ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

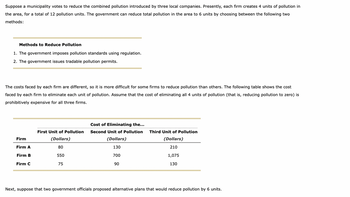

Transcribed Image Text:Suppose a municipality votes to reduce the combined pollution introduced by three local companies. Presently, each firm creates 4 units of pollution in

the area, for a total of 12 pollution units. The government can reduce total pollution in the area to 6 units by choosing between the following two

methods:

Methods to Reduce Pollution

1. The government imposes pollution standards using regulation.

2. The government issues tradable pollution permits.

The costs faced by each firm are different, so it is more difficult for some firms to reduce pollution than others. The following table shows the cost

faced by each firm to eliminate each unit of pollution. Assume that the cost of eliminating all 4 units of pollution (that is, reducing pollution to zero) is

prohibitively expensive for all three firms.

Firm

Firm A

Firm B

Firm C

First Unit of Pollution

(Dollars)

80

550

75

Cost of Eliminating the...

Second Unit of Pollution Third Unit of Pollution

(Dollars)

210

1,075

130

(Dollars)

130

700

90

Next, suppose that two government officials proposed alternative plans that would reduce pollution by 6 units.

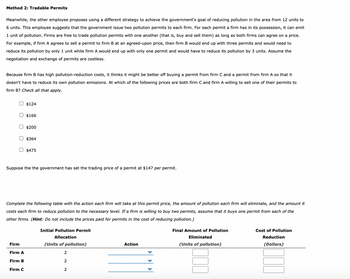

Transcribed Image Text:Method 2: Tradable Permits

Meanwhile, the other employee proposes using a different strategy to achieve the government's goal of reducing pollution in the area from 12 units to

6 units. This employee suggests that the government issue two pollution permits to each firm. For each permit a firm has in its possession, it can emit

1 unit of pollution. Firms are free to trade pollution permits with one another (that is, buy and sell them) as long as both firms can agree on a price.

For example, if firm A agrees to sell a permit to firm B at an agreed-upon price, then firm B would end up with three permits and would need to

reduce its pollution by only 1 unit while firm A would end up with only one permit and would have to reduce its pollution by 3 units. Assume the

negotiation and exchange of permits are costless.

Because firm B has high pollution-reduction costs, it thinks it might be better off buying a permit from firm C and a permit from firm A so that it

doesn't have to reduce its own pollution emissions. At which of the following prices are both firm C and firm A willing to sell one of their permits to

firm B? Check all that apply.

$124

$166

O $200

$364

O $475

Firm

Firm A

Firm B

Firm C

Suppose the the government has set the trading price of a permit at $147 per permit.

Complete the following table with the action each firm will take at this permit price, the amount of pollution each firm will eliminate, and the amount it

costs each firm to reduce pollution to the necessary level. If a firm is willing to buy two permits, assume that it buys one permit from each of the

other firms. (Hint: Do not include the prices paid for permits in the cost of reducing pollution.)

Initial Pollution Permit

Allocation

(Units of pollution)

2

2

2

Action

Final Amount of Pollution

Eliminated

(Units of pollution)

Cost of Pollution

Reduction

(Dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Figure 17.2) Suppose the external marginal cost is constant at $5 per unit. Price (demand) equals social marginal cost at output level: Select one: a. 7 b. 3 c. 6 d. 4 Price (S) 14 12 10 00 8 6 4 2 -N G 8 o 10 S = MC 12 14 Quantityarrow_forwardSuppose a lake enjoyed by three homeowners is cleaned up to the socially efficient level of pollution by splitting the cost of cleanup equally among the three homeowners. 1. Describe a situation where at least one homeowner would be made worse off by this cleanup policy. 2. In the situation you described above, is there an alternative way to allocate costs that would avoid this problem? 3. What are the barriers, if any, to achieving this alternative? (250 words or fewer.)arrow_forwardOnly typed answer You are an industry analyst that specializes in an industry where the market inverse demand is P = 100 - 3Q. The external marginal cost of producing the product is MCExternal = 6Q, and the internal cost is MCInternal = 14Q. Instruction: Round your answers to the nearest two decimal places. a. What is the socially efficient level of output? units b. Given these costs and market demand, how much output would a competitive industry produce? units c. Given these costs and market demand, how much output would a monopolist produce? units d. Which of the following are actions the government could take to induce firms in this industry to produce the socially efficient level of output. Instructions: You may select more than one answer. Click the box with a check mark for the correct answers and click twice to empty the box for the wrong answers. You must click to select or deselect each option in order to receive full credit. Pollution taxes…arrow_forward

- Which statement about externalities is wrong? O Markets are typically not efficient in dealing with externalities O Externalities can be positive or negative O A firm naturally takes into account negative externalities that result from their production O Interventions such as carbon taxes can help correct externalities gative externalities imply that the social cost is high than the internal (or private) costarrow_forward500 450 The graph on the right may help in answering question 25 400 350 300 250 200 150 100 50 O 10 20 30 40 50 60 70 80 90 100 110 120 130 140 150 Quantity Demand MC Exter nality MC private MC Social A competitive tire manufacturing industry spews emissions into the air at47 per tire a marginal cost of 1.5-q, where q is the quantity of tires produced per month (in thousands). The industry marginal cost, excluding the cost of emissions (private marginal cost), is 4 + 4•q, expressed in $ per tire. The inverse demand curve for tires is p = 480 - 3-q, also expressed in $ per tire. In order to achieve the socially efficient level of tire production, which takes into account the optimal level of air pollution, the government levies a tax on the industry. What is the efficient pollution tax? $84 per tire $101 per tire $152 per tire Pricearrow_forwardA profit-maximizing firm operating two factories currently emits 10 tons of pollution. Marginal private benefit of each ton emitted at each factory is listed in the table below. If it must reduce pollution by 6 tons, how many tons would it continue to emit from Factory B? Marginal Private Benefit Factory B $14 $12 $9 Factory A $20 Ton $18 $15 $11 $7 3 4 $6 $3arrow_forward

- 5. The marginal benefits (MB) and marginal damage costs (MD) for daily particulate air pollution in East St. Louis, Illinois are given in the following figure: $ per pound per day 2 MB MD 1 Pounds 1,000 2,000 per day a. What is the efficient level of pollution in pounds per day? Explain. b. If East St. Louis imposes an absolute ban on particulate pollution, how large would be the deadweight loss? (Be quantitative.) c. If instead of an absolute ban, the city levels a Pigouvian tax on polluters, how large should it be per pound per day to achieve efficiency? What will be the total revenues to the government? What will be the gain or loss to residents compared to the absolute ban? What will be the after tax gain or loss to polluters compared to the absolute ban? d. If instead of an absolute ban, the right to be free of pollution is given to the residents and they are allowed to bargain with the polluters, what level of pollution will Coase expect to be bargained between polluters and…arrow_forwardQuestion 1 Price $1.90 1.80 1.70- 1.60 1.50 1.35 35 38 42 Supply (Private+ Public Costs) 58 Supply (Private Costs) Quantity Refer to the figure above. This graph represents the tobacco industry. The socially optimal price and quantity are O $1.90 and 38 units, respectively. O $1.80 and 35 units, respectively. O $1.60 and 42 units, respectively. O $1.35 and 58 units, respectively.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education