ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

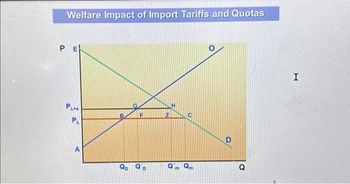

Transcribed Image Text:Based on the graph above, society's welfare before the tariff levied on imported goods was:

a) ABCE

b) ABGHE

c) BGF and ZHC

d) PLCHPL+a

Based on the graph above, society's welfare after the imposition of the tariff is as follows:

a) ABGHE

b) ABGFZHE

c) BGF and ZHC

d) PL-HE

Transcribed Image Text:Welfare Impact of Import Tariffs and Quotas

PE

PLAA

PL

B.

8

F

a

D

Z

m

C

am

D

O

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the United States is currently importing 14 million barrels per day at a world price of $4.00 per unit (the entire amount consumed), what is the effect on imports of a tax equal to $4.00 per unit? 1.) Using the line drawing tool, help determine the quantity of U.S. crude oil imports after the $4.00 per-unit tax by drawing a horizontal line at the price paid by U.S. consumers. Label this line + Tax'. 2.) Using the point drawing tool, determine quantity demanded at the price paid by U.S. consumers after the imposition of the import tax. Label this line 'Pop'. 3.) Using the point drawing tool, determine quantity supplied at the price paid by U.S. consumers after the imposition of the import tax. Label this line "Pas". Carefully follow the instructions above and only draw the required objects. The amount of imports after the $4.00 per-unit tax is million barrels per day. Before the tax, domestic producers supplied 0 barrels of crude oil. They now supply million barrels Price per barrel…arrow_forward(a) Draw an offer curve for Guatemala that shows its offer of coffee for wheat. Include both an elastic and inelastic range in Guatemala’s offer curve. (b) Draw an offer curve for the United States that shows its offer of wheat for coffee. Show this US curve intersecting the Guatemalan offer curve in the inelastic range of the Guatemalan curve. Note the equilibrium terms of trade established. (c) Compare the equilibrium international price you found in question (b) to the autarky prices in Guatemala and in the United States. (You can find a country’s autarky price by drawing a line tangent to the offer curve at the origin.) Explain which country benefits the most from a more favorable movement in its terms of trade when it abandons its autarky position. (d) “The Guatemalan offer curve is likely to be less elastic than the US offer curve.” Justify this claim by explaining what factors determine the elasticity of an offer curve.arrow_forwardChina placed tariffs on the importation of US soybeans. Assume that the domestic market for soybeans in China is described by the following equations: Demand: P = 11.5 – Q Supply: P = 5.5 + Q Price is in 10 Yuan (¥) per bushel of soybeans and the units for Quantity are 100 million bushels per year. This is to make graphing simpler. This does NOT mean that the price is 10 and quantity is 100. Rather it means that if the price was 40¥ and the quantity was 7,500,000,000 bushels, this would plot as 4 and 7.5 respectively. The world price for soybeans is ¥65/bushel (this would graph as a horizontal line at 6.5). Graph the soybean market in China showing equilibrium both with no barriers to trade and with a ¥15/bushel tariff. Be sure to fully and clearly label the graph including: Domestic Demand curve (D), Domestic Supply curve (S), the World Price (WP), and the Price with tariffs (PT), along with the quantities imported both with and without the tariff. Based on your graph, what…arrow_forward

- 4. Effects of a tariff on international trade The following graph shows the domestic demand for and supply of oranges in Honduras. The world price (Pw) of oranges is $535 per ton and is displayed as a horizontal black line. Throughout the question, assume that all countries under consideration are small, that is, the amount demanded by any one country does not affect the world price of oranges and that there are no transportation or transaction costs associated with international trade in oranges. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place. Domestic Demand 775 735 X 695 655 615 535 + 895 PRICE (Dollars per ton) 855 815 575 495 Domestic Supply 0 50 100 150 200 250 300 350 400 450 500 QUANTITY (Tons of oranges) PW A tariff set at this level would raise ? If Honduras is open to international trade in oranges without any restrictions, it will import Suppose the Honduran government wants to reduce…arrow_forwardIf a country removes a tariff on imported shoes, we expect the domestic price of shoes to and the number of shoes consumed in the domestic market to a. fall; fall b. fall; rise c. rise; fall d. rise: risearrow_forwardWhat is the effect of a tariff on consumer and producer surplus? Under which conditions is protectionism advisable? Discuss with reference to at least one case study and examine distributional consequences.arrow_forward

- The following graph shows the supply and demand curves of gloves for Portugal. Germany and France supply gloves to Portugal at a price of $2 and $3, respectively. The green line indicates a 100% nondiscriminatory tariff on Portugal's glove imports. PRICE (Dollars per pair of gloves) 10 9 O 8 2 1 0 ☐ 0 □ 2 ☐ 4 O ☐ O ☐ O 6 ☐ O ☐ O 8 10 12 14 QUANTITY (Pairs of gloves) Suppose Portugal forms a customs union with France. □ C 16 The customs union results in the trade creation effect of $ 0 Stariff SE F SG O 18 20 (?) and the trade diversion effect of $ If, instead, Portugal forms a customs union with Germany, the result will be a by an amount equal to a effect of $ The overall welfare of Portugal customs union. The welfare of Portugal willarrow_forwardIf a smaller country imports a good (electronics) from a larger country, is it beneficial for the smaller countryto impose quotas on the good coming from the larger country. Will this affect the consumers of electronics, the domestic producers of electronics and the government?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education