FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:b. Prepare all consolidation entries needed to prepare consolidated statements

for 20X5. Note: If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.a. Prepare all journal entries that Pizza recorded

during 20×5 related to its investment in Slice. Note: If no entry is required for a

transaction/event, select "No journal entry required" in the first account field. View

transaction listPizza Corporation acquired 80 percent ownership of Slice Products Company

on January 1, 20X1, for $151,000. On that date, the fair value of the noncontrolling interest

was $37,750, and Slice reported retained earnings of $46,000 and had $95,000 of common

stock outstanding Pizza has used the equity method in accounting for its investment in

Slice. Trial balance data for the two companies on December 31, 20X5, are as follows: Item

Pizza Corporation Slice Products Company Debit Credit Debit Credit Cash and Receivables

$ 86,000 $ 67,000 Inventory 277,000 103,000 Land 86,000 86,000 Buildings and

Equipment 517,000 167,000 Investment in Slice Products Company 180,540 Cost of Goods

Sold 112,000 46,000 Depreciation Expense 21,000 11,000 Inventory

Losses 11,000 5,000 Dividends Declared 37,000 17,200 Accumulated Depreciation

$193,000 $ 77,000 Accounts Payable 42,000 15,000 Notes Payable 277,160129,200 Common

Stock 282,000 95,000 Retained Earnings 296,000 85,000 Sales 210,000 101,000 Income from

Slice Products Company 27,380 $1,327,540 $1,327,540 $ 502,200 $ 502,200 Additional

Information On the date of combination, the fair value of Slice's depreciable assets was

$47,750 more than book value. The accumulated depreciation on these assets was

$10,000 on the acquisition date. The differential assigned to depreciable assets should be

written off over the following 10-year period. There was $10,000 of intercorporate receivables

and payables at the end of 20X5. Required: Prepare all joumal entries that Pizza recorded

during 20X5 related to its investment in Slice. Note: If no entry is required for a

transaction/event, select "No journal entry required" in the first account field a. Prepare all

journal entries that Pizza recorded during 20x5 related to its investment in Slice. Note: If no

entry is required for a transaction/event, select "No journal entry required" in the first account

field. View transaction list

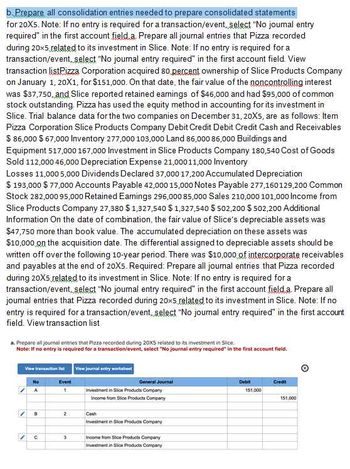

a. Prepare all journal entries that Pizza recorded during 20X5 related to its investment in Slice.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction fist View journal entry worksheet

No

A

Event

General Journal

Investment in Slice Products Company

Income from Sice Products Company

B

2

с

3

Cash

Investment in Slice Products Company

Income from Stice Products Company

Investment in Slice Products Company

Debit

Credi

151.000

151,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. P Company acquired 70% interest in S Company in 2019. S reported net income of P80,000 and P90,000 for 2019 and 2020 respectively. During 2019, S sold merchandise to P for P10,000 at a profit of P2,000. The merchandise was later resold by P to outsiders for P15,000 during 2020. For consolidation purposes, what is the non-controlling interest in net income of S for 2020? * Your answerarrow_forwardPlease answer requirement 1 - 9arrow_forwardDo not use negative signs with your answers below. Reconciliation of Cost to Equity Method Parent's pre-consolidation net income 401000 v Dividend Income 81000 v P% x Net income of subsidiary P% x AAP amortization 0 x Net income attributable to controlling interest $ 0 x b. Prepare the consolidated income statement for the current year. Do not use negative signs with your answers below. Consolidated Income Statement Sales $ 12200000 v Cost of goods sold 8120000 v Gross profit 4080000 v Operating expenses 0 x Net income Net income attributable to noncontrolling interests 0 x Net income 0 xarrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education