FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

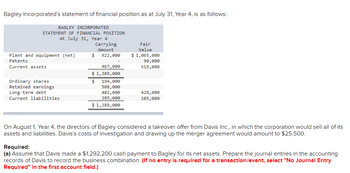

Transcribed Image Text:Bagley Incorporated's statement of financial position as at July 31, Year 4, is as follows:

BAGLEY INCORPORATED

STATEMENT OF FINANCIAL POSITION

At July 31, Year 4

Plant and equipment (net)

Patents

Current assets

Ordinary shares

Retained earnings

Long-term debt

Current liabilities

$

Carrying

Amount

922,000

467,000

$ 1,389,000

$ 194,000

508,000

402,000

285,000

$ 1,389,000

Fair

Value

$ 1,065,000

90,000

519,000

428,000

285,000

On August 1, Year 4, the directors of Bagley considered a takeover offer from Davis Inc., in which the corporation would sell all of its

assets and liabilities. Davis's costs of investigation and drawing up the merger agreement would amount to $25,500.

Required:

(a) Assume that Davis made a $1,292,200 cash payment to Bagley for its net assets. Prepare the journal entries in the accounting

records of Davis to record the business combination. (If no entry is required for a transaction/event, select "No Journal Entry

Required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2021 Pail corp acquired 80 percent of Sand Company's stock fo 640,000 cash. The fair value of the noncontrolling interest at that date was determined to be 160,000. For the year ended December 31 2021 Pail reported dividends of 46,000 on its general ledger. Sand reported devidends of 37000 on its general ledger. What amount of dividends would be reported on 12/31/21 consolidated statement of retained earnings?arrow_forwardThe balance sheet for Shankland Corporation follows: 000'009 $ 000006 Current assets Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings 000 0000 000 00 000 009' 000 006 Total liabilities and stockholders' equity 000'00s Required Compute the following. (Round "Ratios" to 1 decimal place.) Working capital Current ratio Debt-to-assets ratio Debt-to-equity ratioarrow_forwardThe financial statements of a ltd and b ltd at 1 july 2020 are as follows. A Ltd B Ltd cash 25000 plant 60000 35000 Accumulated depreciation (15000) (120000) inventories 12000 24000 Account receivable 20000 36000 goodwill 0 10000 Total assets 102600 117000 Account payable 1800 17000 Net assets 100800 100000 Share capital Retained earnings 50000 81000 General reserve 8800 4000 Total equity 2000 15000 100800 100000 All the assets and liabilities of B Ltd were recorded for fair value except for the following assets. Plant 47000(Fair value) Inventory 22000(Fair value) A Ltd agreed to pay B Ltd $6000 in cash plus 16000 fully paid shares having a fair value of $7.5 per share. The business combination was completed and B ltd liquidation. Cash of liquidation amounted to $1200. A Ltd incurred legal and accounting costs amounted to $482 in relation to the…arrow_forward

- What is the net increase or (net decrease) in the identifiable assets of SD Corporation?a. 13,700,500b. 13,307,500c. 13,957,500d. 13,050,500arrow_forwardWAG PAPALOKO Inc. has the following balance sheet on January 1, 2018, which is the date of acquisition: Assets Liabilities and Equity Accounts Receivable 79,000 Current Liabilities 145,000 Inventory 112,000 Long-term notes 100,000 Other current assets 55,000 Ordinary share, P1 par 50,000 Equipment (net) 294,000 Share premium 200,000 Goodwill 30,000 Retained earnings 75,000 Total assets 570,000 Total liabilities and equity 570,000 On January 1, 2018, WAG PAPATINAG Corp. acquired the net assets of WAG PAPALOKO Inc. by issuing 7,000 shares of its P25 par value common stock. Subsequently, WAG PAPALOKO Inc. was liquidated and its assets and liabilities merged into WAG PAPATINAG Corp. WAG PAPATINAG Corp. and WAG PAPALOKO Inc. stocks were selling for P40 per share and P6 per share, respectively on January 1, 2018. The book values of WAG PAPALOKO Inc.’s identifiable assets and liabilities equaled their…arrow_forwardOn 1 July 2021, Xero Ltd acquired 90% of the issued shares of Accounting Ltd for $750,000 when the equity of Accounting Ltd consisted of: Share Capital $400,000 Retained Earnings $150,000 Asset Revaluation reserve $50,000 At the acquisition date all the identifiable assets and liabilities of Accounting Ltd were recorded at fair value except for the following assets: Carrying Amount Fair Value Equipment (Cost $100,000) $160,000 $200,000 Land $560,000 $700,000 The NCI at acquisition date is measured based on the proportionate share of the identifiable assets and liabilities in Accounting Ltd. The tax rate is 30%. Required Prepare Acquisition analysis as of 1 July 2021arrow_forward

- The following book and fair values were available for Westmont Company as of March 1. Book Value Fair Value Inventory $ 494,000 $ 449,500 Land 763,500 1,060,500 Buildings 1,975,000 2,303,500 Customer relationships 0 859,500 Accounts payable (118,000 ) (118,000 ) Common stock (2,000,000 ) Additional paid-in capital (500,000 ) Retained earnings, 1/1 (427,000 ) Revenues (486,000 ) Expenses 298,500 Arturo Company pays $4,060,000 cash and issues 29,600 shares of its $2 par value common stock (fair value of $50 per share) for all of Westmont’s common stock in a merger, after which Westmont will cease to exist as a separate entity. Stock issue costs amount to $31,200 and Arturo pays $49,000 for legal fees to complete the transaction. Prepare Arturo’s journal entries to record its acquisition of Westmont. (If no entry is required for a transaction/event, select "No journal entry…arrow_forwardThe following book and fair values were available for Westmont Company as of March 1 Book Value Fair Value Inventory $ 350,000 $ 298,250 Land 820,500 1,085,250 Buildings 2,040,000 2,361,000 Customer relationships 0 871,500 Accounts payable (105,000) (105,000) Commom stock (2,000,000) Additional paid-in capital (500,000) Retained earnings 1/1 (425,500) Revenues (496,000) Expenses 316,000 Aturo pays cash of $4,380,000 to acquire Westmont. No stock is issued and…arrow_forwardB.On January 1, 2021, LASER LTD. acquired 70% of outstanding ordinary shares of JUSTICE INC. at a price of P210,000. On the same date, the net assets of JUSTICE INC. were reported at P260,000. On January 1, 2021, LASER LTD. reported retained earnings of P2,000,000 while JUSTICE INC. reported retained earnings of P200,000. All the assets and liabilities of JUSTICE INC. are fairly valued except machinery, which is undervalued by P80,000 and inventory which is overvalued by P10,000. The said machinery has remaining useful life of five years while 40% of the said inventory remained unsold at the end of 2021. For the year ended December 31, 2021, LASER LTD. reported net income of P1,000,000 and declared dividends of P200,000 in the separate financial statements while JUSTICE INC. reported net income of P150,000 and declared dividends of P20,000 in the separate financial statements. LASER LTD. accounted the investment in JUSTICE INC. using cost method in the separate financial statements.…arrow_forward

- On January 1, Park Corporation and Strand Corporation had condensed balance sheets as follows: Items Current assets Noncurrent assets Total assets Current liabilities Long-term debt Stockholders' equity Total liabilities and equities Park $ 74,500 92,250 $ 166,750 $ 32,000 51,750 83,000 $166,750 Strand $ 16,050 46,200 $ 62,250 $ 12,250 0 50,000 $ 62,250 On January 2, Park borrowed $66,000 and used the proceeds to obtain 80 percent of the outstanding common shares of Strand. The acquisition price was considered proportionate to Strand's total fair value. The $66,000 debt is payable in 10 equal annual principal payments, plus interest, beginning December 31. The excess fair value of the investment over the underlying book value of the acquired net assets is allocated to inventory (60 percent) and to goodwill (40 percent). Required: On a consolidated balance sheet as of January 2, calculate the amounts for each of the following: a. Current assets b. Noncurrent assets c. Current…arrow_forwardHw.44. The following information relates to Adele Ltd. Since the date of acquisition, Adele Ltd has held interests in multiple subsidiaries totalling DNCI of 25%, and INCI of 15%. The following summarised financial information is provided: Retained earnings at DOA $117,000 Retained earnings at 1/7/2021 $476,000 Current period profit for year ended 30/6/2022 $236,000 Required: a) Based on the financial information you have available, prepare the journal entries to record the allocation to NCI upon consolidation on 30 June, 2022. Your workings and narrations will be awarded marks. (show consolidation journals) b) Briefly explain what effect these journal entries have on the consolidated financial reports.arrow_forwardTiger Ltd. has an authorized capital of 700,000 $1 ordinary shares, of which 300,000 have been issued as fully paid. The following information was extracted from the accounts for the year ended September 30, 2019: Details/Accts. $ DR $ CR Motor Vehicle at cost 1,750,000 Acc. Depreciation Motor Vehicle 450,000 Freehold premises at cost 400,000 Carriage inwards 35,500 Sales 4,500,000 Stock, October 1, 2018 95,000 Administration (Wages and Salaries) 170,000 Distribution (Wages and Salaries) 250,000 Motor vehicle running costs 350,000 Purchases 935,000 Returns inward 32,000 Returns outward 51,000 Directors’ remuneration 865,000 Auditors’ fees 120,000 General administrative expenses…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education