Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

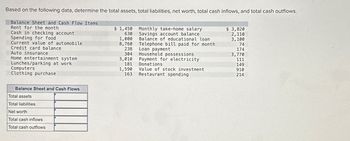

Transcribed Image Text:Based on the following data, determine the total assets, total liabilities, net worth, total cash inflows, and total cash outflows.

Balance Sheet and Cash Flow Items

Rent for the month

Cash in checking account

Spending for food

Current value of automobile

Credit card balance

Auto insurance

Home entertainment system

Lunches/parking at work

Computers

Clothing purchase

Balance Sheet and Cash Flows

Total assets

Total liabilities

Net worth

Total cash inflows

Total cash outflows

$ 1,450

630

1,000

8,760

238

304

3,010

181

1,590

163

Monthly take-home salary

Savings account balance

Balance of educational loan

Telephone bill paid for month

Loan payment

Household possessions

Payment for electricity

Donations

Value of stock investment

Restaurant spending

$ 3,820

2,110

3,100

74

174

3,770

111

149

910

214

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Answer full question.arrow_forwardReporting Cash Tina Company has the following items at year-end. Currency and coin in safe. $4,100 Funds in savings account (requires $2,500 compensating balance) 26,540 Funds in checking account 6,750 Traveler’s checks 625 Postdated check 1,250 Not-sufficient-funds check 1,880 Money market fund 35,100 RequiredIdentify the amount of the above items that should be reported as cash and cash equivalents on Tina Company’s balance sheet. Cash and Cash Equivalents = $Answerarrow_forwardSubject - account Please help me. Thankyouarrow_forward

- The April 30, Current Year, bank statement and the April ledger account for cash showed the following (summarized): Balance, April 1, Current. Year Deposits during April Interest collected Checks cleared during April NSF check-A. B. Wright Bank service charges Balance, April 30, Current Year Debit April 1 Balance April Deposits BANK STATEMENT Cash balance Checks Cash (A) $45,500 270 150 Deposits $37,200 1,210 Credit 25,300 April Checks written 43,400 Balance $31,500 68,700 69,910 24,410 24,140 23,990 23,990 43,700 A comparison of checks written before and during April with the checks cleared through the bank showed outstanding checks at the end of April of $4,400 (including $2,600 written before and $1,800 written during April). No deposits in transit were carried over from March, but a deposit was in transit at the end of April. 3. What was the beginning balance in the cash account in the ledger on May 1, Current Year?arrow_forwardNeed help with this Questionarrow_forwardUse the following excerpts from Brownstone Company's financial statements and complete the worksheet below to determine cash received from customers in 2018. From Balance Sheets Accounts Receivable Dec. 31, 2018 S 25,000 Dec. 31, 2017 $20,000 From Income Statement: Sales 2018 220,000 PLEASE NOTE: You are to follow the format shown in the textbook. Cash Collected from Sales Revenue | Select ) [ Select ] | Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] > > > > > > > >arrow_forward

- how do I journalize the entry to record the cash receipts and cash sales on March 1st? Refer to the chart of accounts for the exact wording of the account titles. Every line on a journal page is used for debit or credit entries. DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 On March 1, the actual cash received from cash sales was $66,670, and the amount indicated by the cash register total was $66,341. Required: CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 131 Notes Receivable 132 Interest Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Office Equipment 192 Accumulated Depreciation-Office Equipment 193 Store Equipment 194 Accumulated Depreciation-Store Equipment…arrow_forwardCash receipts totaled $875,000 for property taxes and $292,500 from other revenue. Note: Enter debits before credits. Transaction General Journal Debit Credit 04 .arrow_forwardHills Company's June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Balance, June 1 Deposits during June Checks cleared during June Bank service charges Balance, June 30 Cash (A) Debit June 1 Checks $ 19,900 Deposits Other $ 18,800 Credit Balance 7,360 June Deposits 20,600 20,200 Checks written June June 30 Balance 7,760 $31 Balance $ 7,360 26,160 6,260 6,229 6,229 1. In addition to the balance in its bank account, Hills Company also has $420 of petty cash on hand. This amount is recorded in a separate account called Petty Cash on Hand. What is the total amount of cash that should be reported on the balance sheet at June 30?arrow_forward

- On the schedule of collection from sales what are the percentage calculations for cash collected from prior months sales? Note A Calculations for cash collected and percentages from current months sales Note Barrow_forwardAt August 31, Concord Company has a cash balance per books of $7,900 and the following additional data from the bank statement: charge for printing Concord Company checks $64, interest earned on checking account balance $71, and outstanding checks $840.Determine the adjusted cash balance per books at August 31. Adjusted cash balance per books $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education