Correcting errors in a

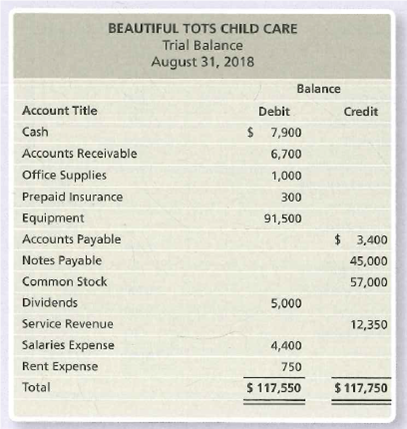

The trial balance of Beautiful Tots Child Care does not balance.

The following errors are detected:

a. Cash is understated by $1,500.

b. A $4,100 debit to

c. A $1,400 purchase of office supplies on account was neither journalized nor posted.

d. Equipment was incorrectly transferred from the ledger as $91,500. It should have been transferred as $83,000.

e. Salaries Expense is overstated by $700.

f. A $300 cash payment for advertising expense was neither journalized nor posted.

g. A $200 cash dividend was incorrectly journalized as $2,000.

h. Service Revenue was understated by $4,100,

i. A 12-month insurance policy was posted as a $1,900 credit to Prepaid Insurance. Cash was posted correctly.

Prepare the corrected trial balance as of August 31, 2018.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- The total of a list of balances in Patricia Co’s receivables ledger was $643,700 on 30 September 20X9. This did not agree with the balance on Patricia Co’s receivables ledger control account. The following errors were discovered: (i) A credit balance on an individual customer’s account of $400 was incorrectly extracted as a debit balance (ii) An invoice for $3,553 was posted to the customer account as £3,535 (iii) The total of the sales returns day book was overcast by $600 What amount should be shown in Patricia Co’s statement of financial position for accounts receivable at 30 September 20X9? A. $642,918 B. $642,882 C. $644,482 D. $643,418arrow_forwardUrmila benarrow_forwardI'm needing help on these questions for my Homework. Can anyone please help me?arrow_forward

- background info: Green checkmark means that entry is correct, red is wrong. There is only supposed to be a total of 19 entries. look at 1 picture with the complete journal and adjust to fit the allowance method to go into the second table with green and red corrections. The first entry....you are removing the account so you have to remove the allowance and related receivable (2 parts) The second entry...you want to record the cash received, the removal of the allowance and related receivable (3 parts) The third entry...recording a credit sales (2 parts) The fourth entry...setting up receivable and the allowance (2 parts) The fifth entry...record collection of a previously recorded credit sale (2 parts) The sixth entry...record collection of a previously recorded credit sale (2 parts) The seventh entry...adjusting the allowance by reducing the allowance and reducing 5 customer receivable accounts (6 parts) 1. Finalize the journal entries shown on the Fan-Tastic Sports Gear Inc. panel…arrow_forwardSubject: accountingarrow_forwardCalculation of Net Realizable Value K. L. Dearborn owns a department store that has a $45,500 balance in Accounts Receivable and a $3,000 credit balance in Allowance for Doubtful Accounts. 1. Determine the net realizable value of the accounts receivable? 2. Assume that an account receivable in the amount of $500 was written off using the allowance method. Determine the net realizable value of the accounts receivable after the write-off?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education