ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

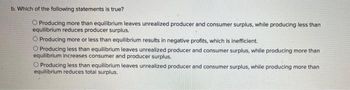

Transcribed Image Text:b. Which of the following statements is true?

O Producing more than equilibrium leaves unrealized producer and consumer surplus, while producing less than

equilibrium reduces producer surplus.

O Producing more or less than equilibrium results in negative profits, which is inefficient.

Producing less than equilibrium leaves unrealized producer and consumer surplus, while producing more than

equilibrium increases consumer and producer surplus.

O Producing less than equilibrium leaves unrealized producer and consumer surplus, while producing more than

equilibrium reduces total surplus.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A producer recently increased cost per unit and also increased economic surplus per unit. Which of the following statements is most true? A. Consumer surplus per unit decreased. B. Consumer willingness to pay for one unit increased C. Producer surplus per unit increased. D. Total costs increased E. Sales price per unit increased O F. Production volume decreasedarrow_forwardpart L Marrow_forwardWhich one of the following statement is incorrect? O A. The difference between the lowest price at which producers are willing to supply a product and the price they actually receive is known as the producer surplus O B. The producer surplus is depicted by the area below the demand curve and above the market price. O C. The value between what consumers pay and the maximum value that they are willing to pay for a product is known as the consumer surplus O D. To determine consumer surplus, one must have knowledge of the market price of a particular productarrow_forward

- 8arrow_forwardHelparrow_forwardQUESTION 10 A decrease in price will increase consumer welfare or consumer surplus due to O a. Old consumers paying a higher price, and new consumers entering into the market. O b. Old consumers paying a lower price, and new consumers entering into the market. O c. New consumers paying a higher price, and old consumers leaving the market. d. New consumers paying a lower price, and old consumers leaving the market.arrow_forward

- Consider a perfectly competitive market with our usual downward sloping demand and upward sloping supply curves. The market has a $2 per-unit tax that consumers pay. This tax is decreased to a $1 per-unit tax. Which of the statement is TRUE about the market equilibrium with the lower $1 tax. O Consumer surplus decreases because market price rises. O Tax revenues increase. O Tax revenues decrease. O Producer surplus increases.arrow_forward8. Consumer and Producer Surplus Suppose Charles is the only seller in the market for bottled water and Yakov is the only buyer. The following lists show the value Yakov places on a bottle of water and the cost Charles incurs to produce each bottle of water: Yakov's Value Value of first bottle: $7 Value of second bottle: $5 Value of third bottle: $3 Value of fourth bottle: $1 Charles's Costs Cost of first bottle: $1 Cost of second bottle: $3 Cost of third bottle: $5 Cost of fourth bottle: $7 The following table shows their respective supply and demand schedules: Price Quantity Demanded Quantity Supplied $1 or less 4 о $1 to $3 3 1 $3 to $5 2 2 $5 to $7 1 3 More than $7 0 4 Use Charles's supply schedule and Yakov's demand schedule to find the quantity supplied and quantity demanded at prices of $2, $4, and $6. Enter these values in the following table. Price Quantity Demanded Quantity Supplied 2 4 A price of brings supply and demand into equilibrium. At the equilibrium price, consumer…arrow_forwardneed correct answer .absuletly upvote !!1arrow_forward

- Gas-powered hedge trimmers Price (P) S D Quantity (Q) The cost of labor rises in this industry. At the same time consumer tastes shift away from this product in favor of quieter or less-polluting alternatives. What is likely to happen in this market? Select one: O a. Price may rise or fall; Quantity will fall. O b. Price may rise or fall; Quantity will rise. O c. Price will rise; Quantity may rise or fall. O d. Price will fall; Quantity may rise or fall. Clear my choice Checkarrow_forward17) JA perfectly competitive market has a market price of $10 and a quantity of 50 is traded. When the government imposes a $3 per-unit tax on the market, market price increases by 10%. Which of the statements below could be true based on this information. A Consumers pay the tax and supply is relatively more inelastic than demand. B Consumers pay the tax and demand is relatively more inelastic than supply. C Producers pay the tax and supply is relatively more inelastic than demand. D Producers pay the tax and demand is relatively more inelastic than supply. E Producers pay the tax and the elasticity of supply is the same as demand (in absolute terms).arrow_forwardWhich of the following statements is correct? Deadweight loss is: Select one: O a. Borne entirely by consumers. O b. The society's loss in total surplus resulting from inefficient level of production. O c. The loss in producer surplus resulting from inefficient level of consumption. O d. Borne entirely by producers. nstitute of Business & Management tradingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education