Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

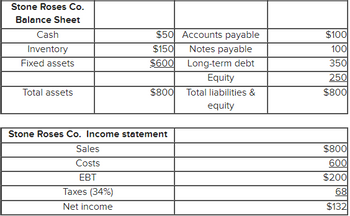

Suppose that current assets, costs, and accounts payable maintain a constant ratio to sales. The firm retains 40% of earnings. If the firm is producing at only 90% capacity, what is the total external financing needed if sales increase 25%?

Transcribed Image Text:Stone Roses Co.

Balance Sheet

Cash

Inventory

Fixed assets

Total assets

$50 Accounts payable

$150

Notes payable

$600

Long-term debt

Taxes (34%)

Net income

Equity

$800 Total liabilities &

equity

Stone Roses Co. Income statement

Sales

Costs

EBT

$100

100

350

250

$800

$800

600

$200

68

$132

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- YiYu Manufacturer wishes to maintain a growth rate of 6 percent a year, a debt-equity ratio of 0.45, and a dividend payout ratio of 30 percent. The ratio of total assets to sales is constant at 1.25. Calculate the profit margin the firm must achieve.arrow_forwardThe ROA of your firm is 5%. The firm also has a debt-asset ratio of 70%. If your firm reinvests 100% of its earnings, at what rate can your assets grow without having to change your capital structure? Further, at what rate can your assets grow without having to raise capital externally? I know the formula for sustainable growth is ROE x b / 1 - ROE x b Internal growth ROA x 1 - b / 1 - (ROA x 1- b) But I do not know how to get the information with what is provided. I think I'm missing a formula to go from ROA (which is the 5% provided) to ROE. Can you show me how to solve this problem? Thank you in advance for your help.arrow_forwardXYZ Co is thinking about expanding. They have provided the following information: Expect an extra $2.5million in sales 18% of the sales will be uncollectible Collection Costs are 3% on all new sales Production Costs 70% of sales Selling expenses are 11% of sales Opportunity Cost of 22% (before taxes) Turn Receivables 4 times per year Should XYZ Co expand?arrow_forward

- (Using degree of operating leverage) Last year Baker-Huggy Inc. had fixed costs of $150,000 and net operating income of $34,000. If sales increase by 18 percent, by how much will the firm's NOI increase? What would happen to the firm's NOI if sales decreased by 21 percent? If sales increase by 18%, the change in the firms NOI will be (a decrease or increase) of _ %arrow_forwardA firm is considering relaxing credit standards, which will result in annual sales increasing from P1.5 million to P1.75 million, the cost of annual sales increasing from P1,000,000 to P1,125,000, and the average collection period increasing from 40 to 55 days. The bad debt loss is expected to increase from 1 percent of sales to 1.5 percent of sales. The firm's required return on investments is 20 percent. The firm's cost of marginal investment in accounts receivable is? Format: 11,111.11arrow_forwardThe most recent free cash flow (FCF) for Heath Inc. was $200 million, and the management expects the free cash flow to begin growing immediately at a 7% constant rate. The cost of capital is 12%. Using the constant growth model, determine the value of operations of Heath Inc.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education