Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

BEP, ROE, AND ROIC Broward Manufacturing recently reported the following information: Net income $615,000

Transcribed Image Text:Show Notebook

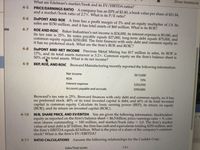

What are Edelman's market/book and its EV/EBITDA ratios?

PRICE/EARNINGS RATIO A company has an EPS of $2.40, a book value per share of $21.84,

and a market/book ratio of 2.7X. What is its P/E ratio?

4-5

DUPONT AND ROE A firm has a profit margin of 3% and an equity multiplier of 1.9. Its

sales are $150 million, and it has total assets of $60 million. What is its ROE?

4-6

ROE AND ROIC Baker Industries's net income is $24,000, its interest expense is $5,000, and

its tax rate is 25%. Its notes payable equals $27,000, long-term debt equals $75,000, and

common equity equals $250,000. The firm finances with only debt and common equity, so

it has no preferred stock. What are the firm's ROE and ROIC?

ate

4-7

DUPONT AND NET INCOME Precious Metal Mining has $17 million in sales, its ROE is

17%, and its total assets turnover is 3.2X. Common equity on the firm's balance sheet is

50% of its total assets. What is its net income?

4-8

4-9

BEP, ROE, AND ROIC Broward Manufacturing recently reported the following information:

Net income

$615,000

ROA

10%

Interest expense

$202,950

Accounts payable and accruals

$950,000

Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has

no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested

capital is common equity. Calculate its basic earning power (BEP), its return on equity

(ROE), and its return on invested capital (ROIC).

M/B, SHARE PRICE, AND EV/EBITDA You are given the following information: Stockholders'

equity as reported on the firm's balance sheet

mon shares outstanding

value of totaldebt is $7 billion, the firm has cash and equivalents totaling $250 million, and

the firm's EBITDA equals $2 billion. What is the price of a share of the company's common

stock? What is the firm's EV/EBITDA?

4-10

$6.5 billion, price/earnings ratio = 9, com-

2.0. The firm's market

180 million, and market/book ratio

%3D

4-11

RATIO CALCULATIONS Assume the following relationships for the Caulder Corp.:

1.3X

Sales/Total assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 40. JoelEmbi, Inc. has an ROA (return on assets) of 15.2 percent, total assets of $4,500,000 and a net profit margin of 7.6 percent. What are JoelEmbi, Inc.'s annual sales? Enter your answer a whole number (i.e., rounded to zero decimal places. 41. JimmyButle, LLC. has a debt-to-total assets ratio of 39.6%. What is the company's debt-to-equity ratio? Enter your answer as a ratio (that is, do not convert to a percent), rounded to 2 decimal places. 42. JohCol, Inc has a debt ratio of 27.0% and ROE = 20.2%. What is JohCol, Inc.'s ROA? Enter your answer as a percent rounded to 1 decimal place. Enter 43. PauGeo, Inc. has an ROA of 18.2% and a debt/equity ratio of 0.83. The firm's ROE is answer as a percent rounded to 1 decimal place. 44. Assume that TraeYoung, Inc. has: Debt ratio 60% ● Net profit margin = 15.2% ● Return on assets (ROA) = 52% Find Trae Young's Total Asset Turnover ratio. Enter answer as a ratio (that is, do not convert to a percent), rounded to 2 decimal places.arrow_forwardThe Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 15%, its before-tax cost of debt is 8%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,201. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $ 10 Accounts receivable 240 Short-term debt 51 Inventories 360 Long-term debt 1,150 Plant and equipment, net 2,160 Common equity 1,669 Total assets $2,880 Total liabilities and equity $2,880 Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardThe W.C. Pruett Corp. has $600,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 7%. In addition, it has $600,000 of common equity on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $2.7 million, its average tax rate is 25%, and its profit margin is 7%. What are its TIE ratio and its return on invested capital (ROIC)?arrow_forward

- The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 10%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,183. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Cash Assets Accounts receivable Inventories Liabilities And Equity $ 120 Accounts payable and accruals $ 10 53 240 360 Short-term debt Long-term debt 1,130 30 Plant and equipment, net Total assets 2,160 $2,880 Common equity Total liabilities and equity 1,687 $2,880 Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardBroward Manufacturing recently reported the following information: Net income $770,000 ROA 7% Interest expense $292,600 Accounts payable and accruals $1,000,000 Broward's tax rate is 40%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, while 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). Do not round intermediate calculations. Round your answers to two decimal places. ВЕР % ROE % ROICarrow_forwardBroward Manufacturing recently reported the following information: Net income ROA BEP: 26.73 Interest expense $102,120 Accounts payable and accruals $950,000 Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). Do not round intermediate calculations. Round your answers to two decimal places. ROE: 73.60 ROIC: 44.55 % % $276,000 % 8%arrow_forward

- A company with no debt financing has EBIT of $1000. The corporate tax rate is 40%. So the company's net income is $600. What would be the return to all investors if the company had been financed partly with debt so that interest expenses was $200?arrow_forwardThe most recent financial statements for Mandy Company are shown below: Balance Sheet $ 32,000 Debt 93,200 Equity $ 125,200 Total Income Statement Sales Costs Taxable income Tax (218) Net Income $91,200 Current assets 66,150 Fixed assets $ 25,050 5,261 Total $ 19,789 Sustainable growth rate Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 35 percent dividend payout ratio. No external equity financing is possible. What is the sustainable growth rate? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. $ 42,000 83,200 $ 125,200 %arrow_forwardThe most recent financial statements for Mandy Company are shown here: Income Statement Balance Sheet $ 11,760 27,450 $ 39,210 Sales Costs Taxable income Taxes (24%) Net income $19,200 13,050 $ 6,150 Sustainable growth rate 1,476 $4,674 Current assets Fixed assets Total Debt Equity % Total Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 45 percent dividend payout ratio. What is the sustainable growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) $ 15,880 23,330 $ 39,210arrow_forward

- The W.C. Pruett Corp. has $800,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 12%. In addition, it has $700,000 of common equity on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $4.8 million, its average tax rate is 25%, and its profit margin is 2%. What are its TIE ratio and its return on invested capital (ROIC)? Round your answers to two decimal places. TIE: ROIC: X %arrow_forwardBinomial Tree Farm's financing includes $5 million of bank loans. Its common equity is shown in Binomial's Annual Report at $6.67 million. It has 500,000 shares of common stock outstanding, which trade on the Wichita Stock Exchange at $18 per share. What debt ratio should Binomial use to calculate its company cost of capital or asset beta? Note: Enter your answer as a percent rounded to 2 decimal places. Debt ratio %arrow_forwardDuffert Industries has total assets of $970, 000 and total current liabilities (consisting only of accounts payable and accruals) of $115,000. Duffert finances using only long-term debt and common equity. The interest rate on its debt is 9% and its tax rate is 25%. The firm's basic earning power ratio is 17% and its debt - to capital rate is 40% What are Duffert's ROE and ROIC? Do not round your intermediate calculations. Group of answer choices a. 12.68%; 14.03% b.13.63%; 14.46% с 10.90%; 12.44% d. 15.54%; 16.06% e. 8.86%; 12.73%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education