Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

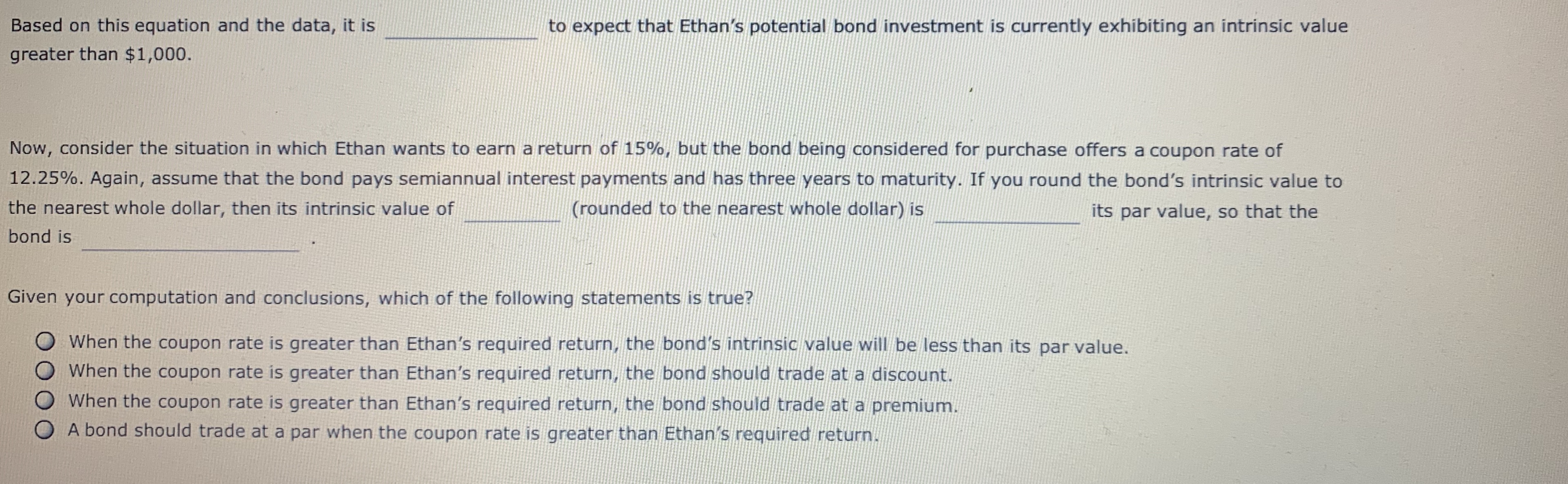

Transcribed Image Text:Based on this equation and the data, it is

greater than $1,000.

to expect that Ethan's potential bond investment is currently exhibiting an intrinsic value

Now, consider the situation in which Ethan wants to earn a return of 15%, but the bond being considered for purchase offers a coupon rate of

12.25%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to

the nearest whole dollar, then its intrinsic value of

bond is

(rounded to the nearest whole dollar) is

its par value, so that the

Given your computation and conclusions, which of the following statements is true?

when the coupon rate is greater than Ethan's required return, the bond's intrinsic value will be less than its par value.

O When the coupon rate is greater than Ethan's required return, the bond should trade at a discount.

O When the coupon rate is greater than Ethan's required return, the bond should trade at a premium.

O A bond should trade at a par when the coupon rate is greater than Ethan's required return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- You own a bond with an annual coupon rate of 5% maturing in two years and priced at 85%. Suppose that there is a 23% chance that at maturity the bond will default and you will receive only 45% of the promised payment. Assume a face value of $1,000.A. What is the bond’s promised yield to maturity?B. What is its expected yield (i.e., the possible yields weighted by their probabilities)arrow_forwardYou have a risk-free bond with 2 years to maturity. The bond has a face value of $ 1000 and a coupon rate of 5%. The next coupon will be paid one year from now, and the bond pays annual coupons. a. What is the price of the bond? What is its own yield to maturity? Is it trading at a discount or at a premium? b. Suppose you buy the 2-year bond above, and you sell it after one year. What is the expected return on your investment?Kindly solve the question in 10 mins. It is urgent.arrow_forwardYou are a fixed income analyst with an active investment in two bonds. X and Y. Bond X has a coupon rate of 9% and Bond Y has a 10% annual coupon. Both bonds have 5 years to maturity. The yield to maturity for both bonds is now 10%. If the required return rises by 14%, by what percentage will the price of the bond X change? Please provide complete details of the calculations (formula/steps) of the above questionarrow_forward

- I need assistance with the following: Suppose you have bough the above zero-coupon bond, with value and duration equal to your obligation. Now suppose the rates immediately increase to 9%. What happens to your net position? How much is the tuition obligation? How much is the zero-coupon bond? How much is the net position?arrow_forwardUse the following table to fill in values for the bond's coupon payment and present value, and Sam's semiannual required rate of return for this investment. Variable Name Coupon Payment Semiannual Required Rate of Return Present Value Variable Value Now, suppose Sam wants to earn a return of 14.00 percent, but the bond being considered for purchase offers a coupon rate of 14.00 percent. It is a $1,000 par value bond that pays a 14.00 percent coupon rate (distributed semiannually) and has three years remaining to maturity. The bond's present value is its par value, which means that the bond is which is Given your calculations and conclusions, which of the following statements are true? Check all that apply. When the coupon rate is less than Sam's required rate of return, the bond should trade at a premium. When the coupon rate is equal to Sam's required return, the bond should trade at par. When the coupon rate is less than Sam's required rate of return, the bond should trade at a…arrow_forwardSuppose you purchase a 10-year bond with 6% annual coupons. You hold the bond for four years and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 4.01% when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $100 face value? b. What is the internal rate of return of your investment? Note: Assume annual compounding. The cash flow at time 1-3 is $ (Round to the nearest cent. Enter a cash outflow as a negative number.) (Round to the nearest cent. Enter a cash outflow as a negative number.) The cash outflow at time 0 is $ The total cash flow at time 4 (after the fourth coupon) is $ negative number.) b. What is the internal rate of return of your investment? (Round to the nearest cent. Enter a cash outflow as aarrow_forward

- Answer this question using the Par Value formula and showing all work. You have been given the following information for an existing bond that provides coupon payments. Par Value: $2000 Coupon rate: 6% Maturity: 4 years Required rate of return: 6%. What is the Present Value (PV) of the bond? If the required rate of return by investors were 11% instead of 6%, what would the Present Value of the bond be? Look at the same Par Value $2,000 Same Coupon rate: 6% Maturity: 10 years Required rate of return: 7% What is the Present Value of the Bond now? Explain how the longer maturities and higher required rate of return by investors affects the bond valuation.arrow_forwardAssume you can buy a bond that has a par value of $1000, matures in 10 years, yielding 6% and has a duration of 5. If you would like to use this bond to form a guaranteed investment contract “GIC” and offer a guaranteed rate of return to investors for certain years. a. what is the maximum yield you can offer? Why? Explain. b. For how many years would you make the guarantee? Explain.arrow_forwardAssume that you are considering the purchase of a 5-year, noncallable bond with an annual coupon rate of 8.00%. The bond has a face value of $1000, and it makes semiannual interest payments. If you require an 11.55% yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond? Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72.arrow_forward

- Assume that you are considering the purchase of a 11-year, noncallable bond with an annual coupon rate of 8.90%. The bond has a face value of $1000, and it makes semiannual interest payments. If you require an 13.90% yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond? Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72.arrow_forwardFor the following questions, assume the normal case that coupon payments are semi-annual. a. What is the yield to maturity on a 12-year, 6.2% coupon bond if the bond is currently selling for $1,000? b. For the bond above, suppose that immediately after purchase market rates change to 3.60%. If you hold the bond for 4 years and then sell it, what is your effective annual return on this investment? % (enter response rounded to decimal places; i.e., x.xx%) b. Your effective annual return is % (enter response rounded to decimal places; i.e., x.xx%) a. The YTM isarrow_forwardYou plan to buy an 8% coupon 8-year maturity bond when market rate of return of similar bond is 10%. a) Calculate the proper price for this bond. b) TWO years later, the market rate has changed to 9% and the price of your bond has also changed accordingly. If you sell this bond at the market price, what is the ANNUAL rate of return from your investment in this bond? c) What will be your real rate of return over the two years if inflation rate is 3% in the first year and 5% in the second?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education