FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:B.

C.

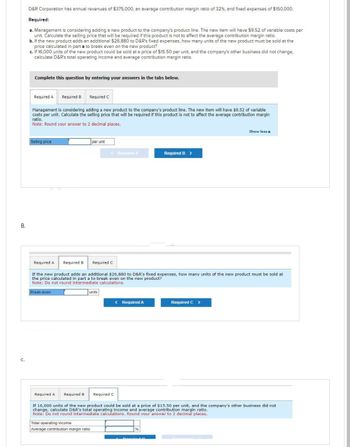

D&R Corporation has annual revenues of $375,000, an average contribution margin ratio of 32%, and fixed expenses of $150,000.

Required:

a. Management is considering adding a new product to the company's product line. The new item will have $9.52 of variable costs per

unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin ratio.

b. If the new product adds an additional $26,880 to D&R's fixed expenses, how many units of the new product must be sold at the

price calculated in part a to break even on the new product?

c. If 16,000 units of the new product could be sold at a price of $15.50 per unit, and the company's other business did not change,

calculate D&R's total operating income and average contribution margin ratio.

Complete this question by entering your answers in the tabs below.

Required A Required B

Management is considering adding a new product to the company's product line. The new item will have $9.52 of variable

costs per unit. Calculate the selling price that will be required if this product is not to affect the average contribution margin

ratio.

Note: Round your answer to 2 decimal places.

Selling price

Required A

Required C

Required B

Break-even

per unit

< Required A

Required C

units

Total operating income

Average contribution margin ratio

If the new product adds an additional $26,880 to D&R's fixed expenses, how many units of the new product must be sold at

the price calculated in part a to break even on the new product?

Note: Do not round intermediate calculations.

Required B >

< Required A

Show less A

Required C >

Required A Required B Required C

If 16,000 units of the new product could be sold at a price of $15.50 per unit, and the company's other business did not

change, calculate D&R's total operating income and average contribution margin ratio.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Assume that a company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Desired return on investment (ROI) 15,000 $ 33.00 $ 63,900 $780,000 12% The selling price that the company would establish using a markup percentage on absorption cost is closest to:arrow_forwardProvide step by step solution and answer. Answer number 2 and 3. lack of answer will be given down votearrow_forwardCalculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $78.30 per unit. Determine whether management should accept or reject the new business.arrow_forward

- Wilderness Products, Incorporated, has designed a self-inflating sleeping pad for use by backpackers and campers. The following information is available about the new product: a. An investment of $1,350,000 will be necessary to carry inventories and accounts receivable and to purchase some new equipment needed in the manufacturing process. The company's required rate of return is 24% on all investments. b. A standard cost card has been prepared for the sleeping pad, as shown below: Direct materials Direct labor Manufacturing overhead (20% variable) Total standard cost per pad Standard Quantity or Hours 4.0 yards 2.4 hours 2.4 hours Standard Price or Rate $2.70 per yard $8.00 per hour $12.50 per hour Standard Cost $10.80 19.20 30.00 $ 60.00 c. The only variable selling and administrative expense will be a sales commission of $9 per pad. The fixed selling and administrative expenses will be $732,000 per year. d. Because the company manufactures many products, no more than 38,400 direct…arrow_forward1. If the company accepts this offer and rejects some business from regular customers so as not to exceed capacity, what would be the total net operating income next year? 2. If the company rejects the offer of the foreign distributor, how much is the opportunity cost?arrow_forwardYour Company is considering the addition of a new product to its current product lines. The expected cost and revenue data for the new product are as follows: Annual sales in units 3,000 Selling price per unit $309 Variable costs per unit: Production $130 Selling $50 Traceable annual fixed costs: Production $51,000 Selling $75,000 Allocated annual fixed cost $54,000 If the new product is added to the existing product line, then sales of existing products will decline. As a consequence, the contribution margin of the existing product lines is expected to drop $78,000 per year. What is the increase in net income if the new product is added next year? This is a reverse drop the segment. New CM is positive and new FC and lost CM are negative.arrow_forward

- .arrow_forwardAjani Company has variable costs equal to 40% of sales. The company is considering a proposal that will increase sales by $10,000 and total fixed costs by $6,000. By what amount will net income increase? A. $6,000 B. $4,000 C. $2,000 D. $0arrow_forwardA company wants to expand by offering a new product. Expected cost and revenue data for this product are: Annual sales 5,000 units Unit selling price ? Unit variable costs: Production $ 30.20 Selling 6. Incremental fixed costs per year: 32:16 Production $35,000 Selling $45,000 If the company adds this new product, sales of its other product lines will be impacted, causing the contribution margin of other product lines to drop by $18,500 per year. What is the lowest price the company could charge for its new product without affecting the company's total profits? Multiple Choice $39.90 $52.20arrow_forward

- Required: Consider each part independently 1A. Determine the division’s expected ROI using Dupont formula. What is the division’s expected Residual Income? 1B. How many units must Smart sell to earn P100,000 Residual Income? 1C. The manager has the opportunity to sell additional 15,000 units at P29.50. Variable cost per unit would be the same but fixed cost would be increased by P50,000. An additional investment of P150,000 would be required. If the manager of Smart Division accepts the special order, by how much and in what direction will residual income change? increasing or decreasing direction? Answer 1a to 1c with solution plsarrow_forwardtype the correct answwer for the ;problem bellowarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education