ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:b. Assuming that there is no charge for entry, what is the total number of vehicles entering downtown? (Give your answers In tens of

thousands of vehicles.)

Quantity of vehicles:[

C. Suppose that government, in an effort to reduce the number of vehicles by 50 percent, decides to Impose a traffic fee (the same fee

for both commuters and shoppers) for entry into the downtown area. What will be the amount of the fee, and how many of each group

will enter downtown?

Fee: $

Number of commuter vehicles:[

Number of shoppers vehicles:

d. Assume that government, alternatively, decides to have a two-fee system but still wishes to reduce the traffic by 50 percent of the

no-fee entry level. If It decides to charge shoppers $2, how much will it have to charge commuters?

Fee to commuters: $

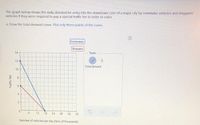

Transcribed Image Text:The graph below shows the daily demand for entry into the downtown core of a major city by commuter vehicles and shoppers

vehicles if they were required to pay a special traffic fee in order to enter.

a. Draw the total demand curve. Plot only three points of the curve.

Commuters

Shoppers

14

Tools

12

Total demand

10

6.

4

2.

6.

12

18

24

36

42

Number of vehicles per day (tens of thousands)

Traffic fee

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- ols 4. The Laffer curve Government-imposed taxes cause reductions in the activity that is being taxed, which has important implications for revenue collections. To understand the effect of such a tax, consider the monthly market for champagne, which is shown on the following graph. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph, Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. PRICE (Dollars per case) 22***RES 40 35 Show Transcribed Text AX REVENUE (Dolan) 018 27 345 54 63 72 81 00 QUANTITY (Cases) Suppose the government imposes a $10-per-case tax on suppliers. At this tax amount, the equilibrium quantity of champagne is [ . 648 576 504 432 360 204 3214 144 72 D Supply . Demand Now calculate the government's tax revenue if it sets a tax of $0, $10, $20, $25, $30, $40, or $50 per case. (Hint: To find the equilibrium quantity…arrow_forwardRead the following excerpt: 'In the UK, fuel duty is levied per unit of fuel purchased and is included in the price paid for petrol, diesel and other fuels used in vehicles or for heating. The rate depends on the type of fuel: the headline rate on standard petrol and diesel has been reduced from 57.95 pence to 52.95 pence per litre.' Suppose that, in order to reduce greenhouse gas emissions, the UK government is considering raising fuel duty on standard petrol and diesel. Suppose that the government intends to earmark the additional fuel tax revenue, not for subsidising less carbon-intensive energy production (e.g., wind energy) but for supporting higher education (e.g., reduction in university fees). Are there additional theoretical implications in terms of efficiency in resource allocation, due to the intended use of the revenue? Explain.arrow_forwardSolve full question get like. Hand written solutions are strictly prohibited.arrow_forward

- QUESTION 46 46. Given that the U.S. government mandates the use of ethanol as a partial substitute for gasoline (10% by volume), and that ethanol manufactured in the U.S. is made from corn, what will happen if the government eliminates the price support for corn? a) Demand for ethanol will increase. b) Demand for ethanol will decrease. c) Supply of ethanol will increase. d) Supply of ethanol will decrease. e) Both (a) and (c)arrow_forward2. Hope, Arkansas (home of both ex-President Bill Clinton and former Presidential candidate Mike Huckabee), has a subway system, for which a one-way fare is $1.50. There is pressure on Governor Huckabee to reduce the fare by one-third, to $1.00. The Governor is dismayed, thinking that this will mean Hope is losing one-third of its revenue from sales of subway tickets. The Governor's economic advisor reminds him that he is focusing only on the price effect and ignoring the quantity effect. Explain why the Governor's estimate of a one-third loss of revenue is likely to be an overestimate using elasticity of demand.arrow_forwardthan high high minimum prices and taxation, what policies could be used to tackle binge drinking? 1. Other otherarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.arrow_forward4. What do you think would be the effect on the equilibrium price and quantity of marijuana as a result of its consumption being legalized? Give reasons for your answer.arrow_forwardPlease answer the following, a diagram and one paragraph should help support your answer. With consideration for elasticity (especially PED), what would be one industry in which the government instituting a subsidy would make sense and why? EXAMPLE: It would make sense for the government to subsidize the fashion industry because it is generally elastic in terms of PED, and it would benefit both producers and consumers due to etc.arrow_forward

- HELP ME WITH PART B PLEASE BY SHOWING IN A DIAGRAM a. The elasticity of demand for beer in country A is 1.8 and the elasticity ofdemand for beer in country B is 1.7. Suppose that the supply of beer isthe same in both countries and that both countries impose the same levelof tax on beer. Does the consumer in country A share more burden of tax?b. ii. Suppose the demand curve for sugar is Q = 60 − 3P and the supply curveis Q = 2P. Suppose the government announces a per-unit tax of 1 on theprice of sugar. What is the deadweight loss from the tax?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardSinead commutes from her suburban residence to the city center. When asked her opinion of a proposed congestion tax of $5 per trip, she says, “Of course I oppose the congestion tax. It would make me worse off by $5 per trip. What do you think I am, stupid?” Critically appraise Sinead’s statement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education