FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

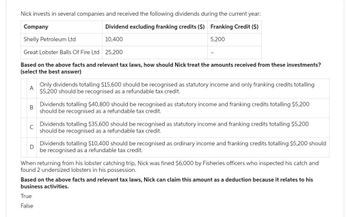

Transcribed Image Text:Nick invests in several companies and received the following dividends during the current year:

Dividend excluding franking credits ($) Franking Credit ($)

Company

Shelly Petroleum Ltd

10,400

5,200

Great Lobster Balls Of Fire Ltd 25,200

Based on the above facts and relevant tax laws, how should Nick treat the amounts received from these investments?

(select the best answer)

A

B

C

Only dividends totalling $15,600 should be recognised as statutory income and only franking credits totalling

$5,200 should be recognised as a refundable tax credit.

Dividends totalling $40,800 should be recognised as statutory income and franking credits totalling $5,200

should be recognised as a refundable tax credit.

Dividends totalling $35,600 should be recognised as statutory income and franking credits totalling $5,200

should be recognised as a refundable tax credit.

D

Dividends totalling $10,400 should be recognised as ordinary income and franking credits totalling $5,200 should

be recognised as a refundable tax credit.

True

False

When returning from his lobster catching trip, Nick was fined $6,000 by Fisheries officers who inspected his catch and

found 2 undersized lobsters in his possession.

Based on the above facts and relevant tax laws, Nick can claim this amount as a deduction because it relates to his

business activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- 4arrow_forwardIn your own words, describe the similarities and differences between tax credits and tax deductions. Your response must include two (2) examples of each kind and a discussion on why you think credits are better than deductions, or if deductions are better than credits, or maybe you think they are equal! Tell us why you feel this way.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- There are many tax rules and regulations you should be aware of when investing-whether it be in stocks; bonds; mutual funds; real estate; or collectibles such as artwork, antiques, gems, memorabilia, stamps, and coins. Capital gains are proceeds derived from these types of investments. Unless they are specified as being tax-free, such as municipal bonds, you must pay capital gains taxes on these proceeds. Capital gains are taxed in one of two ways. If the investment is held for one year or less, this is considered short-term and is taxed as ordinary income at your regular income tax rate. As this is written, if the investment is held for more than one year, it is considered long-term and qualifies for various tax discounts, as follows for single taxpayers with earnings as shown below. Stocks Held Capital Gains Rates Up to $38,700 $38,700–$426,700 Over $426,700 Over 1 year(long-term) 0% 15% 20% (a) If you are in the 23% tax bracket for ordinary income and have a 15% capital…arrow_forwardWhich of the following would be a good question to ask before advising a client to move from a Schedule C to S corporation tax treatment? Review Later How does moving to S corp tax treatment impact the ability to pump tons of money into a tax-deferred retirement plan? What really are the net savings, after accounting for all the extra fees attached to operating an S corporation? Is this client likely to actually do the compliance stuff associated with operating an S corporation, or is the "extra red tape" possibly (read: probably) going to become a nightmare for the client?.arrow_forwardWhich of the following statements are correct? i. A tax resident is normally liable to tax on their worldwide, profits, income, and gains, whether received. ii. Non-residents are generally liable to tax on certain income and profits generated from sources within the country. iii. A domiciled taxpayer is normally liable to tax on their worldwide, profits, income, and gains, whether received. iv. Tax is imposed on certain sources of income, such as interest, dividends, royalties, and fees, by way of withholding tax. a. i, ii and iv b. i only c. All of the above d. i, iii and ivarrow_forward

- If the IRS increases the capital gain tax, institutional investors' preference for dividends versus repurchases would: a. prefer dividends b. I don't know c. not change d. prefer repurchasesarrow_forwardComment on the following items relative to tax planning strategies of a fiduciary entity. A. To reduce taxes for a typical family, should income be shifted to a trust or from a trust? Why? B. To reduce overall taxes, should a high-income, wealthy beneficiary be assigned to the first or second tier of trust distributions? Why?arrow_forwardWhich of the following accurately describes taxation of cryptocurrency transactions?a) Cryptocurrency transactions are exempt from taxation. b) Cryptocurrency transactions are subject to capital gains tax. c) Cryptocurrency transactions are taxed at corporate tax rates. d) Cryptocurrency transactions are taxed at a fixed rate set by the IRS.arrow_forward

- Which of the following accurately describes the tax implications of investing in real estate and rental properties? a) Real estate investments are not subject to taxation. b) Rental income is tax-exempt. c) Rental income is subject to taxation, and expenses related to real estate investments may be deductible. d) Rental income is taxed at a fixed rate determined by the IRS.arrow_forwardWhich of the following statements BEST describes an important tax planning opportunity with regard to loss carry overs? Question 5 options: As noncapital loss carry overs have an unlimited carry forward period, only net capital loss carry overs should be used to reduce Taxable Income to zero. As personal tax credits have an unlimited carry forward period, loss carryovers should be used to reduce Taxable Income to nil. Loss carry overs should not be used to reduce Taxable Income to zero as this prevents the application of personal tax credits. Loss carry overs should be used to reduce Taxable Income to zero so that personal tax credits can be applied to trigger a refund of taxes in the year.arrow_forwardWhat will be the effect after To complete a successful tax-deferred exchange for the investor?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education