Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

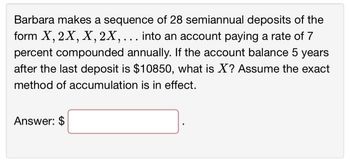

Transcribed Image Text:Barbara makes a sequence of 28 semiannual deposits of the

form X, 2X, X, 2X, ... into an account paying a rate of 7

percent compounded annually. If the account balance 5 years

after the last deposit is $10850, what is X? Assume the exact

method of accumulation is in effect.

Answer: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- A car loan of $30714 is to be repaid by making payments each month for 3 years. If interest is 21% compounded quarterly, how much is our monthly car payment?arrow_forwardFind i (the rate per period) and n (the number of periods) for the following annuity. Quarterly deposits of $700 are made for 7 years into an annuity that pays 6.5% compounded quarterly.arrow_forwardJesse purchases a retirement annuity that will pay him $1,500 at the end of every six months for the first nine years and $600 at the end of every month for the next three years. The annuity earns interest at a rate of 3.5% compounded quarterly. a. What was the purchase price of the annuity? Round to the nearest cent b. How much interest did Jesse receive from the annuity?arrow_forward

- For 7 years, Janet saved $450 at the beginning of every month in a fund that earned 4.75% compounded annually. a. What was the balance in the fund at the end of the period? Round to the nearest cent b. What was the amount of interest earned over the period? Round to the nearest centarrow_forwardAn employee invests £1000 at the end of each month into her Pension Fund (b) for 30 years. What is the value of her Pension Fund if it grows at an annual rate of 6% (0.5% per month) at the end of the 30 years.arrow_forwardSuppose you invest $120 a month for 3 years into an account earning 6% compounded monthly. After 3 years, you leave the money, without making additional deposits, in the account for another 20 years. How much will you have in the end? Submit Questionarrow_forward

- Assume that you want to have $ 3100 saved in a sinking fund in 1 year. The account pays 4.5% compounded monthly. What should be your monthly payments?arrow_forwardA couple plans to invest money into an account that earns 9% interest, compounded quarterly, for their child's college education. What principal must be deposited by the parents when their child turns 5 in order to have $25,000 when the child reaches the age of 18?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,