EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

I don't need

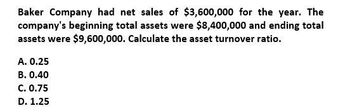

Transcribed Image Text:Baker Company had net sales of $3,600,000 for the year. The

company's beginning total assets were $8,400,000 and ending total

assets were $9,600,000. Calculate the asset turnover ratio.

A. 0.25

B. 0.40

C. 0.75

D. 1.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Right Company reported beginning and ending total assets of $36,000 and $30,000, respectively. Its net sales revenue for the year were $26,070. What was Right's asset turnover ratio? A. 0.87 OB. 1.27 OC. 0.79 OD. 0.72arrow_forwardBountiful Company had sales of $650,000 and cost of goods sold of $200,000 during a year. The total assets balance at the beginning of the year was $175,000 and at the end of the year was $167,000. Calculate the asset turnover ratio. a.0.26 b.3.00 c.3.80 d.0.29arrow_forwardIndependence Company reported beginning and ending total assets of $38,000 and $42,000, respectively. Its net sales revenue for the year were $34,000. What was Independence's asset turnover ratio? OA. 0.80 ОВ. 0.85 OC. 1.18 OD. 0.81 pe here to search Pi 50 G This question:arrow_forward

- Ansarrow_forwardWhat is the asset turnover ratio on these general accounting question?arrow_forwardA company had average total assets of $897,000. Its gross sales were $1,090,000 and its net sales were $1,000,000. The company's total asset turnover equals: A. 0.82.B. 0.90.C. 1.09.D. 1.11.E. 1.26.arrow_forward

- MCQarrow_forwardDundee Company reported the following for the current year: Net sales Cost of goods sold Beginning balance of total assets. Ending balance of total assets Compute total asset turnover. Numerator. 1 1 $ 100,800 72,000 127,000 97,880 Total Asset Turnover Denominator: = = = Total Asset Turnover Total asset turnover timesarrow_forwardPlease provide answer the general accounting questionarrow_forward

- Dundee Company reported the following for the current year: Net sales Cost of goods sold Beginning balance of total assets Ending balance of total assets $ 87,200 69,000 124,000 94,000 Compute total asset turnover. Numerator: Average total assets Cost of goods sold Net sales Total Asset Turnover Denominator: = Total Asset Turnover = Total asset turnover = timesarrow_forwardSelect financial statement data for two recent years for Davenport Company are as follows: Line Item Description 20Y5 20Y4 Sales $2,011,500 $1,088,000 Fixed assets: Beginning of year 720,000 640,000 End of year 770,000 720,000 a. Determine the fixed asset turnover ratio for 20Y4 and 20Y5. Round your answers to one decimal place. Line Item Description 20Y5 20Y4 Fixed Asset Turnover Ratio fill in the blank 1 of 2 fill in the blank 2 of 2arrow_forwardAardvark & Co. has sales of $291,200, cost of goods sold of $163,300, net profit of $11,360, net fixed assets of $154, 500, and current assets of $89, 500. What is the total asset turnover rate? a) 1.19 b) 1.11 c) 1.24 d) 1.08 e) 1.28arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning