FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

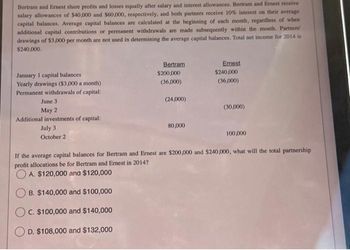

Transcribed Image Text:Bertram and Ernest share profits and losses equally after salary and interest allowances. Bertram and Ernest receive

salary allowances of $40,000 and $60,000, respectively, and both partners receive 10% interest on their average

capital balances. Average capital balances are calculated at the beginning of each month, regardless of when

additional capital contributions or permanent withdrawals are made subsequently within the month. Partners'

drawings of $3,000 per month are not used in determining the average capital balances. Total net income for 2014 is

$240,000.

January 1 capital balances

Yearly drawings ($3,000 a month)

Permanent withdrawals of capital:

June 3

May 2

Additional investments of capital:

July 3

October 2

Bertram

$200,000

(36,000)

(24,000)

80,000

Ernest

$240,000

(36,000)

(30,000)

100,000

If the average capital balances for Bertram and Ernest are $200,000 and $240,000, what will the total partnership

profit allocations be for Bertram and Ernest in 2014?

OA. $120,000 and $120,000

B. $140,000 and $100,000

C. $100,000 and $140,000

D. $108,000 and $132,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Watts and Lyon are forming a partnership. Watts invests $24,500 and Lyon invests $45,500. The partners agree that Watts will work one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss: (a) in the ratio of their initial capital investments; (b) in proportion to the time devoted to the business; (c) a salary allowance of $18,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments; or (d) a salary allowance of $18,000 per year to Lyon, 9% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1, $17,000 net loss; Year 2, $42,500 net income; and Year 3, $70,833 net income. Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of…arrow_forwardThe balance in Xue's capital account includes an additional investment of $10,000 made on May 5, 20Y2. Instructions: 1. Prepare an income statement for 20Y2, indicating the division of net income. The partnership agreement provides for salary allowances of $38,000 to Ramirez and $46,000 to Xue, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or a net loss. 2. prepare a statement of partnership equity for 20Y2. 3. Prepare a balance sheet as of the end of 20Y2.arrow_forwardRies, Bax, and Thomas invested $40,000, $56,000, and $64,000, respectively, in a partnership. During its first calendar year, the firm earned $418, 200. Required: Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $418, 200 net income under each of the following separate assumptions. 2. The partners agreed to share income and loss in the ratio of their beginning capital investments.arrow_forward

- Ahmed contributes cash of $12, 000 and Fatima contributes Office equipment that cost $10,000but valued at $8,000, during the first-year partners earn a profit of $5, 000. Assume the partners agreed to share the profit and loss equally.1. Prepare a journal entry to form the partnership? 2. How much profit should each partner earned?arrow_forwardThe capital accounts of Heidi and Moss have balances of $90,000 and $65,000, respectively, on January 1, the beginning of the current fiscal year. On April 10, Heidi invested an additional $8,000. During the year, Heidi and Moss withdrew $40,000 and $32,000, respectively. Revenues were $540,000 and expenses were $420,000 for the year. The articles of partnership make no reference to the division of net income. Required: 1. Prepare a statement of partners' equity for the partnership of Heidi and Moss. If an amount box does not require an entry, leave it blank. Enter all amounts as positive numbers. Heidi and Moss Statement of Partners' Equity For the Year Ended December 31 Heidi Moss Total Capital, January 1 $fill in the blank 7e8152f83026faf_2 $fill in the blank 7e8152f83026faf_3 $fill in the blank 7e8152f83026faf_4 Additional investment during the year fill in the blank 7e8152f83026faf_6 fill in the blank 7e8152f83026faf_7 fill in the blank 7e8152f83026faf_8…arrow_forwardThe partnership agreement of Jones, King, and Lane provides for the annual allocation of the business's profit or loss in the following sequence: • Jones, the managing partner, receives a bonus equal to 15 percent of the business's profit. • Each partner receives 10 percent interest on average capital investment. Any residual profit or loss is divided equally. The average capital investments for 2021 were as follows: Jones King Lane The partnership earned $84,000 net income for 2021. Prepare a schedule showing how the 2021 net income should be allocated to the partners. (Loss amounts should be indicated with a minus sign.) Net income Bonus Interest $ 190,000 380,000 570,000 Remainder to allocate Total allocation Jones King Lane Totalarrow_forward

- Lewis Wardell and Lewis Lomas own Lewis’ Antiques. Their partnership agreement provides for annual salary allowances of $200,000 for Wardell and $180,000 for Lomas, and interest of 10 percent on each partner’s invested capital at the beginning of the year. The remainder of the net income or loss is to be distributed 50 percent to Wardell and 50 percent to Lomas. The partners withdraw their salary allowances monthly. On January 1, 20X1, the capital account balances were Wardell, $600,000, and Lomas, $560,000. On December 15, 20X1, Lomas made a permanent withdrawal of $55,000. The net income for 20X1 was $640,000. Required: Prepare the general journal entry on December 15, 20X1, to record the permanent withdrawal by Lomas. Prepare the general journal entries on December 31, 20X1, to: Record the salary allowances for the year. Record the interest allowances for the year. Record the division of the balance of net income. Close the drawing accounts into the…arrow_forwardThe partnership of Magda and Sue shares profits and losses in a 50:50 ratio after Mary receives a $7,000 salary and Sue receives a $6,500 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A $10,000 C. ($12,000)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education