Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

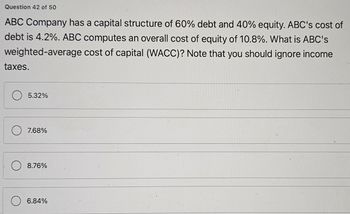

Transcribed Image Text:Question 42 of 50

ABC Company has a capital structure of 60% debt and 40% equity. ABC's cost of

debt is 4.2%. ABC computes an overall cost of equity of 10.8%. What is ABC's

cost of capital (WACC)? Note that you should ignore income

weighted-average

taxes.

5.32%

7.68%

8.76%

6.84%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the following information for Harding Hardware , determine the capital structure that results in the lowest weight average cost of capital (Waco) for the film. Explain your answer . proportion Earning per share. Stock price 10%. $3.85. $95.40 30 % $3.98 $97.25 50% $4.10 $96.80arrow_forwardConsider the following data for the firms Acme and Apex: Acme Apex Required: Equity Debt ($ million) ($ million) 210 1,050 105 350 ROC Cost of Capital (*) (%) 17% 9% 15% 10% a-1. Calculate the economic value added for Acme and Apex. a-2. Which firm has the higher economic value added? b-1. Calculate the economic value added per dollar of invested capital for Acme and Apex. b-2. Which firm has the higher economic value added per dollar of invested capital? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 Calculate the economic value added for Acme and Apex. Note: Enter your answers in millions rounded to 2 decimal places. Economic value added for Acme million Economic value added for Apex millionarrow_forwardEvans Technology has the following capital structure. Debt Common equity 35% 65 The aftertax cost of debt is 7.50 percent, and the cost of common equity (in the form of retained earnings) is 14.50 percent. a. What is the firm's weighted average cost of capital? Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. Debt Common equity Weighted average cost of capital Weighted Cost % % An outside consultant has suggested that because debt is cheaper than equity, the firm should switch to a capital structure that is 50 percent debt and 50 percent equity. Under this new and more debt-oriented arrangement, the aftertax cost of debt is 8.50 percent, and the cost of common equity (in the form of retained earnings) is 16.50 percent. Debt Common equity Weighted average cost of capital b. Recalculate the firm's weighted average cost of capital. Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal…arrow_forward

- Company X has a cost of equity of 16.31% and a pretax cost of debt of 7.8%. The debt-equity ratio is 0.56 and the tax rate is 21%. What is the unlevered cost of capital? A )14.01% b) 13.85% c) 13.70% D) 14.08% E)14.26%arrow_forwardThe capital structure of ABC Company is: Debt 40%. Equity 60%. The cost of debt is 13%. The cost of equity is 16.5%. What is the weighted average cost of capital for ABC Company? Show your calculationsarrow_forwardCalculate the Weighted Average Cost of Capital (WACC) Cost of Equity = 11.02% Cost of Debt = 5.35% Debt-to-Equity Ratio = 15.52%arrow_forward

- Firm K has a margin of 9%, turnover of 1.4, and sales of $1,610,000. Required: Calculate Firm K's net Income, average total assets, and return on Investment (ROI). Choose Factors: Choose Numerator: Net Income * Choose Factors: X Average Total Assets /Choose Denominator: = 1 Return on Investment Choose Numerator: /Choose Denominator: 1 1 Net Income Net Income Average Total Assets Average Total Assets 0 Return on Investment Return on Investment 0arrow_forwardBased on the following information, what is the firm's weighted average cost of capital of the operating assets, WACCO? Cost of debt, RD: 7% Cost of equity, Rs: 20% Total market value of debt, D: 500 Total market value of equity, S: 1,500 Number of common shares outstanding: 100 Total market value of non-operating assets, N: 200 Cost of non-operating assets, RN: 9% Corporate tax rate, T: 40% O .143009 b. 168751 a. c. .188232 d. .127767arrow_forwardQuestion: Fama's Llamas has a weighted average cost of capital of 9.5%. The company's cost of equity is 11%, and its cost of debt is 7.5%. The tax rate is 40%. What is the company's debt- equity ratio? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.)arrow_forward

- Calculation of individual costs and WACC: Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 10% preferred stock, and 55% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 28%. debt The firm can sell for $1010 a 14-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $88. An additional fee of$4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $70 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.25 ten years ago to the $3.67 dividendpayment, D0, that…arrow_forwardA firm has a cost of debt of 6.6 percent and a cost of equity of 12.1 percent. The debt-equity ratio is 78. There are no taxes. What is the firm's weighted average cost of capital? Multiple Choice 10.20% 8.07% 9.69% 8.94% 8.72%arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. Q1. ________is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Q2. Avery Co. has $3.9 million of debt, $2 million of preferred stock, and $2.2 million of common equity. What would be its weight on debt? a. 0.27 b. 0.25 c. 0.48 d. 0.20 Q1. Option 1 rS or Option 2 rD or Option 3 rP or Option 4 rE Please provide the correct answers. Thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education