FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

,

owner and CEO, is considering refining the company's costing system by using departmental

attache in ss below

thanks

last part

rwiowrhw

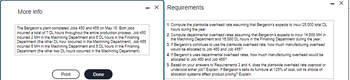

Transcribed Image Text:More info

The Bergeron's plant completed Jobs 450 and 455 on May 15. Both jobs

incurred a total of 7 DL hours throughout the entire production process. Job 450

incurred 2 MH in the Machining Department and 6 DL hours in the Finishing

Department (the other DL hour occurred in the Machining Department). Job 455

incurred 6 MH in the Machining Department and 5 DL hours in the Finishing

Department (the other two DL hours occurred in the Machining Department).

Print

Done

X

Requirements

1. Compute the plantwide overhead rate assuming that Bergeron's expects to incur 25,000 total DL

hours during the year.

2. Compute departmental overhead rates assuming that Bergeron's expects to incur 14,800 MH in

the Machining Department and 18,000 DL hours in the Finishing Department during the year.

3. If Bergeron's continues to use the plantwide overhead rate, how much manufacturing overhead

would be allocated to Job 450 and Job 455?

4. If Bergeron's uses departmental overhead rates, how much manufacturing overhead would be

allocated to Job 450 and Job 455?

5. Based on your answers to Requirements 3 and 4, does the plantwide overhead rate overcost or

undercost either job? Explain. If Bergeron's sells its furniture at 125% of cost, will its choice of

allocation systems affect product pricing? Explain.

X

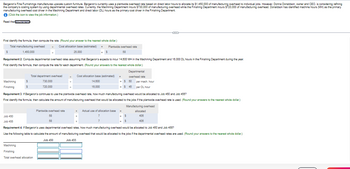

Transcribed Image Text:Bergeron's Fine Furnishings manufactures upscale custom furniture. Bergeron's currently uses a plantwide overhead rate based on direct labor hours to allocate its $1,450,000 of manufacturing overhead to individual jobs. However, Donna Donaldson, owner and CEO, is considering refining

the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $730,000 of manufacturing

manufacturing overhead

t driver in the Machining Department and direct labor (DL) hours as the primary cost driver in the Finishing De overhead while the Finishing Department incurs $720,000 of manufacturing overhead. Donaldson has identified machine hours (MH) as the primary

(Click the icon to view the job information.)

Read the equirement

First identify the formula, then compute the rate. (Round your answer to the nearest whole dollar.)

Total manufacturing overhead

Cost allocation base (estimated)

+

25,000

1,450,000

S

Machining

Finishing

Requirement 2. Compute departmental overhead rates assuming that Bergeron's expects to incur 14,800 MH in the Machining Department and 16,000 DL hours in the Finishing Department during the year.

First identify the formula, then compute the rate for each department. (Round your answers to the nearest whole dollar.)

$

$

Job 450

Job 455

Total department overhead

730,000

720,000

+

Plantwide overhead rate

58

58

Machining

Finishing

Total overhead allocation

= Plantwide overhead rate

= $

58

Cost allocation base (estimated)

14,600

16,000

X

X

Requirement 3. If Bergeron's continues to use the plantwide overhead rate, how much manufacturing overhead would be allocated to Job 450 and Job 455?

First identify the formula, then calculate the amount of manufacturing overhead that would be allocated to the jobs if the plantwide overhead rate is used. (Round your answers to the nearest whole dollar.)

Manufacturing overhead

=

Actual use of allocation base

7

7

= $ 50

S

= $ 45

Departmental

overhead rate

=

= S

=

S

per mach. hour

per DL hour

C

allocated

406

406

Requirement 4. If Bergeron's uses departmental overhead rates, how much manufacturing overhead would be allocated to Job 450 and Job 455?

Use the following table to calculate the amount of manufacturing overhead that would be allocated to the jobs if the departmental overhead rates are used. (Round your answers to the nearest whole dollar.)

Job 455

Job 450

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Objective: Consider that you are an analyst at Regeneron Pharmaceuticals. You need to decide how to allocate administrative overhead costs to Regeneron's main commercial products (Eylea, Dupixent, Kevzara and Praluent). Determine how to appropriately allocate the costs in the table below to each of the commercial products using an allocation methodology of your choice. Department2019 Annual Operating ExpenseTime spent supporting Commercial productsCommercial$200MM100%IT$100MM25%Facilities$150MM0%Finance$25MM20%Human Resources$75MM10% Use the supporting document Net Product Sales of REGN Products to facilitate your analysis. Provide a written summary of how you allocated the overhead costs to each product in an outline of no more than one page. As a starting point, it's recommended that you revisit the material we covered in Chapter 12. Guidance on calculations:Start off with Net Product Sales of REGN Products. Your objective pertains to 2019 expenses, so you should be reviewing 2019…arrow_forwardDo not give answer in imagearrow_forward! Required information [The following information applies to the questions displayed below.] JLR Enterprises provides consulting services throughout California and uses a job-order costing system to accumulate the cost of client projects. Traceable costs are charged directly to individual clients; in contrast, other costs incurred by JLR, but not identifiable with specific clients, are charged to jobs by using a predetermined overhead application rate. Clients are billed for directly chargeable costs, overhead, and a markup. JLR's director of cost management, Victor Anthony, anticipates the following costs for the upcoming year: Percentage of Cost Directly Traceable to Clients 80% 60% 90% 90% 50% Type Professional staff salaries Administrative support staff Travel Photocopying Other operating costs Total Cost $ 2,500,000 300,000 250,000 50,000 100,000 $ 3,200,000 The firm's partners desire to make a $640,000 profit for the firm and plan to add a percentage markup on total cost to…arrow_forward

- Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT tickets Employees Department direct costs. IT HR 0 16 1,525 0 Publishing 2,440 24 $ 152,000 $ 247,950 $ 431,000 Binding 2,135 40 $ 392,500 Woodstock Binding estimates that the variable costs in the IT Department total $112,500, and in the HR Department variable costs to $142,500. Avoidable fixed costs in the IT Department are $18,250. Required: If Woodstock Binding outsources the IT Department functions, what is the maximum it can pay an outside vendor without increasing total costs? Note: Do not round intermediate calculations. × Answer is complete but not entirely correct. Maximum…arrow_forwardGarrell Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study: Time-driven activity rate (cost per unit of activity) Activity cost pool: Receiving Calls Resolving Issues Settling Disputes Cost Object Data: Number of calls received Number of issues resolved Number of disputes settled Customer P 31 17 1 $5.46 $8.58 $13.26 Customer Q 21 10 Required: Using time-driven activity-based costing, determine the total Customer Support Department cost assigned to cach customer.arrow_forward2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education