FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help

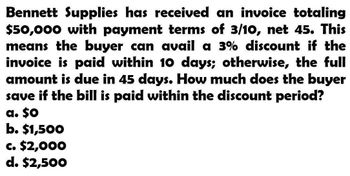

Transcribed Image Text:Bennett Supplies has received an invoice totaling

$50,000 with payment terms of 3/10, net 45. This

means the buyer can avail a 3% discount if the

invoice is paid within 10 days; otherwise, the full

amount is due in 45 days. How much does the buyer

save if the bill is paid within the discount period?

a. $0

b. $1,500

c. $2,000

d. $2,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Select the items below that match the term: Credit terms of 2/10, n/30 A. the seller offers the purchaser a 2% cash discount regardless of when bill is paid B. the full amount is due in 30 days. C. the seller offers the purchaser a 2% cash discount if bill is paid within 30 days D. the seller offers the purchaser a 2% cash discount if bill is paid within 10 days Select all that apply.arrow_forwardProvide helparrow_forwardA merchant sells a product on credit for S/ 50,000 and offers to pay it to a client in three bills of equal nominal value and with maturities at 45, 75 and 105 days respectively, applying on them an APR of 30% with bimonthly capitalization. If this merchant plans to discount the bills in a bank 15 days after the sale is made, being the effective discount rate 2% per month, find: 1. The face value of the bills.2. The net cash value received on discounting the bills.3. Calculate the discount.arrow_forward

- Which one of the following statements is correct if you purchase an item with credit terms of 3/15, net 45? Multiple Choice One-third of your purchase is due in 15 days and the rest is due in 45 days. If you pay within 15 days, you will receive a discount of 3 percent. If you pay within 3 days, you will receive a discount of 15 percent. If you do not pay within 15 days, you will be charged Interest at a rate of 3 percent per month. If you pay 3 percent of your purchases within 15 days, you will have 45 days to pay for the remainder.arrow_forwardA buyer received an invoice for P 60,000, inclusive of 12% VAT dated October 2. If the terms are 2/10, n/45 and the buyer paid the invoice within the discount period, what amount will the seller receive?arrow_forwardA supplier grants credit terms of 1/5, net 30. What is the effective annual rate of the discount on a purchase of $5,000?arrow_forward

- One of your customers has just made a purchase in the amount of $28,000. You have agreed to payments of $590per month and will charge a monthly interest rate of 1.44 percent. How many months will it take for the account to bepaid off?Multiple Choicea. 75.08 monthsB. 86.63 months C. 80.44 monthsD. 47.46 monthsE. 36.43 monthsarrow_forwardA $10,000 credit supply has the following terms: trade terms are 5/5 net 50, interest rate 8%. What is the amount to pay if the buyer will take the discount and pay on the 5th day of the invoice? A. -14.234 B. -14,250 C. -14.260 D. -14,230arrow_forwardPLEASE SHOW ALL WORK 6. You receive an invoice for $18,300 with terms of 5/15, n/60. If the supplier has a policy of allowing a cash discount for partial payments and you pay $11,500 within the discount period, calculate the amount of credit you will receive for this payment.Amount credited = Amount paidComplement of cash discount rate = $11,500 7. For terms of 8/10, n/60 determine the annual rate you, in effect, pay the supplier if you fail to pay the invoice at the end of the discount period. Express the rate with 2 decimal places. 8. An invoice for $75.20 has terms of 3/10, 1/30, n/60. If you make payment 25 days after the invoice date, what amount should you pay? 9. You purchase goods on an invoice dated July 5 with terms of 4/15, n/45 ROG. If you receive the goods on July 23, calculate(a) the last day of the discount period, and (b) the last day of the credit period.b. Last day of credit period:arrow_forward

- The original price of a Honda Shadow to the dealer was $17,045, but the dealer will pay only $16,335 after rebate. If the dealer pays Honda within 15 days, there is a 1% cash discount. a. How much is the rebate? Amount of rebate b. What percent is the rebate? Note: Round your answer to the nearest hundredth percent. Percentage of rebate % c. What is the amount of the cash discount if the dealer pays within 15 days? Note: Round your answer to the nearest cent. Amount of cash discountarrow_forwardplease quickluy , thanks 27. Caterpillar purchased merchandise from Alpha echnologies as follows: Invoice date: March 12th Invoice Amount: $4,000 Terms: 2/10, n/30 If we assume an annual interest rage of 6% and a 360-day year. And Caterpillar has to borrow money for the remaining 20 days of the credit period. How much are the savings from taking the discount? A.19.6 B.66.93 C.13.07 D.6.67arrow_forwardA store will give you a 4.50% discount on the cost of your purchase if you pay cash today. Otherwise, you will be billed the full price with payment due in 1 month. What is the implicit borrowing rate being paid by customers who choose to defer payment for the month? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education