Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

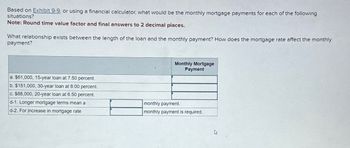

Transcribed Image Text:Based on Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments for each of the following

situations?

Note: Round time value factor and final answers to 2 decimal places.

What relationship exists between the length of the loan and the monthly payment? How does the mortgage rate affect the monthly

payment?

a. $61,000, 15-year loan at 7.50 percent.

b. $151,000, 30-year loan at 8.00 percent.

c. $88,000, 20-year loan at 6.50 percent.

d-1. Longer mortgage terms mean a

d-2. For increase in mortgage rate

Monthly Mortgage

Payment

monthly payment.

monthly payment is required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The principal P is borrowed and the loan's future value, A, at time t is given. Determine the loan's simple interest rate, r, to the nearest tenth of a percent.P = $500, A = $530, t = 4 monthsarrow_forwardSuppose that you want to take out a loan and that your local bank wants to charge you an annual real interest rate equal to 3%. Assuming that the annualized expected rate of inflation over the life of the loan is 1%, determine the nominal interest rate that the bank will charge you. What was the actual real interest rate on the loan if, over the life of the loan, actual inflation is 0.5%?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Given the following loan information: Annual loan payment = $47,100 Number of remaining periods = 6 Interest rate = 12% What is the book value of the loan?arrow_forwardEstimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. (Refer to Exhibit 9-8 and Exhibit 9-9.) Note: Round time value factor to 2 decimal places, intermediate and final answers to the nearest whole number. Monthly gross income Down payment to be made (percent of purchase price) Other debt (monthly payment) Monthly estimate for property taxes and insurance 30-year loan Affordable monthly mortgage payment Affordable mortgage amount Affordable home purchase price Affordable Amount Mortgage Costs $ 3,250 20 Percent $ 175 $ 210 7.0 Percentarrow_forwardBased on Exhibit 7-7, what would be the monthly mortgage payments for each of the following situations? (Round your answers to 2 decimal places.) a A $160.000, 15-year loan at 4.5 percent. b. A $215,000, 30-year loan at 5 percent. c. A $190,000, 20-year loan at 6 percent. +arrow_forward

- Using this table as needed, calculate the required information for the mortgage. (Round dollars to the nearest cent.) Table Factor (in $) Amount Interest Financed Rate $165,300 5.25% Term of Loan (years) 15 Interest Rate (%) 3.50 3.75 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 Number of $1,000s Financed 165.30 7.00 7.25 7.50 7.75 8.00 8.25 8.50 8.75 9.00 9.25 9.50 9.75 10.00 10.25 10.50 10.75 11.00 11.25 11.50 11.75 12.00 12.25 12.50 12.75 13.00 Years 18.19 18.30 18.42 18.53 18.64 18.76 18.87 18.99 19.10 19.22 19.33 Table 14-1: Monthly Payments to Amortize Principal and Interest per $1,000 Financed Monthly Payments (Necessary to amortize a loan of $1,000) 19.68 19.80 19.92 20.04 20.16 20.28 20.40 20.52 20.64 20.76 20.88 21.00 21.12 21.25 21.37 21.49 21.62 $8.04 21.74 21.87 21.99 22,12 22,24 22.37 22.50 22.63 22.75 Years 9.89 10.01 10.12 10.24 10.36 10.48 10.61 10.73 10.85 10.98 11.10 11.23 11.35 11.48 11.61 11.74 11.87 12.00 12.13 12.40 12.53 12.67 12.80 12.94 13.08…arrow_forward(Q) A borrower takes out an interest - only loan at 7% for $1,000,000 with a 10-year term. What is the monthly payment on this loan? (State your answer as a positive number, rounded to two decimal places.)arrow_forwardComplete the following amortization chart by using Table 15.1. Note: Round your "Payment per $1,000" answer to 5 decimal places and other answers to the nearest cent. Selling price of home Down payment Principal (loan) Rate of interest Years Payment per $1,000 Monthly mortgage payment 69 $ 82,000 $ 6,000 5.0 % 30 30arrow_forward

- Complete the following table: (Use Table 15.1.) Note: Do not round intermediate calculations. Round your answers to the nearest cent. Selling price down payment amount mortgage rate years Monthly paymeny First payment broken down to interest first payment broken down to principal Balance at end of month $236,000 $47,200 7.00% 15 TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Rate Interest Only 10 Year 15 Year 20 Year 25 Year 30 Year 40 Year 2.000 0.16667 9.20135 6.43509 5.05883 4.23854 3.69619 3.02826 2.125 0.17708 9.25743 6.49281 5.11825 4.29966 3.75902 3.09444 2.250 0.18750 9.31374 6.55085 5.17808 4.36131 3.82246 3.16142 2.375 0.19792 9.37026 6.60921 5.23834 4.42348 3.88653 3.22921 2.500 0.20833 9.42699 6.66789 5.29903 4.48617 3.95121 3.29778 2.625 0.21875 9.48394 6.72689 5.36014 4.54938 4.01651 3.36714 2.750 0.22917 9.54110 6.78622 5.42166 4.61311 4.08241 3.43728 2.875 0.23958 9.59848 6.84586 5.48361 4.67735 4.14892…arrow_forwardWhat is the effective interest rate (APY) for a loan of $8,500 at 12% APR compounded monthly? use the formula method.arrow_forwardSuppose you earn a gross income of $2,920.00 per month and apply for a mortgage with a monthly PITI of $908.12. You have other financial obligations totaling $169.36 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would you qualify for? Mortgage Type Housing Expense Ratio Total Obligations Ratio FHA 29% 41% Conventional 28% 36% A. FHA only B. Conventional only C. FHA and Conventional D. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education