EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

What is the

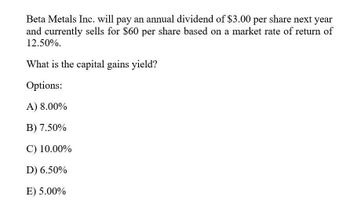

Transcribed Image Text:Beta Metals Inc. will pay an annual dividend of $3.00 per share next year

and currently sells for $60 per share based on a market rate of return of

12.50%.

What is the capital gains yield?

Options:

A) 8.00%

B) 7.50%

C) 10.00%

D) 6.50%

E) 5.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hastings Corporation is interested in acquiring Visscher Corporation. Assume that the riskfreerate of interest is 4%, and the market risk premium is 5%. Visscher currently expects to pay a year-end dividend of $1.99 a share (D1 =$1.99). Visscher’s dividend is expected to grow at a constant rate of 5% a year, and its betais 0.8. What is the current price of Visscher’s stock?arrow_forwardAirMas Airlines will pay a RM4 dividend next year on its common stock, which is currently selling at RM100 per share. What is the market required rate of return on this investment if the dividend is expected to grow at 5 percent forever? Select one: A. 4 percent B. 7 percent C. 9 percent D. 5 percentarrow_forwardA company is currently paying dividend of Tk. 40 per share. The dividend is expected to grow at a 20% annual rate for two years, then at 15% rate for the next two years and then at 10% rate for the next two years, after which it is expected to grow at a 5% rate forever. What should be the current price of the share if required rate of return is 12%? (Consider upto 3 decimal placein case of all fractions).arrow_forward

- The next dividend payment by Hoffman, Inc., will be $2.70 per share. The dividends are anticipated to maintain a growth rate of 6.75 percent forever. Assume the stock currently sells for $49.00 per share. a. What is the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the expected capital gains yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardKindly help me with accounting questionsarrow_forwardWhat is the answer a b c d ? General Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT