Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

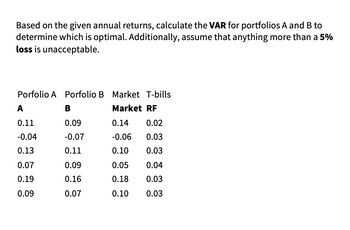

Transcribed Image Text:Based on the given annual returns, calculate the VAR for portfolios A and B to

determine which is optimal. Additionally, assume that anything more than a 5%

loss is unacceptable.

Porfolio A Porfolio B Market T-bills

A

B

Market RF

0.11

0.09

0.14

0.02

-0.04

-0.07

-0.06

0.03

0.13

0.11

0.10

0.03

0.07

0.09

0.05

0.04

0.19

0.16

0.18

0.03

0.09

0.07

0.10

0.03

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the expected return on asset A if it has a beta of 0.5, the expected market return is 13%, and the risk-free rate is 3%? O 6.5% 8% 9.5% 7% O 5%arrow_forwardneed helparrow_forwardAsset W has an expected return of 13.4 percent and a beta of 1.6. If the risk-free rate is 5.0 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Do not round intermediate calculations and enter your expected return answers as a percent rounded to 2 decimal places, e.g., 32.16. Round your beta answers to 3 decimal places, e.g., 32.161.) Asset W has an expected return of 13.4 percent and a beta of 1.6. If the risk-free rate is 5.0 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Do not round intermediate calculations and enter your expected return answers as a percent rounded to 2 decimal places, e.g., 32.16. Round your beta answers to 3 decimal places, e.g., 32.161.)arrow_forward

- Consider the information for assets A, B, and C below: Probability Return on A 0.2 0.4 0.4 State Boom Average Bust 0.3 0.2 0.1 Return on B Return on C 0.05 9.15 0.2 0.1 0.25 0.3 Consider Portfolio (Y) comprising 60% Asset A and 40% Asset C. What is the variance of portfolio Y™?arrow_forwardConsider the following two assets: Asset Expected return Standard deviation of returns 1 18% 30% 2 8% 10% The returns on the two assets are perfectly negatively correlated (i.e. coefficient of -1). Calculate the proportions of assets 1 and 2 that generate a portfolio with a standard deviation of zero. What is the expected return of that portfolio?arrow_forwardCapital asset pricing model (CAPM) For the asset shown in the following table, use the capital asset pricing model to find the required return. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Risk-free rate, RF 1% The required return for the asset is %. (Round to two decimal places.) C Market return, m 5% Beta, b 0.5arrow_forward

- A single mispriced asset has an alpha a = 3.0%, a beta ẞ = 1, and unsystematic risk σ² = 9%. The market risk premium is 5.0% and the market's standard deviation is 0.1. What is the information ratio of the mispriced asset? In constructing an optimal allocation between this mispriced asset and the market portfolio, what proportion of your investment would you place in the mispriced asset? Oa. 0.1; 6.67% O b. 0.33; 6.67% O c. 0.33; 6.90% O d. 0.1; 66.67% O e. 0.1; 6.90%arrow_forwardAssume that the risk-free rate, RF, is currently 9% and that the market return, rm, is currently 16%. a. Calculate the market risk premium. b. Given the previous data, calculate the required return on asset A having a beta of 0.4 and asset B having a beta of 1.8.arrow_forwardCalculate the optimal risky portfolio for the following cases when short-sales are allowed. Compute its expected return and the standard deviation of its returns. 1. Two risky assets: Rp = 3, R' = [6, 9], and 4 5 5 20 2. Three risky assets: Rp = 4, R' = [5,9, 8], and [10 0 0 E=0 40 0 0 20 3. Three risky assets: Rp = 5, R' = [12, 9, 8], and 40 10 -5] E= 10 20 0 5 0 30 4. Five risky assets: Rp = 2, R' = [5, 3, 18, 9, 2], and %3D 2 16 0. -12 5 -12 20 16 10 7 14 27 14 9. -13 8. 7 27 13arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education