FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help me with show all Calculation thanku

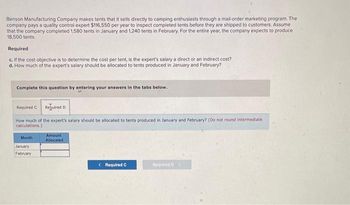

Transcribed Image Text:Benson Manufacturing Company makes tents that it sells directly to camping enthusiasts through a mail-order marketing program. The

company pays a quality control expert $116,550 per year to inspect completed tents before they are shipped to customers. Assume

that the company completed 1,580 tents in January and 1,240 tents in February. For the entire year, the company expects to produce

18,500 tents.

Required

c. If the cost objective is to determine the cost per tent, is the expert's salary a direct or an indirect cost?

d. How much of the expert's salary should be allocated to tents produced in January and February?

Complete this question by entering your answers in the tabs below.

Required C Required D

How much of the expert's salary should be allocated to tents produced in January and February? (Do not round intermediate.

calculations.)

Month

January

February

Amount

Allocated

< Required C

Required D

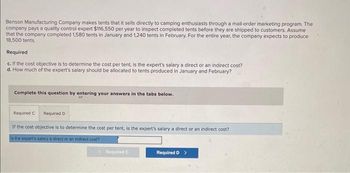

Transcribed Image Text:Benson Manufacturing Company makes tents that it sells directly to camping enthusiasts through a mail-order marketing program. The

company pays a quality control expert $116,550 per year to inspect completed tents before they are shipped to customers. Assume

that the company completed 1,580 tents in January and 1,240 tents in February. For the entire year, the company expects to produce

18,500 tents.

Required

c. If the cost objective is to determine the cost per tent, is the expert's salary a direct or an indirect cost?

d. How much of the expert's salary should be allocated to tents produced in January and February?

Complete this question by entering your answers in the tabs below.

Required C

Required D

If the cost objective is to determine the cost per tent, is the expert's salary a direct or an indirect cost?

Is the expert's salary a direct or an indirect cost?

Required C

Required D >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Define Gift card.arrow_forwardThe following key(s) are used to clear the time value of money registries on the TI BA II Plus financial calculator [2ND] [CLR WORK] O [CEIC] O [CF] [2ND] [CLR WORK] O [HELP] O [2ND] [CLR TVM]arrow_forwardPlease show the calculations for one of them how the NRV(b is received.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education