FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

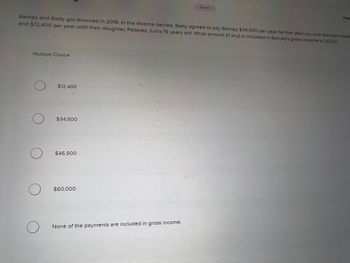

Transcribed Image Text:Barney and Betty got 'divorced in 2018. In the divorce decree, Betty agreed to pay Barney $34,500 per year for five years (or until Barney's deat

and $12,400 per year until their daughter, Pebbles, turns 19 years old. What amount (if any) is included in Barney's gross income in 2022?

Multiple Choice

O $12.400

O

O

O

O

$34,500

$46,900

$60,000

Saved

None of the payments are included in gross income.

Halp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Charles and his wife Diana divorced on May 1, 2022. During 2023, Charles made court-ordered alimony payments in the amount of $7,000. His alimony payments are: A) Included in the income on Diana's return B) Excluded from the income on Diana's return C) Calculated as a deduction on Charles' return OD) Categorized as a credit on Charles' return Back Submit All Nearrow_forwardGodoarrow_forwardRita is a self-employed taxpayer who turns 39 years old at the end of the year (2023). In 2023, her net Schedule C income was $314,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part a (Algo) a. She sets up a SEP IRA. Maximum contributionarrow_forward

- Gadubhiarrow_forwardI need answers for Question a,b,c,darrow_forwardn 2021 Betty loaned her son, Juan, $10,000 to help him buy a car. In 2023, before he repaid the $10,000, Betty to Juan that she was "tearing up" the $10,000 note as a graduation present. How should Juan treat the amount forgi O A. taxable income in year of forgiveness B. excludible gift in year of forgiveness OC. taxable income in year of loan O D. excludible gift in year of loanarrow_forward

- 36. One year prior to his death, Bobby lends his son $250,000 at a 10% interest rate per year to purchase land. As part of the promissory note, the promissory note will cancel upon Bobby's death. At the time of death no payments were made and Bobby did not seek payment from his son. Assuming this is John's only asset, what is the value of his gross estate? a. $0 b. $25,000 c. $250,000 d. $275,000arrow_forwardQuestion 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forwardDengerarrow_forward

- 1. MC.02-075 Ren and Mina are divorced and under the terms of their written divorce agreement signed on December 30, 2016, Ren was required to pay Mina $1,500 per month of which $600 was designated as child support. He made 12 such payments in 2022. Additionally, Ren voluntarily paid Mina $1,200 per month for 12 months of 2022, no portion of which was designated as child support. Assuming that Mina has no other income, her tax return for 2022 should show gross income of a. $7,200 b. $10,800 c. $18,000 d. $0arrow_forwardTed and Alice were divorced in January 2018. The provisions of the divorce decree and Alices's obligations follow: 1. Transfer the title in their resort condo to Ted. At the time of the transfer, the condo had a basis to Alice of $95,000, a fair market value of $115,000; it was subject to a mortgage of $85,000. 2. Alice is to make the mortgage paynents for 17 years regardless of how long Ted lives. Alice paid $12,000 in 2020. 3. Alice is to pay Ted $1,000 per month, beginning in 2018, for 10 years or until Ted dies. Of this amount, $500 is designated as child support. Alice made five payments of $900 each in 2021 (January - May). What is the amount of alimony from his settlement that is includible in Ted's gross income for 2021?arrow_forwardDuring 2023, Anmol Frank had the following transactions: Alimony received (divorce occured in 2017) Interest income on IBM bonds She borrowed money to buy a new car Value of BMW received as a gift from aunt Federal income tax withholding payments The taxpayer's AGI is: a. $74,000. b. $76,000. c. $79,000. d.) $81,000. e. $90,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education