6,037 Qtr4 5,551 2006 Qtr1 5,226 Qtr2 6,476 Qtr3 6,454 Qtr4 5,932 2007 Qtr1 6,103 Qtr2 7,733 Qtr3 7,690 Qtr4 7,331 2008 Qtr1 7,379 Qtr2 9,046 Qtr3 8,393 Qtr4 7,126 2009 Qtr1 7,169 Qtr2 8,267 Qtr3 8,044 Qtr4 7,510 2010 Qtr1 7,525 Qtr2 8,674 Qtr3 8,426 Qtr4 10,494 State the model found when performing a regression using seasonal binaries. (A negative value should be indicated by a minus sign. Round your answers to 4 decimal places.) yt = + t + Q1 + Q2 + Q3 Use the regression equation to make a prediction for each quarter in 2011. (Enter your answers in millions rounded to 3 decimal places.) Quarter Predicted Q1 Q2 Q3 Q4arrow_forwardWhat would Jeremy's taxable income be if he were to choose a standard deduction of $5700 instead of itemizing his deductions? Would it be higher or lower?arrow_forward

- Determine the annual insurance premiums for a policy insuring a male age 40 , who wants to purchase a whole life policy with a face value of $50,500arrow_forwardYear Quarter Revenue 2005 Qtr1 5,196 Qtr2 6,300 Qtr3 6,027 Qtr4 5,541 2006 Qtr1 5,109 Qtr2 6,455 Qtr3 6,402 Qtr4 5,895 2007 Qtr1 6,065 Qtr2 7,695 Qtr3 7,652 Qtr4 7,293 2008 Qtr1 7,360 Qtr2 9,035 Qtr3 8,299 Qtr4 7,015 2009 Qtr1 7,130 Qtr2 8,212 Qtr3 8,015 Qtr4 7,468 2010 Qtr1 7,700 Qtr2 8,655 Qtr3 8,407 Qtr4 10,475 Quarter 2005 2006 2007 2008 2009 2010 Qtr1 5,196 5,109 6,065 7,360 7,130 7,700 Qtr2 6,300 6,455 7,695 9,035 8,212 8,655 Qtr3 6,027 6,402 7,652 8,299 8,015 8,407 Qtr4 5,541 5,895 7,293 7,015 7,468 10,475 (b) State the model found when performing a regression using seasonal binaries. (A negative value should be indicated by a minus sign. Round your answers to 4 decimal places.) yt = + t + Q1 + Q2 + Q3 (c) Use the regression equation to make a prediction for each quarter in 2011. (Enter your answers in millions rounded to 3 decimal places.) Quarter Predicted Q1 Q2…arrow_forwardMarc Batchelor, a self-employed sales consultant, has estimated annual earnings of $305,000 this year. His social security tax rate is 12.4% up to the wage base, Medicare is 2.9%, and his federal income tax rate is 24%. How much estimated tax (in $) must Marc send to the IRS each quarter?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,