ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

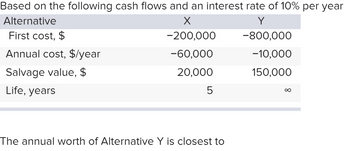

Transcribed Image Text:Based on the following cash flows and an interest rate of 10% per year

Alternative

First cost, $

Annual cost, $/year

Salvage value, $

Life, years

Y

-200,000

-800,000

-60,000

-10,000

20,000

150,000

5

∞

The annual worth of Alternative Y is closest to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For the net cash flow and cumulative cash flows shown, the value of x is nearest: (a) $−8,000 (b) $−16,000 (c) $16,000 (d) $41,000 Year 1 2 3 4 5 Net Cash Flow, $ +13,000 −29,000 −25,000 50,000 x CCF, $ +13,000 −16,000 −41,000 +9000 +1000arrow_forwardFind the What is the CC of initial cost $300,000, annual costs of S35,000, and recurring costs every 5 years of $75,000 at IR 12% per year. "Enter the value only without the currency"arrow_forwardRequired information A company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $ Equipment replacement cost in year 2, $ Annual operating cost, $/year Salvage value, $ Life, years -800,000 -300,000 -850,000 250,000 4 At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors. The equivalent annual cost of the project is $-[arrow_forward

- U.S. Census Bureau statistics show that the annual earnings for persons with a high school diploma are $35, 220 versus $57, 925 for someone with a bachelor’s degree. If the cost of attending college is assumed to be $35, 000 per year for 4 years and the forgone earnings during those years are assumed to be $35, 220 per year, what rate of return does earning a bachelor’s degree represent? Use a 25-year study period. In your analysis, you are expected to: (i) Use Excel to display the cash flow; (ii) Draw a Cash Flow Diagram; (iii) Use Excel to compute the internal rate of return of the CFD. (Hint: The investment in years 1 through 4 is the cost of college plus the foregone earnings, and the income in years 5 through 25 is the difference in income between a high school diploma and a bachelor’s degree.) Use excelarrow_forwardFor the cash flows shown, determine the incremental cash flow between machines B and A for (a) year 0, (b) in year 3, and (c) in year 6. Machine First Cost, $ АОС, $/year Salvage value, $ 3,000 Life, years B -15,000 -25,000 -1,600 -400 6,000 3 4 O (a) = -10000 (b) = -1800 (c) = 1200 %3D !3! O (a) = -10000 (b) = 13200 (c) = 4200 !3! %3! O (a) = -10000 (b) = 13200 (c) =6000 %3! %3D O (a) = -10000 (b) = 13200 (c) = 13200 %3Darrow_forwardWhat are the values of the engineering economy symbols P, F, A, i, and n in the following spreadsheet or TVM calculator functions? Use a “?” for the symbol that is to be determined.a. FV(8%,10,2000,-10000)b. PMT(12%,30,16000)c. PV(9%,15,1000,700)d. n(8.5,5000,-50000,20000)arrow_forward

- Pls help with below homework.arrow_forwardStreet lighting fixtures and their sodium vapor bulbs for a two-block area of a large city need to be installed at a first cost (investment cost) of $130,000. Annual maintenance expenses are expected to be$6,500for the first8years and$8,500 each year thereafter upto 25years. With an interest rate of 9% per year, what is the present worth cost of this project? Choose the closest answer below. A) $202,422 B $238,597 C) $249,468 D) $277,339arrow_forwardStreet lighting fixtures and their sodium vapor bulbs for a two-block area of a large city need to be installed at a first cost (investment cost) of $140,000.Annual maintenance expenses are expected to be $6,500 for the first 7 years and $9,000 each year thereafter up to 25 years. With an interest rate of 6%per year, what is the present worth cost of this project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education