FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

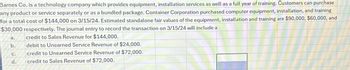

Transcribed Image Text:Barnes Co. is a technology company which provides equipment, installation services as well as a full year of training. Customers can purchase

any product or service separately or as a bundled package. Container Corporation purchased computer equipment, installation, and training

for a total cost of $144,000 on 3/15/24. Estimated standalone fair values of the equipment, installation and training are $90,000, $60,000, and

$30,000 respectively. The journal entry to record the transaction on 3/15/24 will include a

a.

credit to Sales Revenue for $144,000.

b.

debit to Unearned Service Revenue of $24,000.

credit to Unearned Service Revenue of $72,000.

credit to Sales Revenue of $72,000.

C.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aa.38.arrow_forwardManjiarrow_forwardThe Auto Clinic is a wholly owned subsidiary of Fast-Check Equipment Company. Fast-Check Equipment sells and leases 4-wheel alignment machines. The usual selling price of each machine is $35,000; it has a cost to Fast- Check Equipment of $25,000. On January 1, 2015, Fast-Check Equipment leased such a machine to Auto Clinic. The lease provided for payments of $9,096 at the start of each year for five years. The payments include $1,000 per year for maintenance to be provided by the seller. There is a bargain purchase price of $2,000 at the end of the fifth year. The implicit interest rate in the lease is 10% per year. The equipment is being depreciated over eight years.The amortization schedule for the lease prepared by Fast-Check Equipment is as attached:Prepare the eliminations and adjustments, in entry form, that would be required on a consolidated worksheet prepared on December 31, 2015.arrow_forward

- Fajardo Company sells appliance service contracts agreeing to repair appliance for 2-year period. Fajardo Company’s past experience is that, of the total amount for repairs on service contracts, 40% is incurred evenly during the 1st contract year and 60% evenly during the second contract year. Receipts from service contracts for the 2 years ended December 31, 2021, are as follows: 2020, P500,000; 2021, P600,000. Receipts from contracts are credited to unearned service contract revenue. Assume that all contract sales are made evenly during the year. Group of answer choices 630,000 480,000 360,000 470,000arrow_forwardCarla Vista Corporation shipped $20,100 of merchandise on consignment to Wildhorse Company. Carla Vista paid freight costs of $2,000. Wildhorse Company paid $510 for local advertising, which is reimbursable from Carla Vista. By year-end, 58% of the merchandise had been sold for $20,100. Wildhorse notified Carla Vista, retained a 10% commission, and remitted the cash due to Carla Vista. Prepare Carla Vista's journal entry when the cash is received. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)arrow_forwardOn August 15, 2020, Japan Ideas consigned 770 electronic play systems, costing $100 each, to YoYo Toys Company. The cost of shipping the play systems amounted to $1,100 and was paid by Japan Ideas. On December 31, 2020, an account sales summary was received from the consignee, reporting that 420 play systems had been sold for $170 each. Remittance was made by the consignee for the amount due, after deducting a 20% commission. Calculate the inventory value of the units unsold in the hands of the consignee at December 31, 2020. Calculate the profit for the consignor for the units sold at December 31, 2020. Calculate the amount of cash that will be remitted by the consignee at December 31, 2020.arrow_forward

- On March 18, Kudos Corporation sells snack products to a retail warehouse club chain for $40,000 (cost of $24,000). The contract includes an obligation for the warehouse club to run certain advertising campaigns for the snack products in exchange for $3,200 cash from Kudos Corporation on the contract date. The comparable price for this type of advertising campaign to be conducted by a third party is $3,200. Required a. Prepare kudos' journal entry on March 18 for the product sale, the cost of the product sale, and the purchase of advertising services. b. Assume instead that Kudos sold $40,000 of product to a customer (cost of $24,000) and has agreed to pay the customer $800 in slotting fees for preferential product placement in displays. Kudos will pay the $800 fee on April 30. Prepare kudos' journal entry on March 18 for the product sale and the cost of the product sale, and then on April 30 for the payment of the slotting fee. • Note: If a line in a journal entry isn't required for…arrow_forwardBlossom Corporation shipped $21,900 of merchandise on consignment to Cullumber Company. Blossom paid freight costs of $2,100. Cullumber Company paid $550 for local advertising, which is reimbursable from Blossom. By year-end, 65% of the merchandise had been sold for $21,900. Cullumber notified Blossom, retained a 10% commission, and remitted the cash due to Blossom. Prepare Blossom's journal entry when the cash is received. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record the cash remitted to Blossom.) (To record the cost of inventory sold on consignment.) Debit 11 Credit 1arrow_forwardComplete Electronics Inc. sells a point - of -sale computer with a two- year service contract. Complete collects $3,500 cash for the selling price of the computer and $648 for the two - year service contract. How is revenue recognized? O A. Complete will record Sales Revenue of $3.500 when the computer delivered and will record revenue for the service contract as service calls are made. O B. Complete will record Sales Revenue of $2,074 per year for two years. O C. Complete will record Sales Revenue of $4,148 when the computer is delivered to the customer. O D. Complețe will record Sales Revenue of $3,500 when the computer is delivered and Service Revenue of $27 per month for 24 months.arrow_forward

- Allocating Transaction Price to Performance Obligations and Recording Sales Value Dealership Inc. markets and sells the vehicles to retail customers. Along with a new vehicle purchase, a customer will receive a free annual maintenance contract for one year from the date of purchase. The standalone selling price of a vehicle is $30,000 and the standalone selling price for the annual maintenance contract is $400. During October 2020, Value Dealership Inc. sold 30 vehicles for $30,250 per vehicle, each with a free annual maintenance contract. When answering the following questions: Round each allocated transaction price to the nearest dollar. If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero). a. Ignoring the cost entries, record the journal entry in October 2020 for Value Dealership’s sale of vehicles with the associated maintenance contracts to customers.…arrow_forwardRahe Corp. sold a customer service contract with a price of $20,000 to Peterson Warehousing. Rahe Corp. offered terms of 2/10, n/30 and expects Peterson to pay within the discount period. Required: Prepare the journal entry to record the sale using the net method. Prepare the journal entry assuming the payment is made within 10 days (within the discount period).arrow_forwardO’Connor Company ordered a machine on January 1 at a purchase price of $40,000. On the date ofdelivery, January 2, the company paid $10,000 on the machine and signed a Iong-term note payablefor the balance. On January 3, it paid $350 for freight on the machine. On January 5, O’Connor paidcash for installation costs relating to the machine amounting to $2,400. On December 31 (the endof the accounting period), O’Connor recorded depreciation on the machine using the straight-linemethod with an estimated useful life of 10 years and an estimated residual value of $4,750.Required:1. Indicate the effects (accounts, amounts, and 1 or 2 ) of each transaction (on January 1, 2, 3,and 5) on the accounting equation. Use the following schedule:Date Assets 5 Liabilities 1 Stockholders’ Equity2. Compute the acquisition cost of the machine.3. Compute the depreciation expense to be reported for the first year.4. What should be the book value of the machine at the end of the second year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education