Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6.3 million. The equipment will be depreciated straight line over 6 years to a value of zero, but in fact it can be sold after 6 years for $536,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year’s forecast sales. The firm estimates production costs equal to $1.10 per trap and believes that the traps can be sold for $5 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm’s tax bracket is 35%, and the required rate of return on the project is 10%. Use the MACRS depreciation schedule.

| Year: | 0 | 1 | 2 | 3 | 4 | 5 | 6 | Thereafter |

| Sales (millions of traps) | 0 | 0.5 | 0.7 | 0.8 | 0.8 | 0.6 | 0.5 | 0 |

a. What is project NPV?

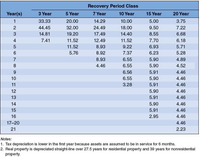

b. By how much would NPV increase if the firm depreciated its investment using the 5-year MACRS schedule? (see image)

Transcribed Image Text:Recovery Period Class

Year(s)

3 Year

5 Year

7 Year

10 Year

15 Year

20 Year

1

33.33

20.00

14.29

10.00

5.00

3.75

44.45

32.00

24.49

18.00

9.50

7.22

3

14.81

19.20

17.49

14.40

8.55

6.68

7.41

11.52

12.49

11.52

7.70

6.18

11.52

8.93

9.22

6.93

5.71

5.76

8.92

7.37

6.23

5.28

6.55

6.55

7

8.93

5.90

4.89

8

4.46

5.90

4.52

9

6.56

5.91

4.46

10

6.55

5.90

4.46

11

3.28

5.91

4.46

12

5.90

4.46

13

5.91

4.46

14

5.90

4.46

15

5.91

4.46

16

2.95

4.46

17-20

4.46

21

2.23

Notes:

1. Tax depreciation is lower in the first year because assets are assumed to be in service for 6 months.

2. Real property is depreciated straight-line over 27.5 years for residential property and 39 years for nonresidential

property.

45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $5.4 million. The equipment will be depreciated straight line over 6 years to a value of zero, but in fact, it can be sold after 6 years for $682,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year's forecast sales. The firm estimates production costs equal to $1.30 per trap and believes that the traps can be sold for $5 each. Sales forecasts are given in the following table. The project will come to an end in 6 years. when the trap becomes technologically obsolete. The firm's tax bracket is 35%, and the required rate of return on the project is 8%. Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. Sales Units millions of traps 0 0.5 0.5 Thereafter 0 By how much will this increase project NPV? (Enter your answer in millions round to 4 decimal places) 0.7 0.8…arrow_forwardFastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $189,000 per year. Once in production, the bike is expected to make $283,500 per year for 10 years. Assume the cost of capital is 10%. a. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment? b. By how much must the cost of capital estimate deviate to change the decision? (Hint: Use Excel to calculate the IRR.) c. What is the NPV of the investment if the cost of capital is 15%? Note: Assume that all cash flows occur at the end of the appropriate year and that the inflows do not start until year 7.arrow_forwardTurner Hardware is adding a new product line that will require an investment of $1,530,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $320,000 the first year, $265,000 the second year, and $230,000 each year thereafter for eight years. The investment has no residual value. Compute the payback period. First enter the formula, then calculate the payback period. (Round your answer to two decimal places.) Full years Amount to complete recovery in next year Projected cash inflow in next year )= Payback )= yearsarrow_forward

- Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6.3 million. The equipment will be depreciated straight-line over 6 years, but, in fact, it can be sold after 6 years for $549,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year’s forecast sales. The firm estimates production costs equal to $1.60 per trap and believes that the traps can be sold for $6 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm’s tax bracket is 40%, and the required rate of return on the project is 10%. Year: 0 1 2 3 4 5 6 Thereafter Sales (millions of traps) 0 0.6 0.8 1.0 1.0 0.5 0.3 0 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV? (Do not round your intermediate…arrow_forwardXYZ is considering an investment which will cost $259,000. The investment produces no cash flows for the first year. In the second year, the cash inflow is $58,000. This inflow will increase to $150,000 and then $200,000 for the following two years before ceasing permanently. The firm requires a 14 percent rate of return and has a required discounted payback period of three years. What is the discounted payback of this project and should the company accept this project?arrow_forwardeEgg is considering the purchase of a new distributed network computer system to help handle its warehouse inventories. The system costs $60,000 to purchase and install and $30,000 to operate each year. The system is estimated to be useful for 4 years. Management expects the new system to reduce the cost of managing inventories by $62,000 per year. The firm’s cost of capital (discount rate) is 10%. Required: 1. What is the net present value (NPV) of the proposed investment under each of the following independent situations? (Use the appropriate present value factors from Appendix C, TABLE 1 and Appendix C, TABLE 2.) 1a. The firm is not yet profitable and therefore pays no income taxes. 1b. The firm is in the 30% income tax bracket and uses straight-line (SLN) depreciation with no salvage value. Assume MACRS rules do not apply. 1c. The firm is in the 30% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Given a four-year life, the DDB…arrow_forward

- Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $5.4 million. The equipment will be depreciated straight line over 6 years to a value of zero, but in fact it can be sold after 6 years for $668,000. The firm believes that working capital at each date must be maintained at a level of 15% of next year’s forecast sales. The firm estimates production costs equal to $1.60 per trap and believes that the traps can be sold for $6 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm’s tax bracket is 35%, and the required rate of return on the project is 9%. Use the MACRS depreciation schedule. Year: 0 1 2 3 4 5 6 Thereafter Sales (millions of traps) 0 0.5 0.7 0.8 0.8 0.7 0.5arrow_forwardK Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.98 million. The product is expected to generate profits of $1.09 million per year for 10 years. The company will have to provide product support expected to cost $98,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 5.6%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.5%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment? a. What is the NPV of this investment if the cost of capital is 5.6%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.5%, respectively. If the cost of capital is 5.6%, the NPV will be $ (Round to the nearest dollar.) Should the firm undertake the project? (Select the best choice…arrow_forwarda company is considering the purchase of a new machine for 480,000. Management predicts that the machine can produce sales of 180,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling 120,000 per year including depreciation of 30,000 per year. The company's tax rate is 40%. What is the payback period for the new machine?arrow_forward

- Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6.3 million. The equipment will be depreciated straight-line over 6 years, but, in fact, it can be sold after 6 years for $583,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year’s forecast sales. The firm estimates production costs equal to $1.10 per trap and believes that the traps can be sold for $5 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm’s tax bracket is 40%, and the required rate of return on the project is 12%. Year: 0 1 2 3 4 5 6 Thereafter Sales (millions of traps) 0 0.6 0.8 0.9 0.9 0.8 0.6 0 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV?arrow_forwardGeoSourcex is considering opening a new titanium mine. Once in operation, the mine is expected to produce positive net cash flows in perpetuity starting 3 years from now at $19.5 million per year but declining at a constant rate of 1.8% per year. The costs of getting the mine operational include an immediate payment of $110.0 million to purchase the land and acquire the mineral rights, plus other start -up costs of $10.0 million per year for three years starting in one year. If the project's cost of capital is 10.2% per year (compounded annually) what is the Net Present Value of this new mine?arrow_forwardThunderbolt Corporation is considering an investment project to produce electric gadgets. Cathie Wood projected unit sales of these gadgets to be 10,000 in the first year, with growth of 6.5 percent each year over the subsequent five years (so the total project life is six years). Production of these gadgets will require $1,200,000 in net working capital to start. The net working capital will be recovered at the end of the project. Total fixed costs are $3,000,000 per year, variable production costs are $350 per unit, and the units are priced at $850 each. The equipment needed to begin production will cost $8,400,000. The equipment will be depreciated using the straight-line method over a six-year life and has a pre-tax salvage value of $520,000 when the project closes. The tax rate is 25%. a) Using Excel, set up a table that shows your detailed calculation with formulas of the project cash flows for each year throughout the life of the project.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education