FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

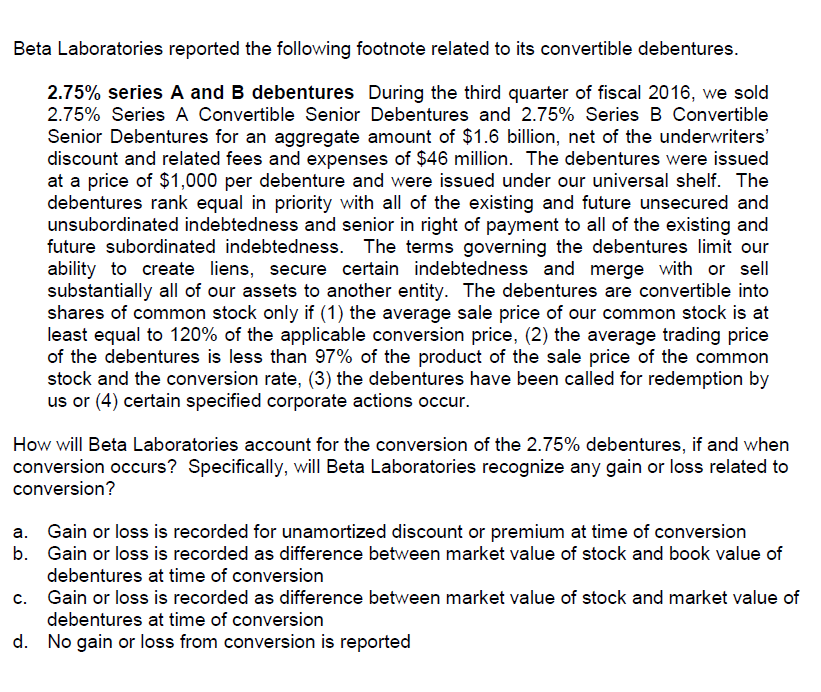

Transcribed Image Text:Beta Laboratories reported the following footnote related to its convertible debentures.

2.75% series A and B debentures During the third quarter of fiscal 2016, we sold

2.75% Series A Convertible Senior Debentures and 2.75% Series B Convertible

Senior Debentures for an aggregate amount of $1.6 billion, net of the underwriters'

discount and related fees and expenses of $46 million. The debentures were issued

at a price of $1,000 per debenture and were issued under our universal shelf. The

debentures rank equal in priority with all of the existing and future unsecured and

unsubordinated indebtedness and senior in right of payment to all of the existing and

future subordinated indebtedness. The terms governing the debentures limit our

ability to create liens, secure certain indebtedness and merge with or sell

substantially all of our assets to another entity. The debentures are convertible into

shares of common stock only if (1) the average sale price of our common stock is at

least equal to 120% of the applicable conversion price, (2) the average trading price

of the debentures is less than 97% of the product of the sale price of the common

stock and the conversion rate, (3) the debentures have been called for redemption by

us or (4) certain specified corporate actions occur.

How will Beta Laboratories account for the conversion of the 2.75% debentures, if and when

conversion occurs? Specifically, will Beta Laboratories recognize any gain or loss related to

conversion?

a. Gain or loss is recorded for unamortized discount or premium at time of conversion

b. Gain or loss is recorded as difference between market value of stock and book value of

debentures at time of conversion

c. Gain or loss is recorded as difference between market value of stock and market value of

debentures at time of conversion

d. No gain or loss from conversion is reported

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Stacy Company issued five-year, 8% bonds with a face value of $6,000 on January 1, 2016. Interest is paid annually on December 31. The market rate of interest of January 1, 2016, is 6%, and the proceeds from the bond issuance equal $6,505. What is the premium amortization?arrow_forwardOn 1 January 20X5, Franco Ltd. purchased $440,000 of Gentron Company 7.00% bonds. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 8% on the date of purchase. The bonds mature on 31 December 20X10. The company has a 31 December year-end. Required: 1. Calculate the price paid by Franco Ltd. (Do not round Intermediate calculations. Round your final answer to the nearest dollar amount.) Price paid Period 2. Assume that the bond is classified as an AC investment. Construct a table that shows interest revenue reported by Franco, and the carrying value of the investment, for four interest periods. Use the effective-interest method. (Do not round Intermediate calculations. Round your final answers to the nearest dollar amount.) 0 $ 1 2 3 4 Cash Payment 361,607 View transaction list Interest Revenue Amortization Bond Carrying Value 3. Prepare the entries for the first four interest periods based on your calculations in requirement 2. (If no entry is…arrow_forwardOn January 1, 2016, Knorr Corporation issued $1,000,000 of 9%, 5-year bonds dated January 1, 2016. The bonds pay interest annually on December 31. The bonds were issued to yield 10%. Bond issue costs associated with the bonds totaled $18,000. Required: Prepare the journal entries to record the following: January 1, 2016 Sold the bonds at an effective rate of 10% December 31, 2016 First interest payment using the effective interest method December 31, 2016 Amortization of bond issue costs using the straight-line method December 31, 2017 Second interest payment using the effective interest method December 31, 2017 Amortization of bond issue costs using the straight-line methodarrow_forward

- PAR lends $10,000 to SUB (80% owned by PAR) on 7/1/2015. SUB signs a one-year, 8% Note, interest payable on the due date. What is the interest receivable that is reported in the 2015 consolidated balance sheet?arrow_forward1)arrow_forwardOn January 1, 2016, a company issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153 based on a 10% market interest rate. The effective-interest method of amortization is used. Rounding all calculations to the nearest whole dollar, what is the interest expense for the six-month period ending June 30, 2016? Select one: A. $20,658. B. $24,000. O C. $24,789. O D. $20,000.arrow_forward

- On July 1, 2017, Agincourt Inc. rendered services in exchange for a 4%, 8-year promissory note having a face value of $500,000 (interest payable annually). Agincourt Inc. recently had to pay 8% Interest for money that it borrowed from British National Bank. The customer of the above fransaction has credit ratings that require them to borrow money at 12% interest. The present value of 1 at 12% for 8 perlods 0.40388 The present value of an ordinary annuity 4,9676 of 1 at 12% for 8 perlods Instructions By hew much amount Ihe service revue wil be credited? (Please wite your answer without commas or sign of the doliar. For example ifyour answer is SI0.000, Swrite it 10000)arrow_forwardUse the financial statement effects template to record the accounts and amounts for the following four transactions involving investments in marketable debt securities classified as available-for-sale securities. Assume that these transactions occur in 2016 (before the new rules for securities went into effect).a. Loudder Inc. purchases 5,000 bonds with a face value of $1,000 per bond. The bonds are purchased at par for cash and pay interest at a semi-annual rate of 4%.b. Loudder receives semi-annual cash interest of $200,000.c. Year-end fair value of the bonds is $978 per bond.d. Shortly after year-end, Loudder sells all 5,000 bonds for $970 per bond.Use negative signs with answers, if appropriate.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education