FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

This topic is about Property, Plant, and Equipment.

Based on the picture,

- What will be the cost of the land and the building?

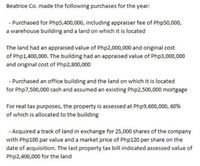

Transcribed Image Text:Beatrice Co. made the following purchases for the year:

- Purchased for Php5,400,000, including appraiser fee of Php50,000,

a warehouse building and a land on which it is located

The land had an appraised value of Php2,000,000 and original cost

of Php1,400,000. The building had an appraised value of Php3,000,000

and original cost of Php2,800,000

- Purchased an office building and the land on which it is located

for Php7,500,000 cash and assumed an existing Php2,500,000 mortgage

For real tax purposes, the property is assessed at Php9,600,000, 60%

of which is allocated to the building

- Acquired a track of land in exchange for 25,000 shares of the company

with Php100 par value and a market price of Php120 per share on the

date of acquisition. The last property tax bill indicated assessed value of

Php2,400,000 for the land

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Understand property, plant, and equipment and its related costs.arrow_forwardhow to calculate additions to plant , property, and equipmentarrow_forwardPlant Asset Cost Listed below are certain costs (or discounts) incurred in the purchase or construction of new plant assets. (1) Indicate whether the costs should be expensed or capitalized (meaning they are included in the cost of the plant assets on the balance sheet). (2) For costs that should be included in plant assets, indicate in which category of plant assets (Equipment, Building, or Land) the related costs should be recorded on the balance sheet. Expensed or Capitalized Asset Category 1. Charges incurred to train employees to use new equipment 2. Invoice cost to purchase new equipment 3. Deduction for an early payment discount taken on the purchase of new equipment 4. Real estate commissions incurred on land purchased for a new plant 5. Property taxes on land incurred after it was purchased 6. Costs of tune-up for the truck used to deliver new equipment 7. Costs to lay the foundation for a new building 8. Insurance on a new building during the construction phasearrow_forward

- What amount should be used as the cost basis of the equipment?arrow_forwardWhich costs would most likely be capitalized in the “Land Improvements” account? Costs associated with clearing the land for its intended business use Costs associated with paving and fencing on the land Costs associated with constructing a building on the landarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education