Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

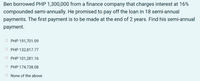

Transcribed Image Text:Ben borrowed PHP 1,300,000 from a finance company that charges interest at 16%

compounded semi-annually. He promised to pay off the loan in 18 semi-annual

payments. The first payment is to be made at the end of 2 years. Find his semi-annual

payment.

PHP 191,701.09

PHP 132,817.77

PHP 101,281.16

O PHP 174,738.08

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On May 8, 2015, Mrs. Siega borrowed php 100,000 from Mr. Singh at 6% payable in 90 days. If the amount is equivalent to 5% in a bank, find it’s present value on July 16, 2015.arrow_forwardRiama's mother deposited Rp. 70,000,000 at bank XYZ with interest (compound) 10% per year paid quarterly. Count Riama's mother's money after 5 years.arrow_forward12.1 pg. 219-220 Find the monthly payment for each loan below. Remember to assume monthly compounding. 12. Frankie purchased a house for $185,000. He put 20% of the purchase down as a down payment. He financed the house for 4.25% for 15 years. The annual taxes are $1250, and the insurance is $1056. What is his monthly principal, interest, tax, and insurance (PITI) mortgage payment?arrow_forward

- Jordan was supposed to pay Courtney $4,200 6 months ago and $2,220 in 5 months. If he wants to repay this amount with two payments of $3,500 today and the balance amount in 3 months, calculate the balance amount. Assume interest is 2.40% p.a. and the agreed focal date is 3 months from now.arrow_forwardCoco borrowed ₱100,000 and wishes to repay Kobe at the end of each month with payments of ₱3,000 for as long as necessary. Coco is charged by Kobe 9% interest compounded monthly. How many regular level payments does Coco have to pay?arrow_forward4. Cassie paid P68 000 to a money lending company after one and a half years to fulfill her loan that costs P60 000. What is the interest rate compounded quarterly that is charged to the loan?arrow_forward

- 18 months ago Bob got 2300$ loan from a Bank. Bob started paying off the loan after 4 months, through constant deliveries, every two months, until today, in which he made the last payment and paid off the debt to the bank. Calculate the amount paid for each payment, knowing that Bank gave the loan based on the compound interest system, capitalized monthly and annual effective rate of 5, 7%. Thank youarrow_forwardMr. Santos started to deposit Php 3,500 monthly in his online bank that pays 5% compounded quarterly for 6 years. What is the interest rate? 0.0000041 0.000041 0.0041arrow_forwardNikularrow_forward

- An employee obtained a loan of P10,000 at the rate of 6% compounded annually in order to repair a house. How much must he pay monthly to amortized the loan within a period of 10 years?arrow_forwardMr. Rabutan borrowed P150,000. He agrees to pay the principal plus interest by paying an equal amount of money for 2 years. What should be his monthly payment if interest is 5% compounded annually? a. P8,895.45 b. P6,573.25 c. P5,786.25 d. P4,458.52arrow_forward1. Apple Bank makes a loan to Harry at 12.5 percent per year to be repaid by level annual payments for t years. Exactly one year before the loan is to be terminated, Harry notices that the decrease in outstanding loan balance since he took out the loan is 18,027.36. Harry's last payment contains 461.58 in interest paid. a. Find the principal paid in the second payment. b. Find the total interest paid in the first three years c. Exactly what was the term of Harry's loan? d. Find OLB3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education