FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

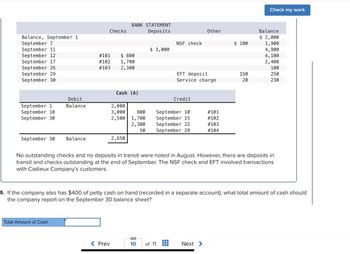

Transcribed Image Text:Balance, September 1

Checks

BANK STATEMENT

Deposits

September 7

NSF check

September 11

$ 3,000

September 12

#101

$ 800

September 17

#102

1,700

September 26

#103

2,300

September 29

September 30

Other

Check my work

Balance

$ 2,000

$ 100

1,900

4,900

4,100

2,400

100

EFT deposit

150

Service charge

150

250

230

Cash (A)

Debit

Credit

September 1

Balance

2,000

September 10

3,000

800

September 10

#101

September 30

2,500

1,700

September 15

#102

2,300

September 22

#103

50

September 28

#104

September 30

Balance

2,650

No outstanding checks and no deposits in transit were noted in August. However, there are deposits in

transit and checks outstanding at the end of September. The NSF check and EFT involved transactions

with Cadieux Company's customers.

4. If the company also has $400 of petty cash on hand (recorded in a separate account), what total amount of cash should

the company report on the September 30 balance sheet?

Total Amount of Cash

S

< Prev

10

of 11

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question attached to screenshot thanks for the help appreciated z zfdfd w3t22arrow_forwardExam 3 (Chapters 5-6) 28 Book The following information is available for Birch Company at December 31 Cash in registers Investment naturing in 9 years Accounts receivable Cash in bank account Accounts payable Cash in petty cash fundi Inventory of postage stamps U.S. Treasury bill maturing in 15 days Based on this information, Birch Company should report Cash and Cash Equivalents on December 31 of Multiple Choice O $40.606 $43.091 $38,061 $39,066 $54,261 $ 2,910 $ 16,200 $ 1,775 $ 23,631 $ 770 $ 320 $ 30 $ 11,200arrow_forwardQUESTION 7 Brown Company's bank statement for September 30 showed: Bank statement balance Book balance of cash $4,210 $6,560 The following information was also available as of September 30: a. A customer's check for $950 marked NSF was returned to Brown Company by the bank. In addition, the bank charged the company's account a $30 processine fee. b. The September 30 cash receipts, $6,000 were placed in the bank's night depository after banking hours on that date and this amount did not appear on the September 30 bank statement C. Outstanding checks amounted to $3,910. d. A check for rent expense was written for $2,198 but by mistake was recorded in the accounting records as $2,918. Required: Prepare bank reconciliation as of September 30.arrow_forward

- Question is attached in the screenshot greatly appreciate the help thank you uye reyearrow_forwardUse the following bank statement and T-account to prepare the May 31 bank reconciliation. BANK STATEMENT Date Checks Deposits Other Balance May 1 $ 340 May 4 #2 $ 45 $ 85 380 May 12 #4 135 NSF check $ 85 160 May 28 #5 55 105 May 30 #6 50 340 395 May 31 #8 90 Service charge 40 265 Cash (A) Debit Credit May 1 340 May 3 85 45 May 3 #2 105 May 4 #3 135 May 8 #4 55 May 11 #5 50 May 21 #6 May 29 340 60 May 29 #7 May 30 220 90 May 30 #8 May 31 445arrow_forwardaj.2arrow_forward

- Nonearrow_forwardA -1 Prepared by Reviewed by William, Inc. Bank Confirmation - General Account December 31, 2022 Balance per Bank at December 31, 2022 $20,200.22 * Deposit in Transit - per A-1-2 2,000.00 # Outstanding Checks - per A-1-3 (5,200.00) Other - Note Collected by Bank (10,000.00) ^ Bank Service Charge (9.50) Balance per Books at December 31, 2022 $8,990.72 * f f Column footed. ^ Amount agrees to amount recorded as a deposit on the bank statement and description agrees with receipt enclosed with 12/31/22 bank statement. This note is the Kristopher note receivable that was recorded as a receipt by the client in the cash receipts journal on January 3, 2023. The receivable was appropriately credited and properly reflected in the January cash receipts journal. No adjustment needed as bank and books simply record this in different periods. #Agreed to December 31,…arrow_forwardCalculator chapter 8 eBook The following June 30 bank reconciliation was prepared for Poway Co. Poway Co. Bank Reconciliation For the Month Ended June 30 $16,185 Cash balance according to bank statement Add outstanding checks: $575 No. 1067 470 1106 1.050 1110 910 3,005 1113 $19,190 6,600 Deduct deposit of June 30, not recorded by bank 512,590 Adjusted balance $8,985 Cash balance according to company's records Addı Proceeds of note collected by banki Principal $6,000 Interest 300 $6,300 Service charges 15 6,315 $15.300 0685 5,400 Deduct: Check returned because of Insufficient funds Error in recording June 17 deposit of S7.150 as 31,750 6,290 s 9,010 Adjusted belance a. Identfy the errors in the above bank reconci lation. Check My Work Assignment Score: 45.08% Type here to searcharrow_forward

- Chapter 8 The December cash records of Dickson Insurance Cash Receipts Cash Payments Date Cash Debit Check no. Cash Credit Dec, 4 Dec, 9 Dec, 14 Dec, 17 Dec, 31 $4,180 500 510 2,130 1,850 Beg. Balance + Deposits - Checks Dickson's Cash account shows a balance of $17,030 at Dec, 31. On Dec, 31 Dickson Insurance received the following bank statement: Dec, 1 Dec, 5 Dec, 10 Dec, 15 Dec, 18 Dec, 22 1416 1417 1418 1419 1420 1421 1422 End. Balance Dec, 8 Dec, 11(Check no. 1416) Dec, 19 Dec, 22 (Check no. 1417) Dec, 29 (Check no. 1418) Dec, 31 (Check no. 1419) Dec, 31 Bank Statement for December $850 130 630 1,190 1,490 1,100 650 Bank End. Balance Bank Reconciliation EFT BC Book End. Balance NSF EFT SC $600 4,180 500 510 2,130 1,400 $1,000 850 $400 130 630 1,910 $40 $13,900 Total 9,320 BC - Bank Collections, EFT – Electronic Fund Transfer, NSF- Nonsufficient funds checks, SC - Service Charge Total (4,960) - The EFT Deposit was a receipt of rent. The EFT check was an insurance payment. - The…arrow_forwardBalance per bank, November 30 Add: Deposits outstanding Less: Checks outstanding #363 #365 # 380 # 381 # 382 Adjusted balance per bank, November 30 Balance, December 1 $3,625 Receipts 42,650 Disbursements (41,853) Balance, December 31 $ 4,422 $ 3,231 1,200 The company's general ledger checking account showed the following for December: Balance, December 1 $3,231 Deposits 43,000 Checks processed (41,918) Service charges NSF checks $ 123 201 56 86 340 (806) (22) (440) Balance, December 31 $ 3,851 $ 3,625 The December bank statement contained the following information: The checks that were processed by the bank in December include all of the outstanding checks at the end of November except for check #365. In addition, there are some December checks that had not been processed by the bank by the end of the month. Also, you discover that check #411 for $320 was correctly recorded by the bank but was incorrectly recorded on the books as a $230 disbursement for advertising expense. Included…arrow_forwardaj.8arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education